Pound Sterling Price News and Forecast: GBP/USD sellers hesitate as key support holds

GBP/USD Forecast: Pound Sterling sellers hesitate as key support holds

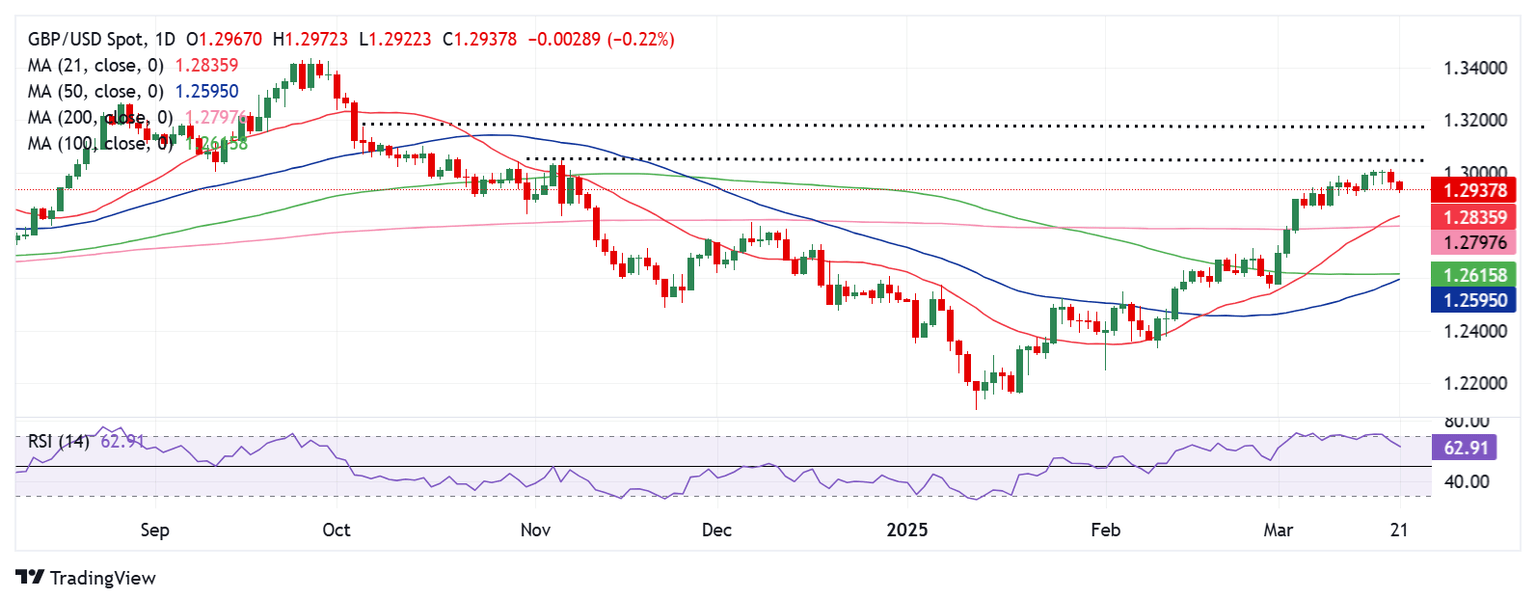

GBP/USD closed in negative territory on Thursday and Friday to end the previous week virtually unchanged. The pair gains traction in the European morning and recovers toward 1.2950.

The renewed US Dollar (USD) weakness at the beginning of the week helps GBP/USD hold its ground, as the market mood improves on easing fears over aggressive reciprocal US tariffs. Read more...

GBP/USD attracts some buyers to near 1.2950 as traders await US PMI release

The GBP/USD pair attracts some buyers to around 1.2940 during the early European session on Monday, bolstered by the softer Greenback. The uncertainty about US President Donald Trump's next round of tariffs and concerns over the US economic slowdown weigh on the US Dollar (USD) against the Pound Sterling (GBP). The preliminary reading of the US S&P Global Manufacturing Purchasing Managers Index (PMI) for March will take center stage later on Monday.

The Greenback remains under pressure as analysts believe Trump’s aggressive and erratic trade policies could trigger a recession. Trump has declared April 2 to be "Liberation Day" for the US, when he will implement so-called reciprocal tariffs that seek to equalize US tariffs with those charged by trading partners, as well as tariffs on sectors such as automobiles, pharmaceuticals, and semiconductors, which he has repeatedly stated would be enacted on that day. Read more...

GBP/USD Weekly Outlook: Geopolitical and economic concerns weigh on Pound Sterling

The Pound Sterling (GBP) corrected after topping near 1.3000 against the US Dollar (USD) mid-week. However, the GBP/USD pair holds at its highest level in four months.

Over the weekend, the US launched large-scale airstrikes on Yemen, targeting the Iran-backed militant group Houthis. In response, Houthis attacked US vessels in the Red Sea, which Trump vowed to stop, warning that "hell will rain down" if they continue. Read more...

Author

FXStreet Team

FXStreet