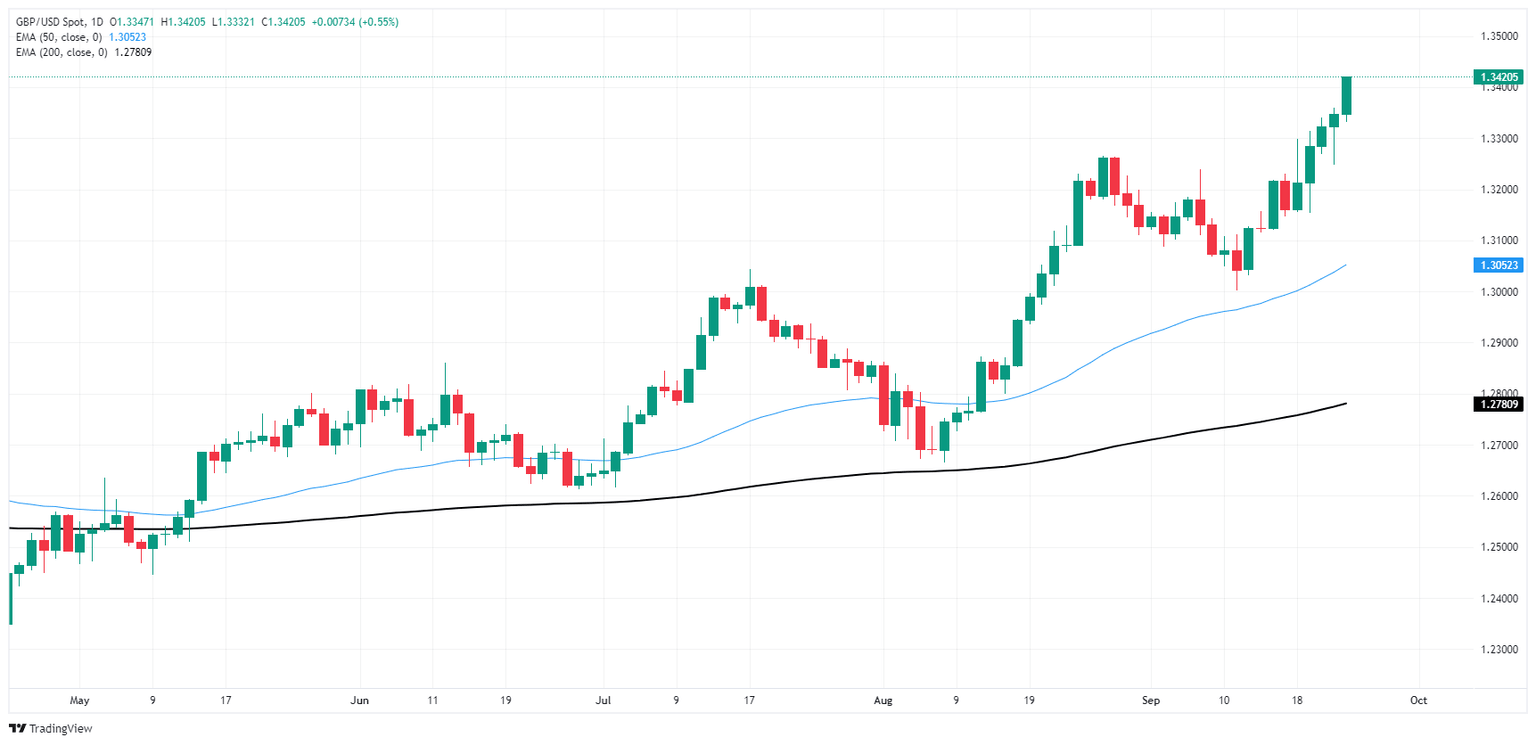

GBP/USD remains firm above 1.3400 mark, highest since March 2022

The GBP/USD pair builds on its recent gains registered over the past two weeks and advances to its highest level since March 2022, around the 1.3430 region during the Asian session on Wednesday. Meanwhile, the fundamental backdrop suggests that the path of least resistance for spot prices is to the upside, though slightly overbought conditions on the daily

chart warrant some caution for bullish traders.

Read More...

GBP/USD crosses 1.34 for the first time since March of 2023

GBP/USD extended the ongoing Pound Sterling rally for another consecutive day, crossing the 1.3400 handle and chalking in fresh 30-month highs after the US Dollar broadly weakened on Tuesday. The Greenback’s market-wide withering gave Cable exactly what it needed to keep the current Pound Sterling bull run on-balance.

Read More...

GBP/USD Price Forecast: Soars towards 1.3400 on soft US data

The Pound Sterling extended its gains against the US Dollar on Tuesday amid a scarce economic docket in the UK. Across the pond, the US Conference Board Consumer Confidence tumbled on labor market views, sending the Greenback sliding and underpinning other currencies higher. The GBP/USD trades at 1.3388 and advances more than 0.30%.

Read More...