Pound Sterling Price News and Forecast: GBP/USD remains sidelined around the monthly bottom

GBP/USD retreats towards monthly bottom below 1.4100, focus UK CPI, Jerome Powell

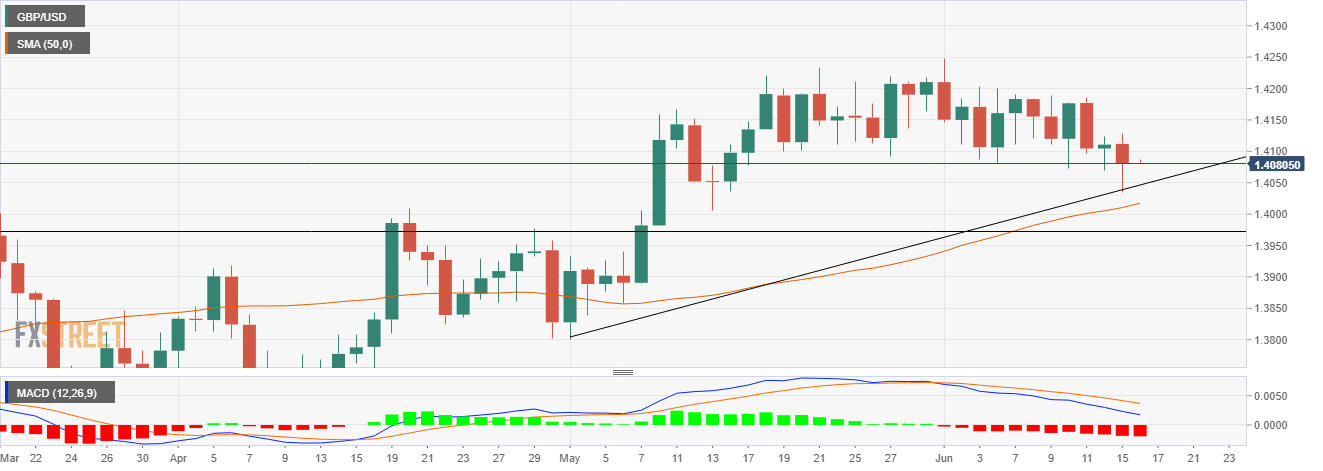

GBP/USD refreshes intraday low to 1.4077 within a choppy range below 1.4100 during Wednesday’s Asian session. The cable pair dropped to the lowest in a month the previous day before bouncing off 1.4034. However, chatters surrounding UK’s covid conditions and Brexit woes join the pre-data/event cautious sentiment to weigh on the quote of late.

GBP/USD Price Analysis: Bears in control, cling to multi-day support near 1.4080

The GBP/USD pair started the session on Wednesday on a lower note. The pair recovered from the low of 1.4034 on Tuesday to close near the 1.4080 mark, where it waivers now. On the daily chart, the GBP/USD pair has been pressurized near the 1.4225 mark, with the formation of multiple tops in the region. The pair closed below the 1.4100 key psychological mark for the first time since May 17.

Author

FXStreet Team

FXStreet