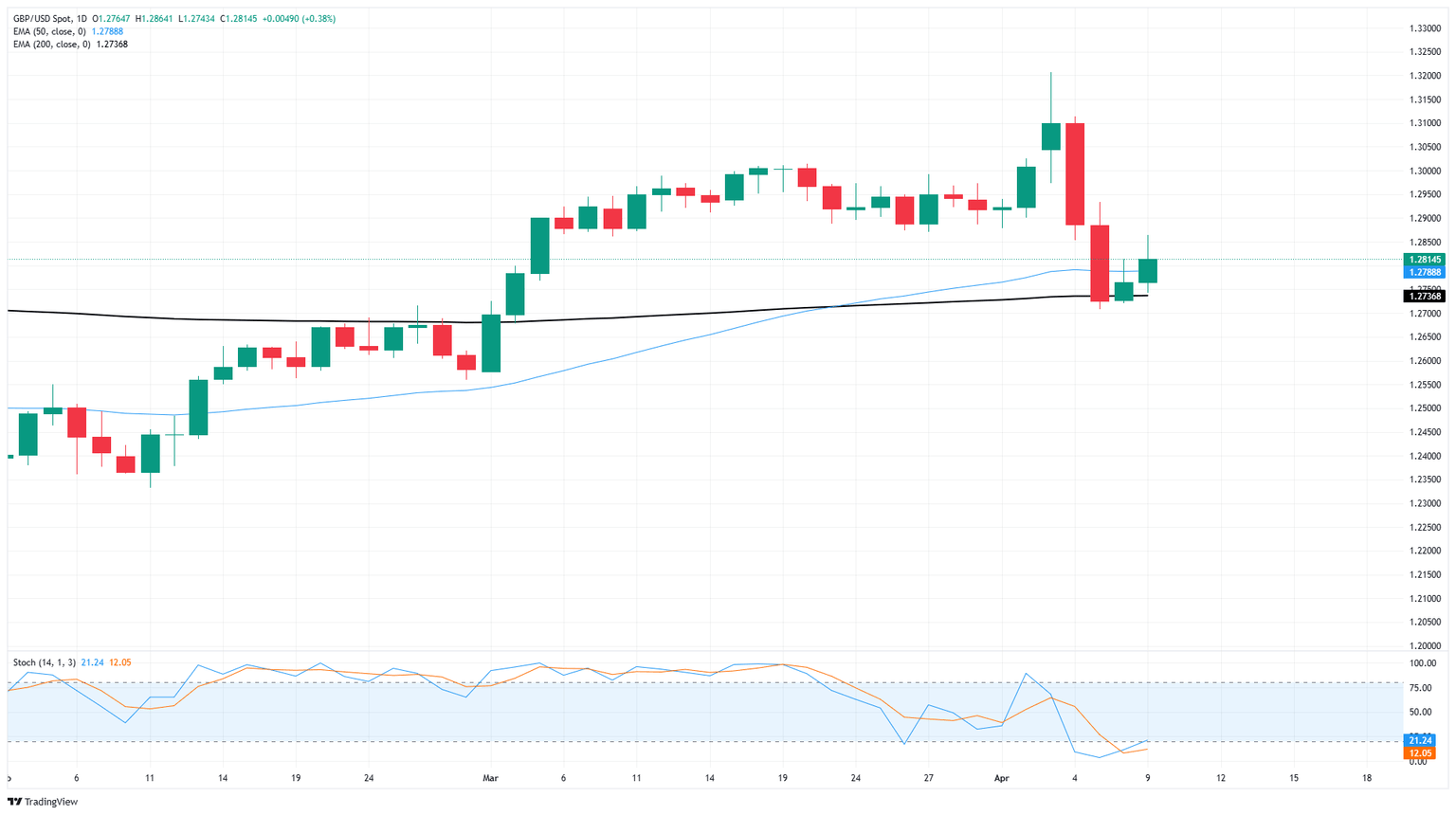

Pound Sterling Price News and Forecast: GBP/USD pair regains its ground ahead of Sarah Breeden's speech

GBP/USD trades near 1.2850 after recovering recent losses, BoE's Breeden speech awaited

The GBP/USD pair recovers its daily losses and continues its winning streak for the third successive session, hovering around 1.2850 during Asian trading hours on Thursday. The British Pound (GBP) came under pressure following the release of weaker-than-expected data from the RICS Housing Price Balance, which showed just a 2% increase in March. This marked a significant slowdown from the 20% and 11% gains recorded in January and February, respectively, and fell far short of the anticipated 8% rise—highlighting a stagnation in price growth over recent months.

Further weighing on the British Pound was renewed trade tension between the US and China. US President Donald Trump announced an immediate hike in tariffs on Chinese imports to 125%, following China’s retaliatory increase in duties on US goods to 84%. This escalating trade war poses a negative backdrop for the United Kingdom (UK), which appears ill-equipped to compete in a price war with China. The tit-for-tat tariff hikes overshadowed earlier efforts to ease trade tensions, where the US had temporarily reduced tariffs to 10% for 90 days to support broader negotiations. Read more...

GBP/USD explores further upside as market sentiment rebounds after tariff delay

GBP/USD tested higher on Wednesday, climbing back over the 1.2800 handle after broad-market sentiment recovered across the board. The Trump administration has once again pivoted away from its own “no exceptions, no delays” tariff policy, and has again delayed tariffs, this time for 90 days.

Global markets responded by widely surging, though bullish appetite remained limited for Cable, which rose a meager 0.3%. US President Donald Trump still has a 10% “reciprocal” tariff in place as the White House gives most of its trading partners time to negotiate out from tariff levels that were initially calculated by dividing imports by US exports, however the Trump administration has still raised tariffs on Chinese goods to 125% in a retaliatory move following China’s own retaliatory tariff on US goods of 84%, which will impact US agriculture almost exclusively. Read more...

Author

FXStreet Team

FXStreet