Pound Sterling Price News and Forecast: GBP/USD plummets to fresh 22-month lows

GBP/USD plummets to fresh 22-month lows and hovers around 1.2450s after US data

The British pound keeps plunging, extending its April monthly fall to 5.43%, and it is approaching the 1.2400 figure on Thursday amidst an upbeat tilted mood, despite that some US and European indices record losses. At the time of writing, the GBP/USD is trading at 1.2440. Read more...

GBP/USD Forecast: Potential for a rebound above 1.2600 on weak US GDP

After having dropped below 1.2500 for the first time since July 2020 in the early European morning, GBP/USD has managed to erase its daily losses to turn positive on the day above 1.2550. The pair remains oversold in the near term and an extended correction could be witnessed in case the greenback loses its strength on an uninspiring growth report. Read more...

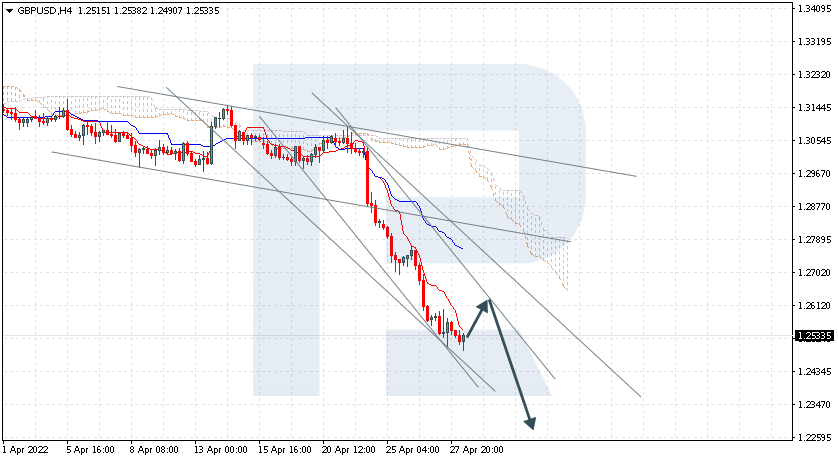

Ichimoku cloud analysis: GBP/USD, NZD/USD, USD/CAD

GBP/USD is still rebounding from Tenkan-Sen. The instrument is currently moving below Ichimoku Cloud, thus indicating a descending tendency. The markets could indicate that the price may test Tenkan-Sen and Kijun-Sen at 1.2615 and then resume moving downwards to reach 1.2265 Another signal in favour of a further downtrend will be a rebound from the descending channel’s upside border. Read more...

Author

FXStreet Team

FXStreet