Pound Sterling Price News and Forecast: GBP/USD may find initial resistance at nine-day EMA of 1.3645

GBP/USD Price Forecast: Falls toward 1.3600 after breaking below nine-day EMA

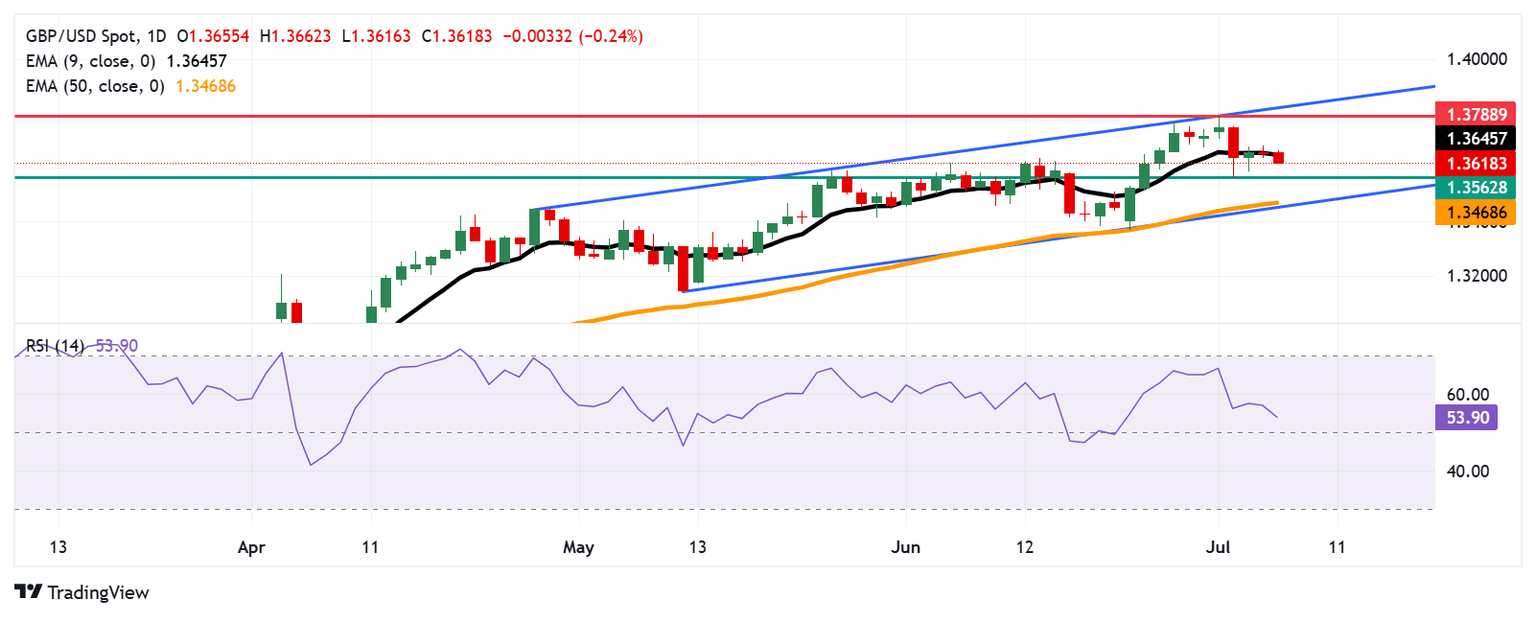

The GBP/USD pair extends its losses for the second successive session, trading around 1.3620 during the Asian hours on Monday. The bullish bias persists as the daily chart’s technical analysis indicates that the pair remains within the ascending channel pattern.

The 14-day Relative Strength Index (RSI) remains slightly above the 50 level, strengthening the bullish bias. However, the GBP/USD pair has moved below the nine-day Exponential Moving Average (EMA), suggesting the short-term price momentum is weaker. Read more...

GBP/USD Weekly Outlook: Pound Sterling to seek multi-year highs as Fed Minutes and UK GDP loom

The Pound Sterling (GBP) stretched its recovery mode and hit its highest since October 2021 against the US Dollar (USD) before sellers jumped in and sent the GBP/USD pair back toward the 1.3650 region.

After a stellar performance, spanning almost two weeks, GBP/USD buyers took a breather as exhaustion set in. The main driver again was the dynamics of the US Dollar, but the British bond market jitters were also felt midweek, undermining the recent bullish momentum in the currency pair. Read more...

GBP/USD lacks firm intraday direction, flat lines around mid-1.3600s

The GBP/USD pair kicks off the new week on a subdued note and oscillates in a narrow band around mid-1.3600s during the Asian session amid mixed fundamental cues.

The British Pound (GBP) drew some support last week from Prime Minister Keir Starmer’s announcement that Chancellor Rachel Reeves would remain in office for the foreseeable future. However, the growing possibility of a Bank of England (BoE) rate cut as early as August acts as a headwind for the GBP/USD pair. In fact, BoE Governor Andrew Bailey stated that interest rates are moving downwards, while MPC member Alan Taylor called for faster rate cuts amid the risk of a hard landing for the UK economy. Read more...

Author

FXStreet Team

FXStreet