Pound Sterling Price News and Forecast: GBP/USD moves little ahead of the release of UK GDP data

GBP/USD remains close to near 1.3450 ahead of Q2 UK GDP data

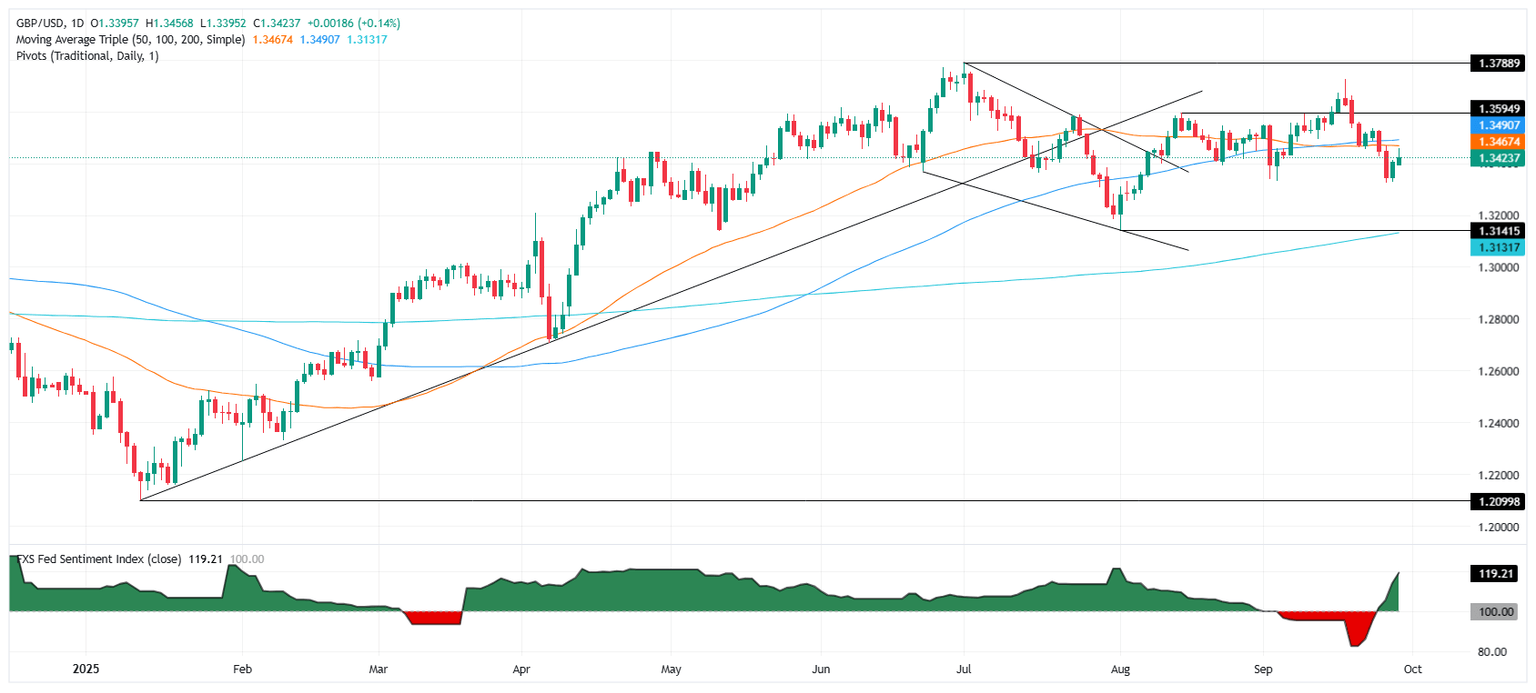

GBP/USD stays silent after two days of gains, trading around 1.3440 during the Asian hours on Tuesday. The pair moves little ahead of the release of the United Kingdom’s (UK) Gross Domestic Product (GDP) data for the second quarter. The Office for National Statistics (ONS) is set to release Q2 UK GDP data at 06:00 GMT, with markets expecting steady growth of 0.3% quarter-over-quarter and 1.2% year-over-year.

The pair shows limited movement as traders exercise caution amid concerns that this week’s US jobs report may be delayed, with the government approaching a potential funding freeze and shutdown. Traders await the September Nonfarm Payrolls report for insights into the labor market, alongside data on job openings, private payrolls, and the ISM manufacturing PMI." Read more...

GBP/USD extends into a two-day bullish recovery as 1.34 holds

GBP/USD clawed its way into a second consecutive winning market session on Monday, squeezing out another one-fifth of one percent as top-heavy US Dollar (USD) flows continued to recede across the board. The Pound Sterling (GBP) gained just enough room to squeeze back about the 1.3400 handle, and now the latest UK Gross Domestic Product (GDP) growth figures lie ahead on Tuesday.

Final Q2 UK GDP growth is expected to hold steady at 0.3% QoQ and 1.2% YoY. The final GDP figure rarely deviates far from consensus. However, a steep enough unexpected tilt in either direction could send the Pound soaring or plummeting, depending on whether the data over- or under-shoots forecasts. Read more...

GBP/USD rises as Fed rate cut bets grow, US shutdown risks loom

The GBP/USD pair advances on Monday as the US Dollar (USD) trims some of last week’s gains as a busy economic docket in the US approaches. The pair trades at 1.3430, up 0.24%. Fears of a potential government shutdown in the US weigh on the US Dollar despite remaining concerns about the UK's finances. On Monday, the Labor Party conference began in Liverpool, and it will be the focus for investors, according to Chris Turner, head of forex strategy at ING.

Aside from this, the central bank divergence favors further upside for the GBP/USD pair. The Bank of England (BoE) is expected to hold rates unchanged at the next meeting, while market participants have priced in almost two rate cuts by the Federal Reserve (Fed). Read more...

Author

FXStreet Team

FXStreet