Pound Sterling outperforms amid renewed concerns on Fed's independence

- The Pound Sterling bounces back against the US Dollar to around 1.3465 as the US DoJ imposes criminal charges on Fed’s Powell.

- Investors await the UK employment and the US inflation data, to be released on Tuesday.

- Fed’s Bostic stresses the need to bring inflation under control.

The Pound Sterling (GBP) recovers strongly to around 1.3465 against the US Dollar (USD) during the European trading session on Monday after a weak opening around 1.3390. The GBP/USD pair bounces back as the US Dollar corrects sharply, following the opening of a criminal investigation on Federal Reserve (Fed) Chair Jerome Powell over mismanaging funds in the reconstruction of Washington’s headquarters.

As of writing, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trades 0.3% lower near 98.80. The DXY has retraced after revisiting the monthly high near 99.25.

Over the weekend, the United States (US) Department of Justice sent a subpoena to the Fed for Jerome Powell, which directs an inquiry into his statements during his testimony at the Senate in June 2025 and an examination of his spending records.

In response, Fed’s Powell has also stated that the “new threat is not about his testimony or the renovation project but a pretext”. Powell added that the threat of criminal charges is a “consequence of the Fed setting interest rates based on its assessment of the public interest rather than the president's preferences”.

Market experts believe that criminal charges against Fed’s Powell have escalated his feud with US President Donald Trump, who has criticized him several times since his return to the White House for not lowering interest rates. This could lead to a serious dent in the Fed's autonomy, an unfavorable situation for the US Dollar.

US Dollar Price Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the weakest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.47% | -0.39% | -0.03% | -0.24% | -0.27% | -0.39% | -0.56% | |

| EUR | 0.47% | 0.08% | 0.44% | 0.22% | 0.20% | 0.08% | -0.09% | |

| GBP | 0.39% | -0.08% | 0.34% | 0.14% | 0.12% | -0.00% | -0.17% | |

| JPY | 0.03% | -0.44% | -0.34% | -0.21% | -0.24% | -0.36% | -0.52% | |

| CAD | 0.24% | -0.22% | -0.14% | 0.21% | -0.02% | -0.14% | -0.31% | |

| AUD | 0.27% | -0.20% | -0.12% | 0.24% | 0.02% | -0.12% | -0.30% | |

| NZD | 0.39% | -0.08% | 0.00% | 0.36% | 0.14% | 0.12% | -0.17% | |

| CHF | 0.56% | 0.09% | 0.17% | 0.52% | 0.31% | 0.30% | 0.17% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Daily Digest Market Movers: Fed's Bostic warns of inflation risks

- Looking at the United Kingdom, the Pound Sterling is expected to be driven by the UK employment data for the three months ending in November this week, which will be released on Tuesday. Investors will pay close attention to the UK labor market data to get fresh cues on the Bank of England’s (BoE) monetary policy outlook.

- In 2025, UK labor market concerns remain elevated as firms avoid aggressive hiring to offset the impact of higher employers’ contributions to social security schemes.

- Meanwhile, the monthly survey by the Recruitment and Employment Confederation (REC) trade body and accountants KPMG showed earlier in the day that labor demand remained soft while wage growth accelerated in December.

- In the US, the Nonfarm Payrolls (NFP) report for December showed on Friday that the Unemployment Rate dropped sharply to 4.4% from 4.6% in November. However, hiring was lower at 50K against estimates of 60K and the prior reading of 56K.

- Going forward, the next major trigger for the US Dollar will be the release of the Consumer Price Index (CPI) data on Tuesday. Investors will closely monitor the US inflation data for fresh cues on the interest rate outlook.

- In 2025, the Fed delivered three interest rate cuts of 25 basis points (bps) in an attempt to contain labor market woes, even as inflation had remained well above the 2% target for a long period.

- On Friday, Atlanta Fed President Raphael Bostic said in an interview with radio station WLRN that inflation is “too high” and that the Fed needs to get it “under control”.

Technical Analysis: GBP/USD attracts bids below 20-day EMA

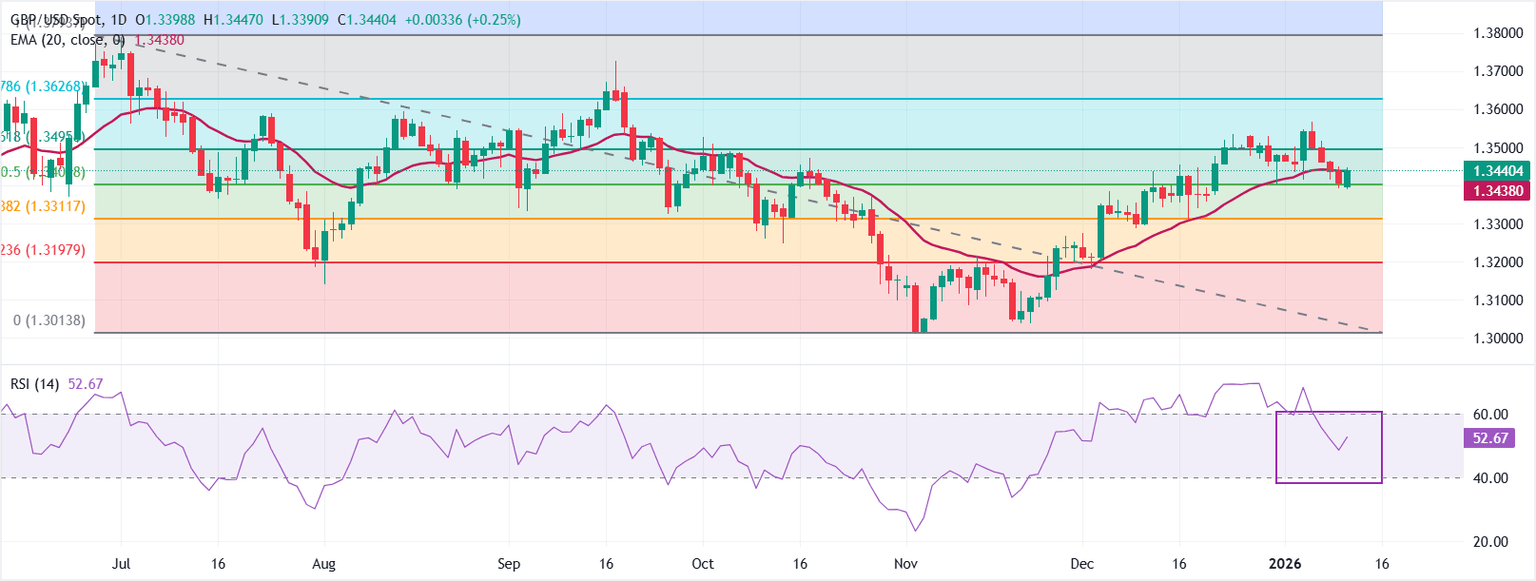

GBP/USD trades higher, at around 1.3465 at the time of writing. The 20-day Exponential Moving Average (EMA) rises and sits at 1.3438, with price holding just above it, which supports a bullish tone.

The 14-day Relative Strength Index (RSI) at 53 (neutral) has turned higher, confirming steady momentum.

Measured from the 1.3794 high to the 1.3014 low, the 61.8% retracement at 1.3496 acts as immediate resistance . A decisive break above it would signal that the bearish downtrend is losing strength and could open further upside towards the September 17 high at 1.3726.

Conversely, failure to clear 1.3496 would keep the pair contained, with a drift back toward the 50% retracement at 1.3404 dampening momentum and maintaining the rebound within a tight range.

(The technical analysis of this story was written with the help of an AI tool.)

Economic Indicator

Consumer Price Index (YoY)

Inflationary or deflationary tendencies are measured by periodically summing the prices of a basket of representative goods and services and presenting the data as The Consumer Price Index (CPI). CPI data is compiled on a monthly basis and released by the US Department of Labor Statistics. The YoY reading compares the prices of goods in the reference month to the same month a year earlier.The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Next release: Tue Jan 13, 2026 13:30

Frequency: Monthly

Consensus: 2.7%

Previous: 2.7%

Source: US Bureau of Labor Statistics

The US Federal Reserve (Fed) has a dual mandate of maintaining price stability and maximum employment. According to such mandate, inflation should be at around 2% YoY and has become the weakest pillar of the central bank’s directive ever since the world suffered a pandemic, which extends to these days. Price pressures keep rising amid supply-chain issues and bottlenecks, with the Consumer Price Index (CPI) hanging at multi-decade highs. The Fed has already taken measures to tame inflation and is expected to maintain an aggressive stance in the foreseeable future.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.