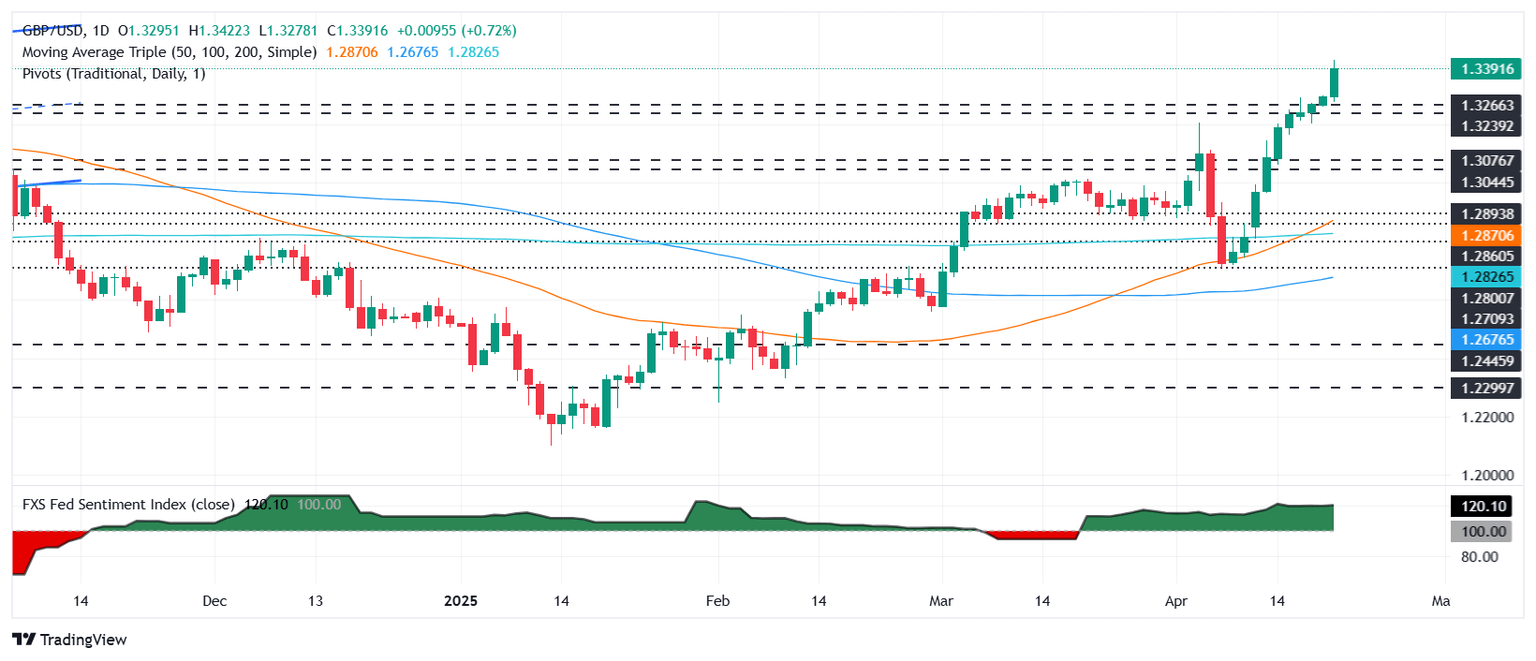

Pound Sterling Price News and Forecast: GBP/USD remains strong near 1.3370

GBP/USD edges higher above 1.3350 as Trump’s attacks on Powell threaten Fed’s independence

The GBP/USD pair trades in positive territory around 1.3370 during the early Asian session on Tuesday. Fears of a slowdown in the United States (US) and concerns over the Federal Reserve (Fed) independence drag the US Dollar (USD) lower and create a tailwind for a major pair.

US President Donald Trump slammed the Fed’s Powell for continuing to support a “wait and see” mode on the monetary policy until greater clarity over how the new tariff policy will shape the economic outlook. Trump warned in a Truth Social post that the US economy would slow unless Powell lowered interest rates immediately. Read more...

GBP/USD soars toward 1.34 as traders question Fed’s independence

The Pound Sterling (GBP) rallies sharply by over 0.70% on Monday as investors grew distrustful of United States (US) policymakers after White House Economic Adviser Kevin Hassett stated that President Donald Trump is seeking ways to sack Federal Reserve (Fed) Chair Jerome Powell. Consequently, traders penalize the Greenback, pushing GBP/USD close to the 1.3400 figure.

The market mood turned sour as Washington threatened the Fed’s independence again. US equities are sinking, while the US Dollar Index (DXY), which reflects the buck’s value against a basket of six currencies including Cable, plummets over 1.09% to 98.31, levels last seen in March 2022. Read more...

Author

FXStreet Team

FXStreet