Pound Sterling Price News and Forecast: GBP/USD may lose ground as the British Pound faces headwinds

GBP/USD maintains position above 1.3300 after strong gains, focus turns to key UK, US data

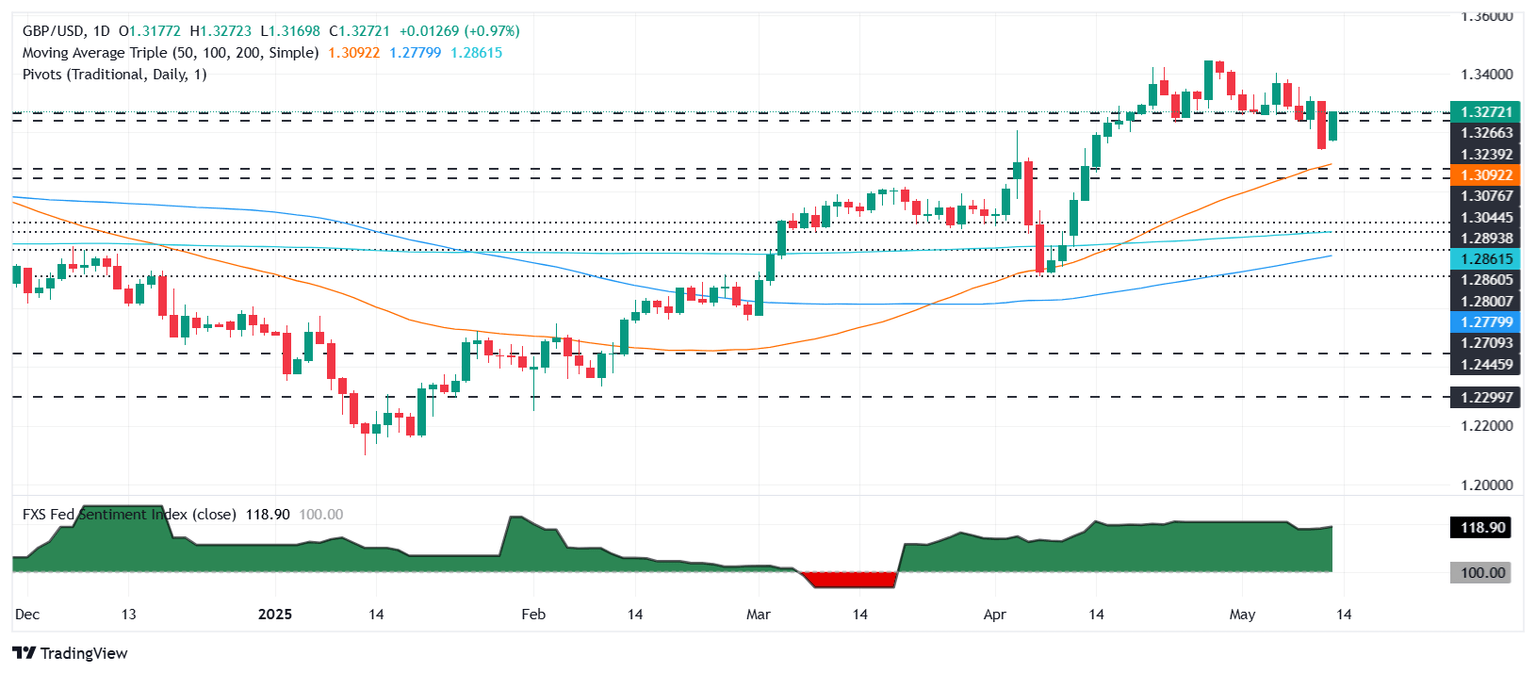

GBP/USD is trading around 1.3300 during Wednesday’s Asian session, stabilizing after posting over 1% gains in the previous session. However, the pair’s upside may be capped as the British Pound (GBP) faces headwinds from cooling employment and moderating wage growth in the UK, factors that could reinforce expectations for further interest rate cuts by the Bank of England (BoE).

This week, market participants are bracing for heightened volatility in the Pound Sterling, with the release of the UK’s preliminary Q1 GDP and Industrial and Manufacturing Production data on Thursday. The UK economy is forecast to have grown by 0.6% in the first quarter. Read more...

GBP/USD enters a choppy phase as market sentiment churns

GBP/USD caught a bid on Tuesday, rebounding above the 1.3300 handle and reversing early week losses as global markets tilt and twist around general Greenback flows based on broad-market sentiment. UK labor figures barely moved the needle, and market reaction to US Consumer Price Index (CPI) inflation was likewise muted. Investors continue to focus on hopes that continued trade deal negotiations between the Trump administration and literally everybody else continues to drive general sentiment, however all trade tariff concessions delivered by team Trump have been strictly temporary in nature.

The UK’s quarterly ILO Unemployment Rate ticked slightly higher to 4.5% as expected, while Claimant Count Change in April rose far less than expected, rising to just 5.2K. However, the figure still wasn’t as good as March’s -16.9K contraction in the number of newly-unemployed workers. On the US side, CPI inflation eased slightly in April, with annualized headline inflation falling to a fresh three-year low. However, the Trump administration’s trade strategy of imposing triple-digit tariffs on its own major trading partners is expected to come home to roost beginning in May, and market experts are broadly expecting this to be the last decent CPI print for a while. Read more...

GBP/USD rebounds on soft CPI, boosting Fed cut bets

The Pound Sterling (GBP) recovered from Monday's losses and climbed over 0.35% against the US Dollar (USD) after the latest inflation report in the United States (US) kept traders' hopes high for further easing by the Federal Reserve (Fed). GBP/USD trades at 1.3226 after bouncing off a daily low of 1.3165. Sterling climbs 0.35% after cooler-than-expected US inflation revives easing hopes; UK jobs data signals BoE caution.

The US Consumer Price Index (CPI) in April was slightly below estimates in the monthly headline and core figures. The CPI came in at 0.2% below forecasts of 0.3%, but a touch higher than the March print of -0.1%. Core CPI stood at 0.2%, up from 0.1% but beneath forecasts of 0.3%. Read more...

Author

FXStreet Team

FXStreet