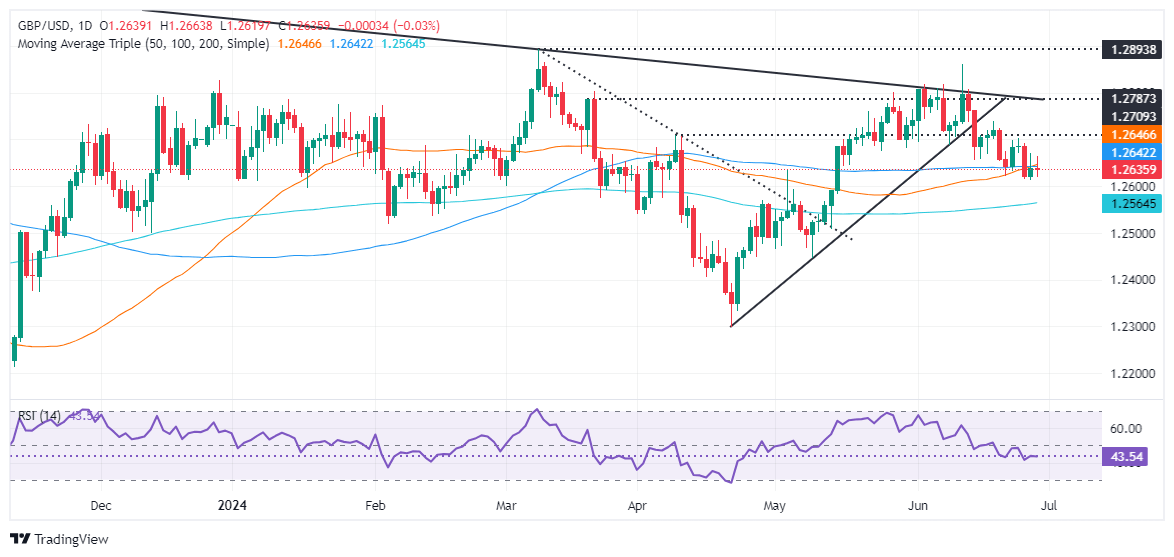

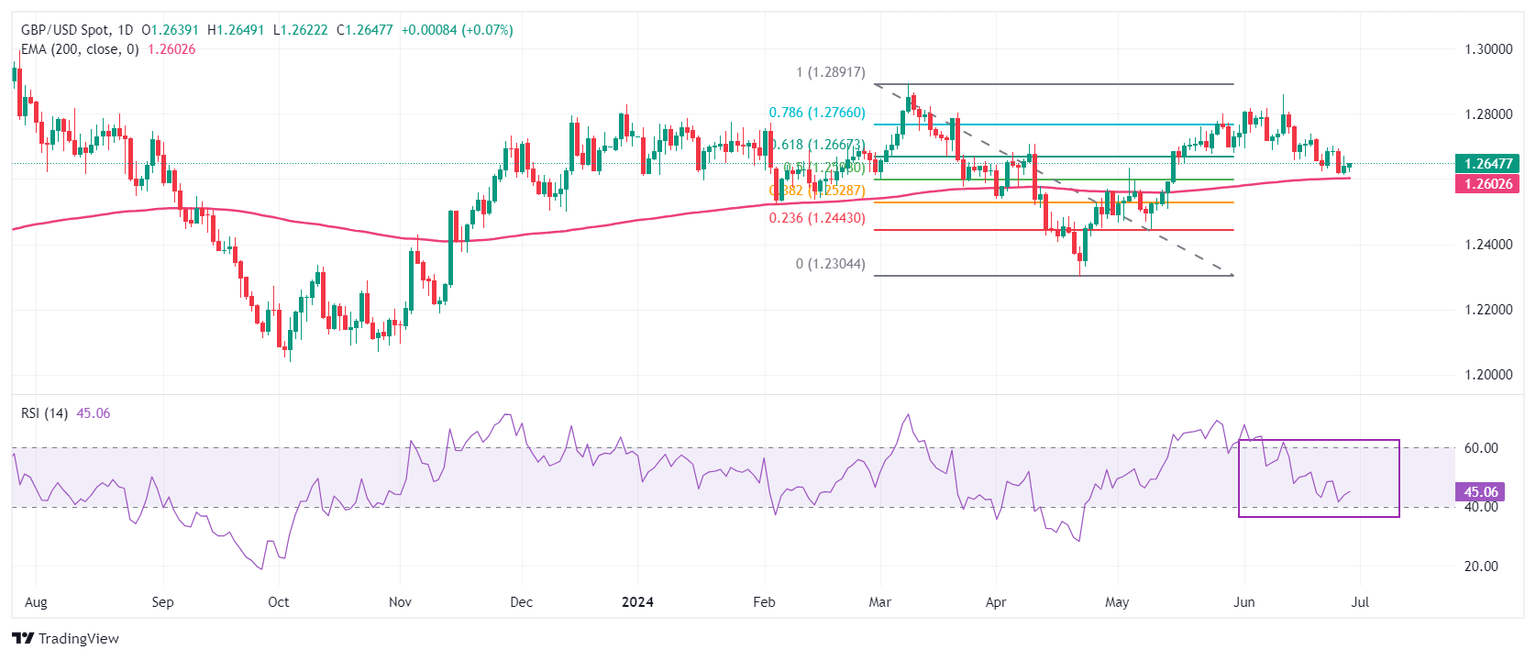

GBP/USD Price Analysis: Posts weekly losses, directionless beneath 1.2650

The GPB/USD is subdued during the North American session on Friday following a positive UK

GDP report, yet an uptick in the Fed’s preferred gauge of inflation, the PCE Price Index, capped the major, which trades at 1.2642, virtually unchanged.

Read More...

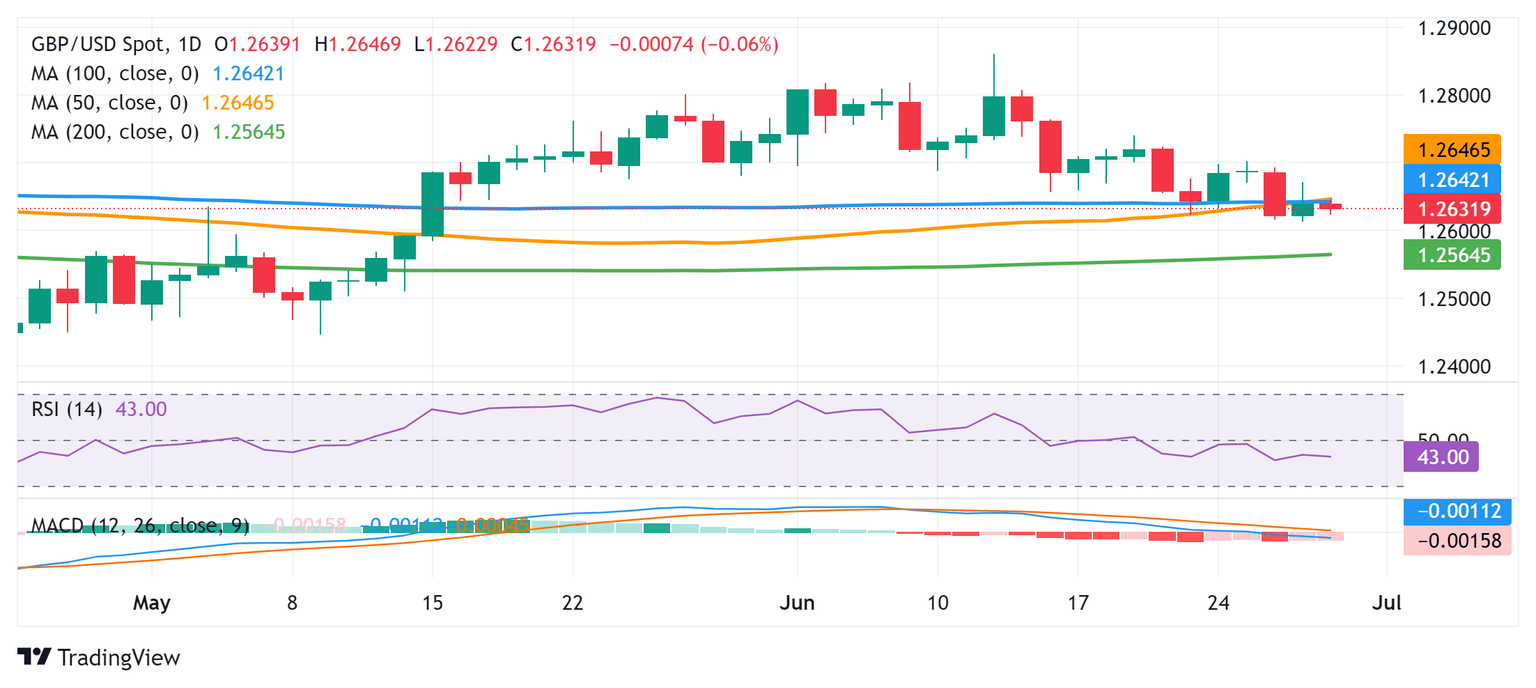

Pound Sterling moves higher as US core PCE Inflation cools down expectedly

The Pound Sterling (GBP) gains against the US Dollar (USD) in Friday’s New York session. The GBP/USD pair rises slightly as the

United States (US) core Personal Consumption Expenditures (PCE) Price Index declined expectedly in May.

Read More...

GBP/USD Price Analysis: Remains vulnerable near monthly low, US PCE data awaited

The GBP/USD pair extends the overnight late pullback from the 1.2670 region and trades with a mild negative bias during the Asian session on Friday. Spot prices currently hover around the 1.2635-1.2630 area and remain well within the striking distance of the lowest level since mid-May touched on Thursday.

Read More...