Pound Sterling Price News and Forecast: GBP/USD sellers look to retain control as 1.2700 resistance holds

GBP/USD Forecast: Pound Sterling sellers look to retain control as 1.2700 resistance holds

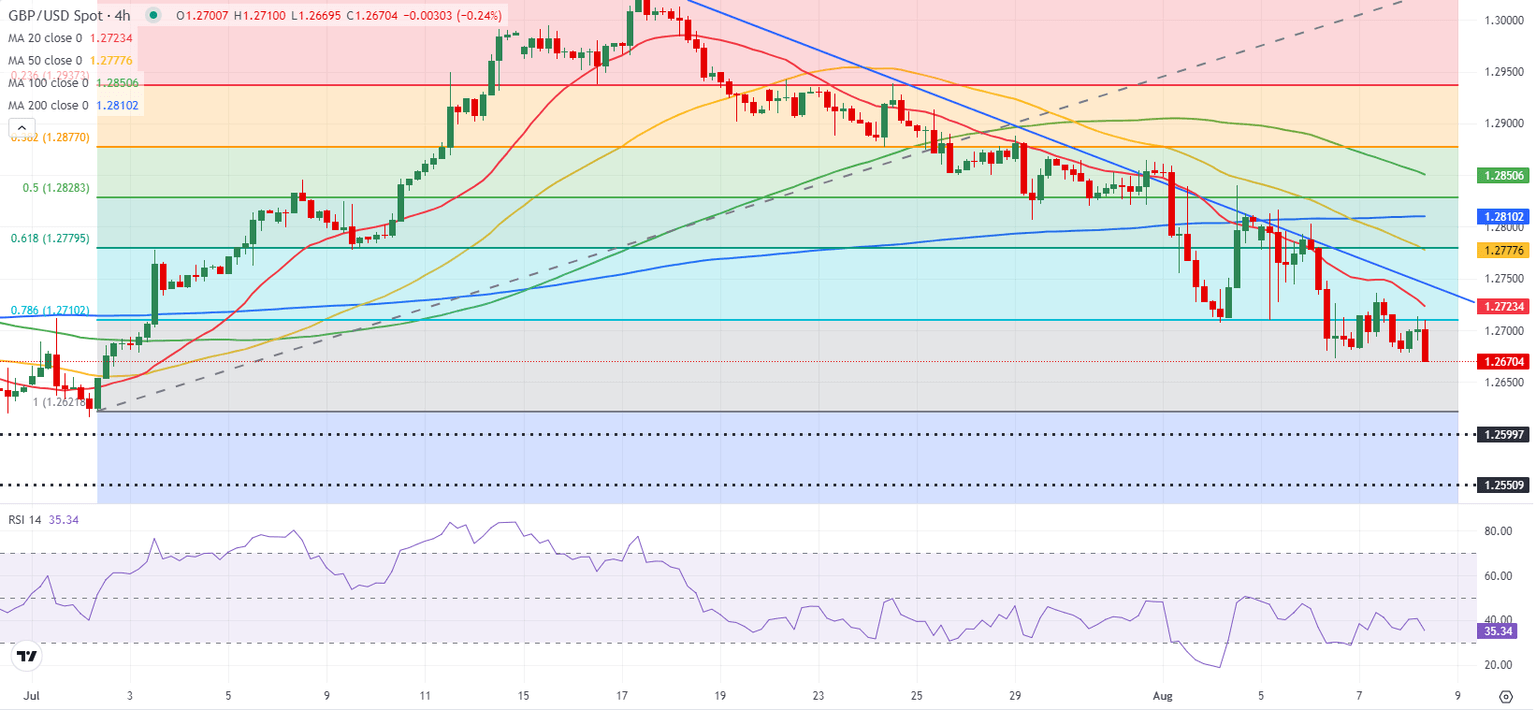

After recovering above 1.2700 during the European trading hours on Wednesday, GBP/USD erased its gains and closed the day virtually unchanged slightly below this level. The pair stays on the back foot early Thursday and trades at its lowest level in a month since early July.

The souring market mood seems to be making it difficult for Pound Sterling to stay resilient against its rivals. At the time of press, the UK's FTSE 100 Index was down 1% on the day and US stock index futures were trading marginally lower. Read more...

GBP/USD defends 100-day SMA amid modest USD weakness, lacks bullish conviction

The GBP/USD pair once again shows some resilience below the 100-day Simple Moving Average (SMA) and attracts dip-buyers in the vicinity of over a one-month low touched earlier this week. Spot prices, however, struggle to capitalize on the uptick and currently trade with only modest intraday gains, around the 1.2700 round-figure mark.

The US Dollar (USD) comes under some renewed selling pressure in the wake of rising bets for bigger interest rate cuts by the Federal Reserve (Fed), which triggers to a fresh leg down in the US Treasury bond yields. This, in turn, offers some support to the GBP/USD pair, though a softer risk tone helps limit losses for the safe-haven buck and acts as a headwind. Read more...

Author

FXStreet Team

FXStreet