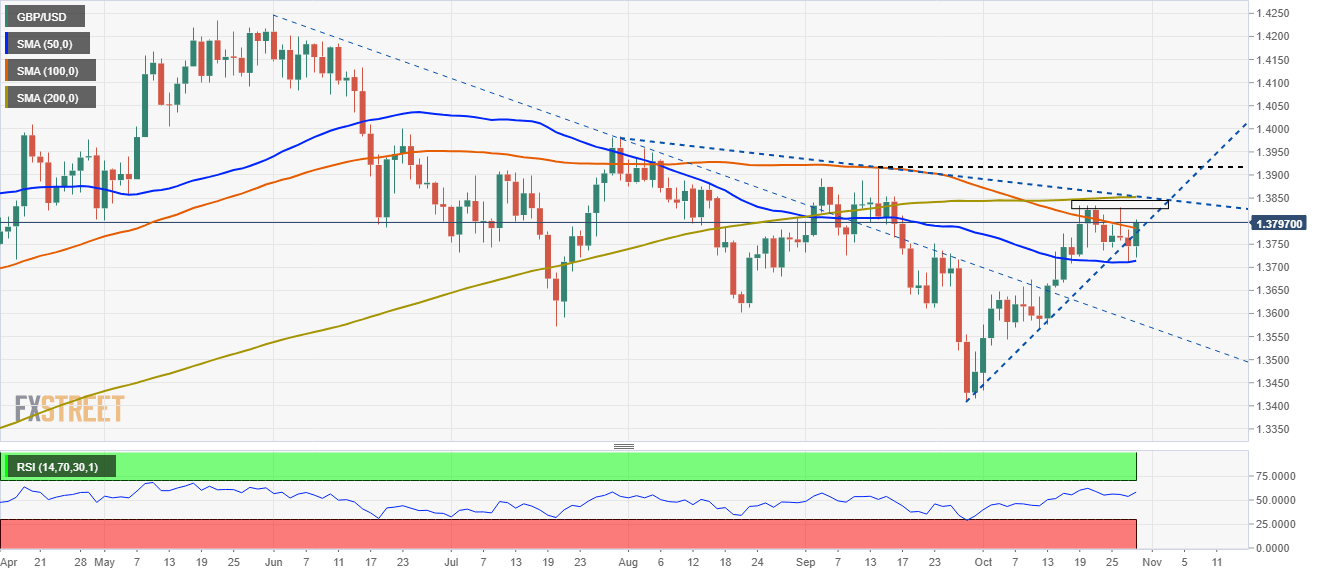

Pound Sterling Price News and Forecast: GBP/USD retraces to resistance near 1.3770

GBP/USD jumps on worse than expected US economic growth report, pierces 1.3800

The GBP/USD rises sharply during the New York session, above the 1.3800 figure, trading at 1.3803 at the time of writing. US mixed macroeconomic data trigger a dollar sell-off across the board. The US economy is growing slower than expected, contrary to rising inflation, showing no signs of peaking. The stagflation narrative clouds the market again.

During the Asian and European session, the GBP/USD seesawed near the bottoms of the day, around 1.3720, towards 1.3770, until stabilizing around current levels after the US GDP announcement. Read more...

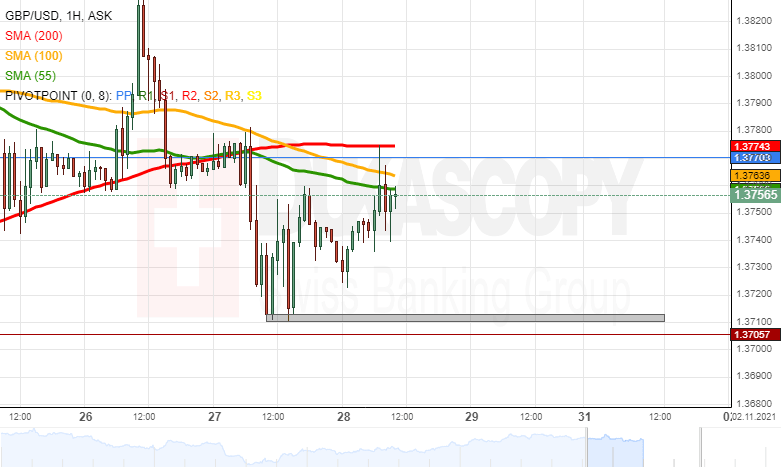

GBP/USD analysis: Retraces to resistance near 1.3770

On Wednesday, the GBP/USD found support at 1.3710 and started a recovery. By the middle of Thursday's trading hours, the GBP/USD had reached the 1.3770 level. From 1.3760 up to 1.3777, the pair faced the resistance of the 55, 100, and 200-hour simple moving averages and the weekly simple pivot point.

A passing of the 1.3760/1.3777 zone would leave the pair with no technical resistance as high as the 1.3831 level, where the weekly R1 simple pivot point is located at. However, the 1.3800 level might act as a resistance level. Read more...

GBP/USD to enjoy a gentle rise on a break above 1.38 – Scotiabank

GBP/USD gains marginally as Bank of England (BoE) hike pricing returns. Economists at Scotiabank see price action in the cable as marginally supportive and expect to see further gains on a break above 1.38.

“After falling for three consecutive days, markets placed renewed bets on BoE tightening yesterday (likely as a consequence of the BoC’s hawkish announcement) which are continuing today to price in 17bps in hikes; December meeting OIS are pricing a similarly sized hike from November.” Read more...

Author

FXStreet Team

FXStreet