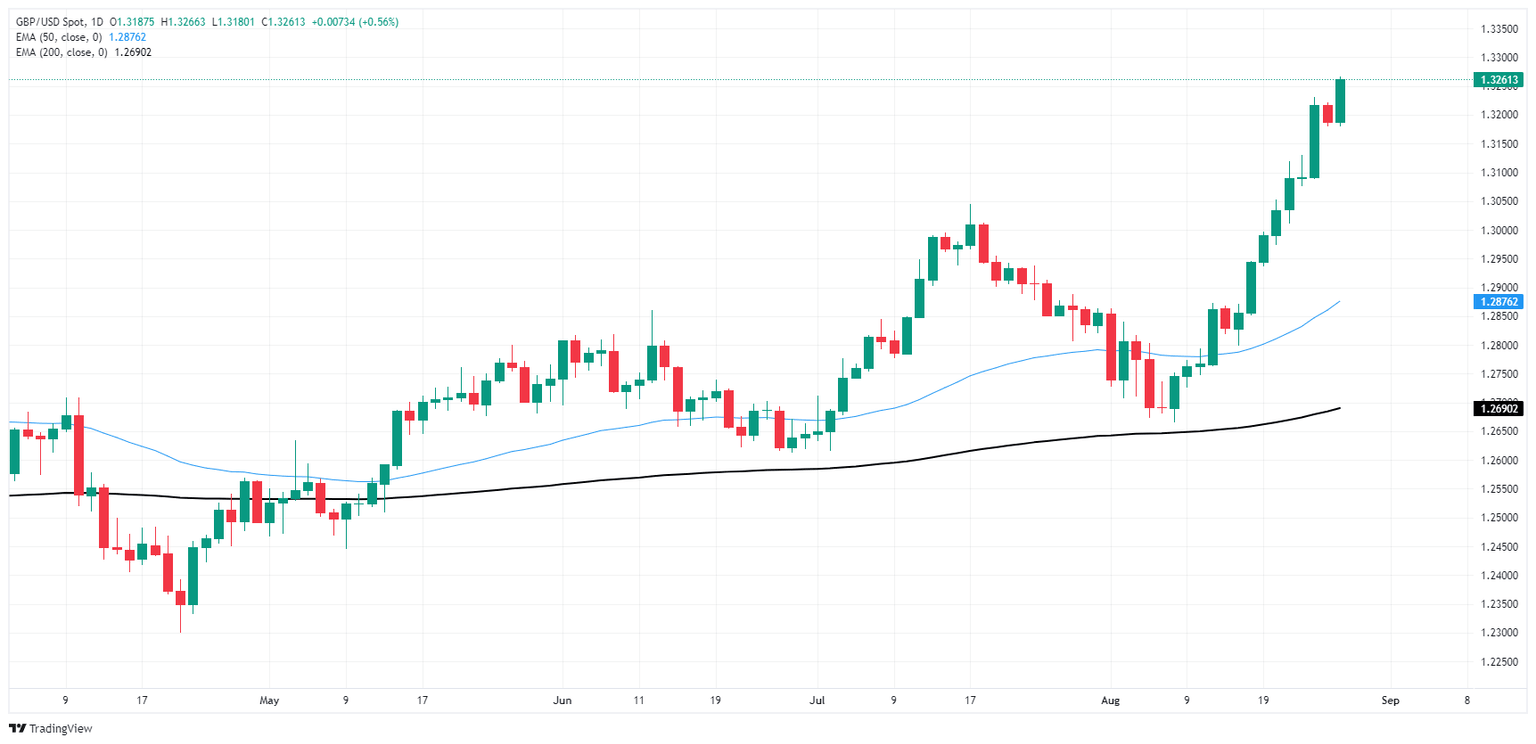

Pound Sterling Price News and Forecast: GBP/USD retreats below 1.3220, set for a pullback

GBP/USD Price Forecast: Retreats below 1.3220, set for a pullback

The Pound Sterling retreats from the multi-year highs it reached on Tuesday and registers losses of over 0.40% against the Greenback as traders brace for the release of US inflation data on Friday. The GBP/USD enjoyed a ride and hit a two-year peak at 1.3266 following Fed Chair Jerome Powell’s speech, yet at the time of writing, the pair trades at 1.3220. Read More...

Pound Sterling declines to near 1.3200 with US PCE inflation under spotlight

The Pound Sterling (GBP) declines from a more-than-two-year high of 1.3266 against the US Dollar (USD) in Wednesday’s American session. The GBP/USD pair drops as the US Dollar recovers some ground, with investors focusing on the United States (US) core Personal Consumption Expenditure Price Index (PCE) data for July, to be published on Friday, as it could be the next big trigger for the pair. Read More...

GBP/USD scours fresh highs on Greenback weakness

GBP/USD tested into a fresh multi-year high on Tuesday, easing into a 29-month peak of 1.3266 as the Pound Sterling continues to catch a ride on a broad-market Greenback sell wave. Investors have piled into hopes for a September rate cut from the Federal Reserve (Fed), and US Personal Consumption Expenditure Price Index (PCE) inflation figures not due until Friday leave markets with little meaningful data to chew on until then. Read More...

Author

FXStreet Team

FXStreet