Pound Sterling Price News and Forecast: GBP/USD remains pressured for the fourth consecutive day

GBP/USD drops back towards 1.2400 as US dollar grinds higher, UK PM Sunak’s US visit eyed

GBP/USD refreshes intraday low as the US Dollar picks up bids to pare the early Asian session losses heading into Wednesday’s London open. In doing so, the Cable pair prints a four-day losing streak around 1.2415 by the press time.

US Dollar Index (DXY) stretches the previous day’s corrective bounce while rising towards 104.20 at the latest, despite being indecisive on the day. In doing so, the greenback’s gauge versus six major currencies suffers from downbeat market bets on the Fed’s next move amid the pre-FOMC blackout for the policymakers. Additionally, recent chatters that the US government’s bond spree, due to the debt-ceiling deal, will trigger the banking crisis, as signaled by the Financial Times (FT), seem to prod the previous risk-on mood and underpin the US Dollar’s rebound. Read more...

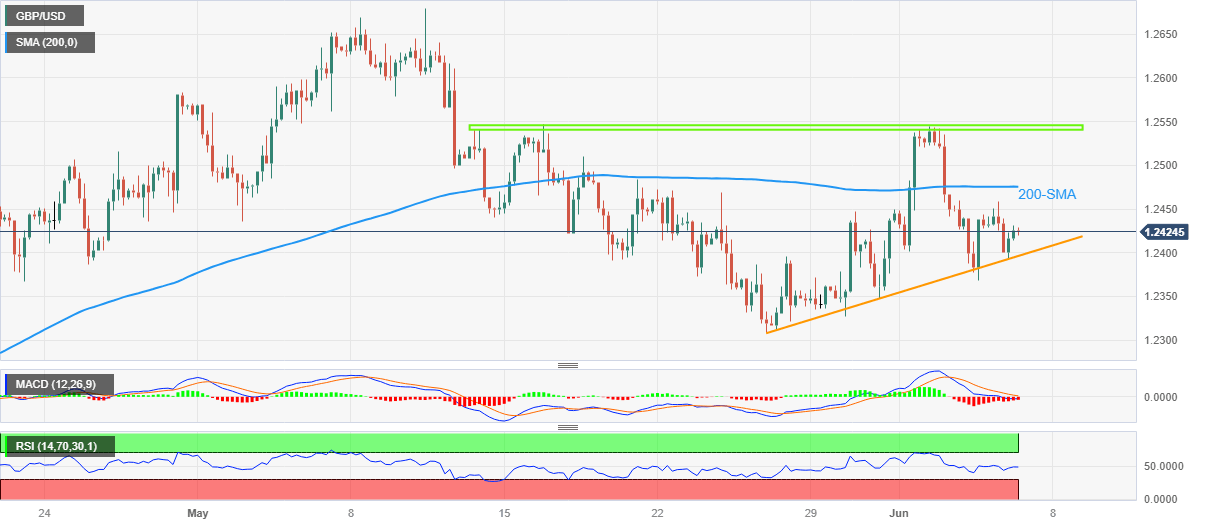

GBP/USD Price Analysis: Cable prods three-day downtrend above 1.2400, further rise appears difficult

GBP/USD licks its wounds near 1.2425 during early Wednesday morning in Asia, after declining in the last three consecutive days. In doing so, the Cable pair rebounds from a two-week-old ascending support line to consolidate the weekly loss, after snapping a three-week downtrend in the last.

That said, the steady RSI (14) line joins the receding bearish bias of the MACD signals to back the latest run-up in the Pound Sterling price. Read more...

Author

FXStreet Team

FXStreet