Pound Sterling Price News and Forecast: GBP/USD regained traction

GBP/USD Forecast: Sterling set to extend gains as Brexit, vaccines and BOE are all pound-positive

Another day, another scandal for UK Prime Minister Boris Johnson, who allegedly said he would prefer seeing bodies pile up than impose a new lockdown – a claim Downing Street strongly denies. For sterling, Johnson's Brexit actions matter more and they are pound-positive.

The EU and the UK are reportedly negotiating a quid pro quo deal on dealing with trade in Northern Ireland. Brussels has made new offers to London, potentially allowing for a breakthrough that could resolve issues and allow for more fluid commerce. While COVID-19 is the overwhelming economic issue, leftovers from Brexit remain a drag on the British economy and any progress could add another boost. Read more...

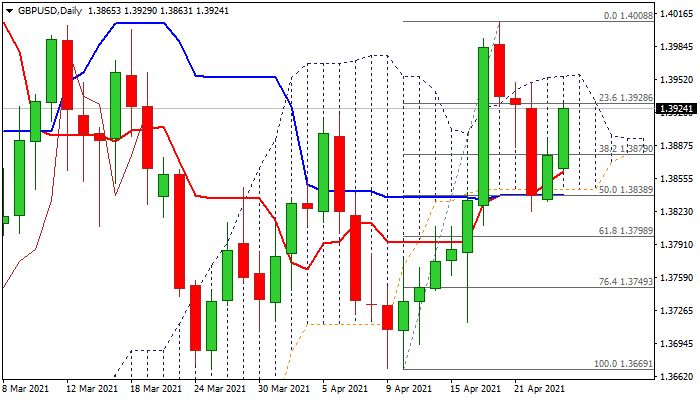

GBP/USD outlook: Sterling regained traction but continues to move within daily cloud

Cable extended Friday’s bounce and rose above 1.39 mark in early European trading on Monday but continues to trade within daily cloud (1.3844/1.3957) which started to narrow and will twist later this week.

Break of cloud top would generate bullish signal for renewed attack at psychological 1.40 barrier, above which the pound last traded two months ago. Revived bullish momentum and daily moving averages in positive setup underpin fresh advance, but mixed fundamentals sour the sentiment. Read more...

GBP/USD: Three British developments set to boost sterling

GBP/USD has been rising as the safe-haven dollar retreats from its highs. Optimism about the NI protocol, Britain's vaccine milestone, and bullish BoE comments may boost sterling, Yohay Elam, an Analyst at FXstreet, reports.

“The EU and the UK are reportedly negotiating a quid pro quo deal on dealing with trade in Northern Ireland. Brussels has made new offers to London, potentially allowing for a breakthrough that could resolve issues and allow for more fluid commerce. Leftovers from Brexit remain a drag on the British economy and any progress could add another boost.” Read more...

Author

FXStreet Team

FXStreet