Pound Sterling Price News and Forecast: GBP/USD recovers a major part of its intraday losses

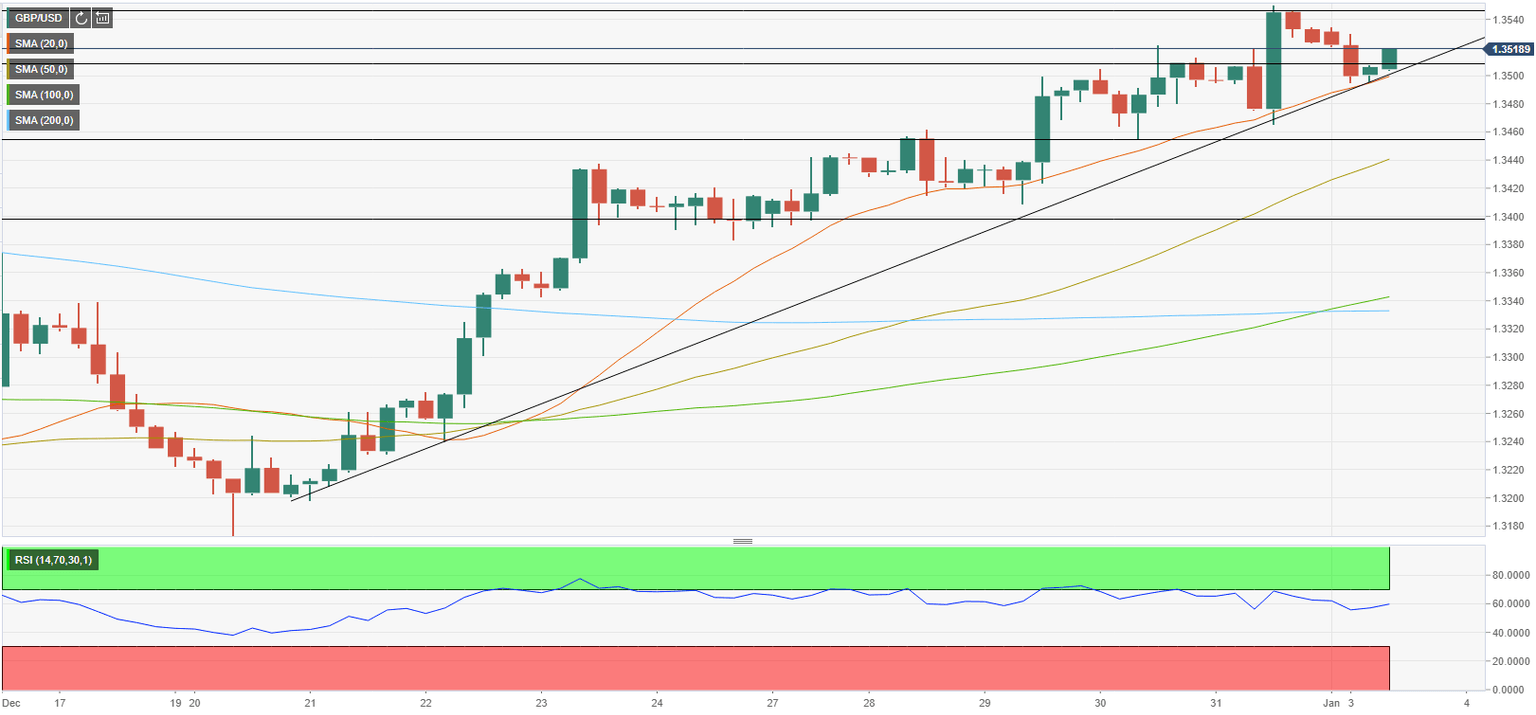

GBP/USD Forecast: Pound to weaken further if buyers fail to defend 1.3500

GBP/USD has registered impressive gains in the last two weeks of the year but bulls seem to have lost interest on the first trading day of 2022. The pair has already tested 1.3500 once, and the bearish pressure could increase in case buyers stop defending that level.

The number of confirmed coronavirus cases in the UK continues to rise at an unprecedented pace. Although the British government refrained from imposing new restrictions before the New Year, widespread staff absences are weighing on economic activity, especially in the service sector. Read more...

GBP/USD recovers a major part of its intraday losses, holds steady above 1.3500 mark

The GBP/USD pair remained on the defensive through the first half of the European session, albeit has managed to recover a few pips from the daily swing low. The pair was last seen trading around the 1.3515-20 region, down less than 0.10% for the day.

The US dollar made a solid comeback on the first trading day of the new year and failed to assist the GBP/USD pair to capitalize on its recent gains recorded over the past two weeks or so. The Fed's hawkish outlook, indicating at least three rate hikes in 2022, along with elevated US Treasury bond yields acted as a tailwind for the greenback. Read more...

GBP/USD: Bearish pressure to increase in case buyers stop defending 1.35

British pound has lost its bullish momentum following Friday's upsurge. As FXStreet’s Eren Sengezer notes, GBP/USD is set to weaken further if buyers fail to defend 1.3500.

“Later in the day, British Prime Minister Boris Johnson is expected to deliver an update on restrictions after assessing the latest Omicron data. In case investors see the negative impact of the Omicron variant on the British economy as a factor that would cause the Bank of England to pause its policy tightening, the GBP could find it difficult to attract buyers.” Read more...

Author

FXStreet Team

FXStreet