Pound Sterling Price News and Forecast: GBP/USD reached 1.4000 mark

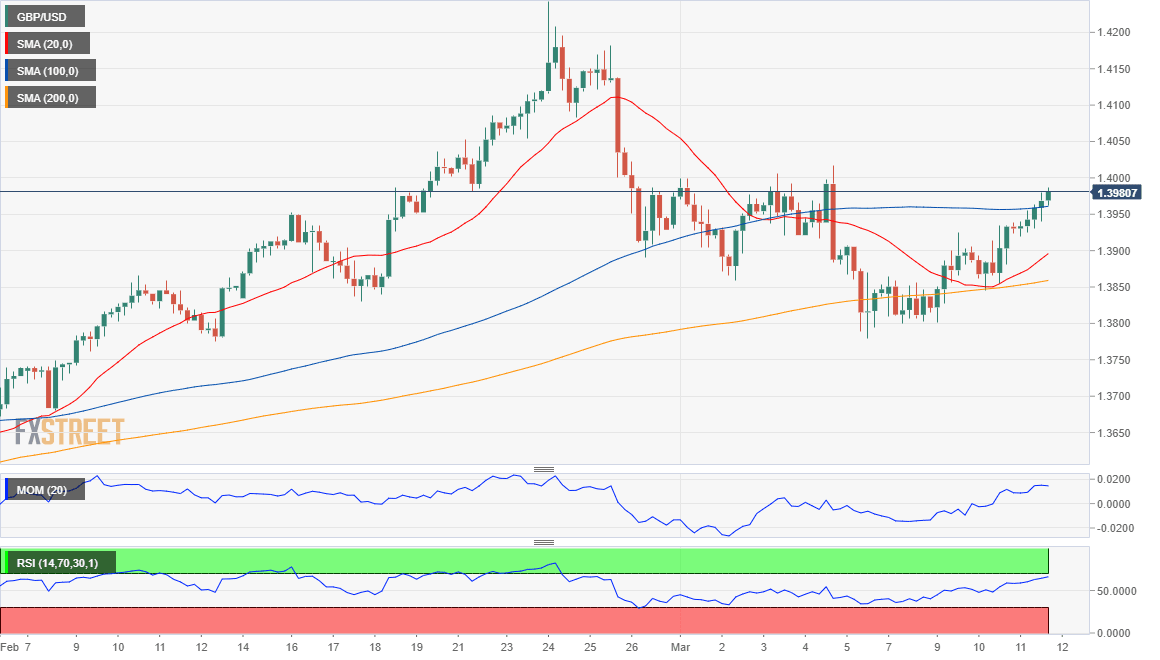

GBP/USD Forecast: Bulls poised to challenge the 1.4000 mark

A weaker dollar helped GBP/USD reach 1.3986, its highest for this week, with the pair holding on to gains at the end of the American session. The pair surged on the back of sub-1.50% 10-year Treasury yields, as the latter fell to 1.475% ahead of the opening. The greenback remained under pressure despite the latter recovered to 1.52%.

The UK published the February RICS Housing Price Balance, which beat expectations by printing at 52%. This Friday, the kingdom will release January Industrial Production, foreseen at -4% YoY, and the monthly Gross Domestic Product, foreseen at -4.9% from 1.2% in January. The country will also unveil the January Trade Balance. Read more...

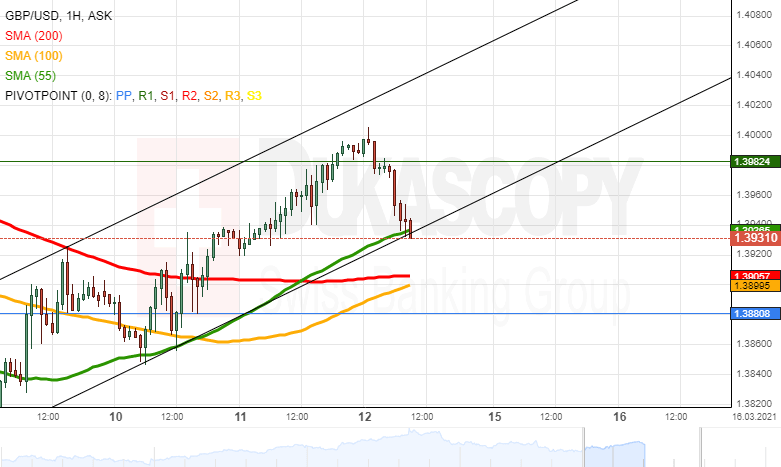

GBP/USD analysis: Reached 1.4000 mark

At midnight to Friday, the GBP/USD reached the resistance of the 1.4000 mark. This level provided resistance and the currency exchange rate retreated. By the middle of the day's trading, the retracement down had reached the combined support of the channel up pattern and the 55-hour simple moving averages.

The channel's line and the 55-hour SMA were most likely going to provide support and cause another test of the resistance of the 1.4000 level. If the 1.4000 level would get passed, the rate could aim at the 1.4100 mark. Read more...

GBP/USD dives to session lows, around 1.3900 mark amid notable USD demand

The GBP/USD pair refreshed daily lows in the last hour, with bears now eyeing sustained weakness below the 1.3900 round-figure mark.

The pair struggled to capitalize on this week's strong positive move of around 200 pips and faced rejection near the key 1.4000 psychological mark amid resurgent US dollar demand. The US Treasury bond yields resumed their climb on the last trading day of the week and assisted the USD to regain positive traction. Read more...

Author

FXStreet Team

FXStreet