Pound Sterling Price News and Forecast: GBP/USD shrugs as UK GDP unexpectedly declines

GBP/USD shrugs as UK GDP unexpectedly declines

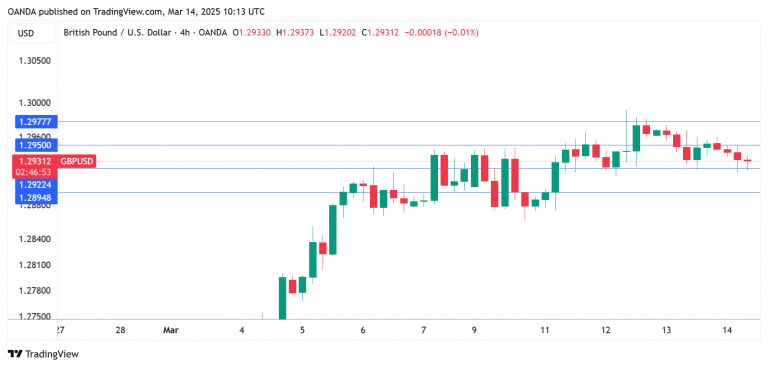

The British pound has edged lower against the US dollar on Friday. GBP/USD is trading at 1.2928 in the European session, down 0.13% on the day.

The UK economy barely registered any growth in the second half of 2024, rising 0.1% in the third quarter and flatlining in the third quarter. The New Year hasn’t seen any improvement, as GDP contracted 0.1% m/m in January, after a 0.4% gain in December and missing the market estimate of 0.1%. The surprise contraction was driven by declines in the production and manufacturing sectors. The economy expanded 0.2% in the three months to January, up from 0.1% in the three months to December but shy of the market estimate of 0.3%. Read more...

GBP/USD Forecast: Pound Sterling struggles to benefit from upbeat mood after weak UK data

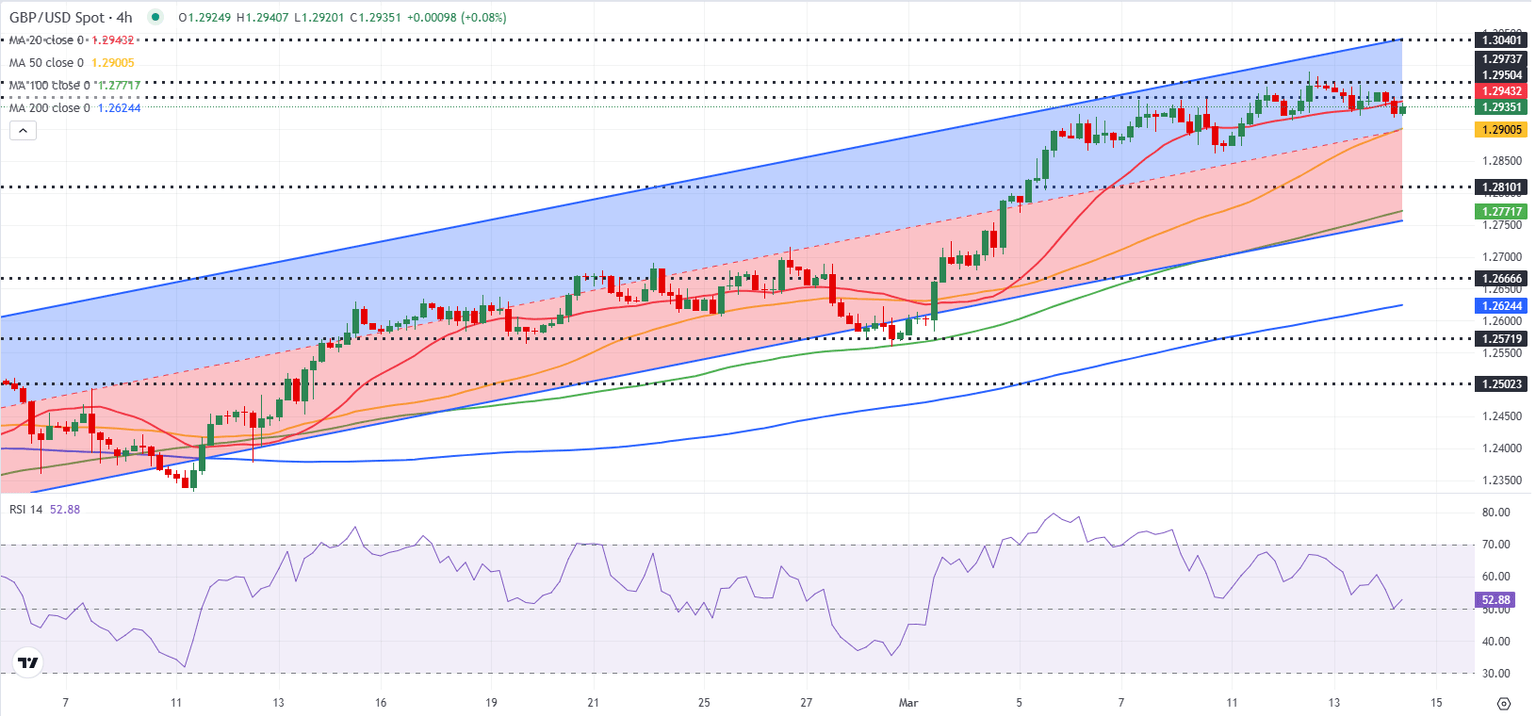

After closing marginally lower on Thursday, GBP/USD stays on the back foot and trades below 1.2950 in the European session on Friday. Although the near-term technical outlook is yet to point to a buildup of bearish momentum, the pair could have a difficult time staging a rebound after disappointing data releases from the UK.

The data published by the UK's Office for National Statistics (ONS) showed early Friday that the UK's Gross Domestic Product (GDP) contracted by 0.1% on a monthly basis in January. This reading followed the 0.4% growth recorded in December and came in below the market expectation for an expansion of 0.1%. Read more...

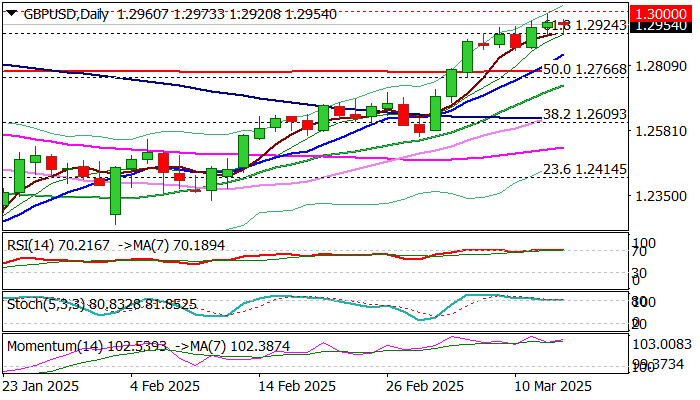

GBP/USD outlook: Bulls pause under 1.3000 barrier but hold grip

Cable edged lower on Thursday but remains constructive near new multi-month high (1.2989) and psychological 1.3000 barrier.

Limited dips on Wednesday/today, support the notion, as weak dollar continues to underpin pound’s advance, along with bullish daily techs (the latest formation of 10/200DMA golden cross contributed to bullish outlook. On the other hand, bulls may face further headwinds as daily studies are overbought and 1.30 marks significant obstacle, which may cap and keep near term action in extended consolidation. Read more...

Author

FXStreet Team

FXStreet