Pound Sterling Price News and Forecast: GBP/USD sellers take a breather

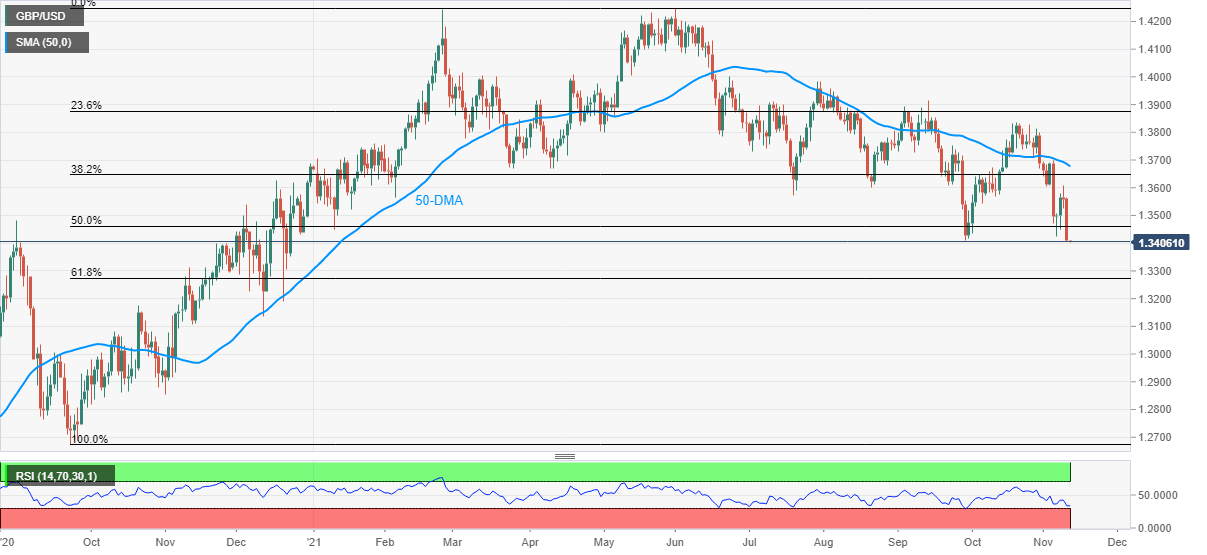

GBP/USD Price Analysis: Oversold RSI probes bears at yearly bottom of 1.3401

GBP/USD defends the 1.3400 threshold amid Thursday’s initial Asian session, following the slump to refresh the yearly low. The lackluster moves could be linked to the cable pair’s inability to extend the downside break of September month’s low near 1.3410, as well as the nearly oversold RSI conditions. That said, the corrective pullback may aim for 50% Fibonacci retracement (Fibo.) of the pair’s run-up from September 2020 to June 2021, around 1.3460.

GBP/USD bearish zigzag is obvious: We go further down

The price is bearish. The markets are going down as technical and fundamentals are aligned. BOE stance was dovish and this has absolutely been reflecting on the price. At this point you can see that markets are bearish and my strong opinion is that bearish continuation is developing atm.You can see all positions that I have and this new GBP/USD position. Targets are 1.3462 followed by 1.3380 and eventually 1.3275.

Author

FXStreet Team

FXStreet