GBP/USD outlook: Bulls pause under 1.3000 barrier but hold grip

GBP/USD

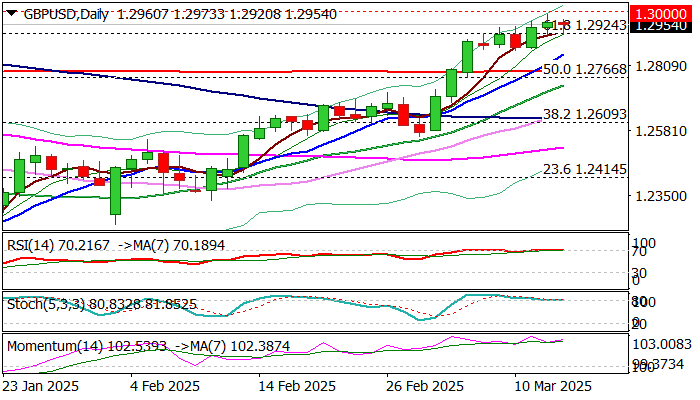

Cable edged lower on Thursday but remains constructive near new multi-month high (1.2989) and psychological 1.3000 barrier.

Limited dips on Wednesday/today, support the notion, as weak dollar continues to underpin pound’s advance, along with bullish daily techs (the latest formation of 10/200DMA golden cross contributed to bullish outlook.

On the other hand, bulls may face further headwinds as daily studies are overbought and 1.30 marks significant obstacle, which may cap and keep near term action in extended consolidation.

Broken Fibo support at 1.2924 (61.8% of 1.3434/1.2099 downtrend) offers immediate support, followed by rising 10 DMA (1.2850), guarding lower pivot at 1.2792 (200DMA).

Limited downticks to keep bulls intact and provide better buying opportunities for probe through 1.30 and possible extension towards 1.3119 (Fibo 76.4%) on clear break.

Res: 1.3000; 1.3042; 1.3119; 1.3150.

Sup: 1.2924; 1.2850; 1.2792; 1.2766.

Interested in GBP/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.