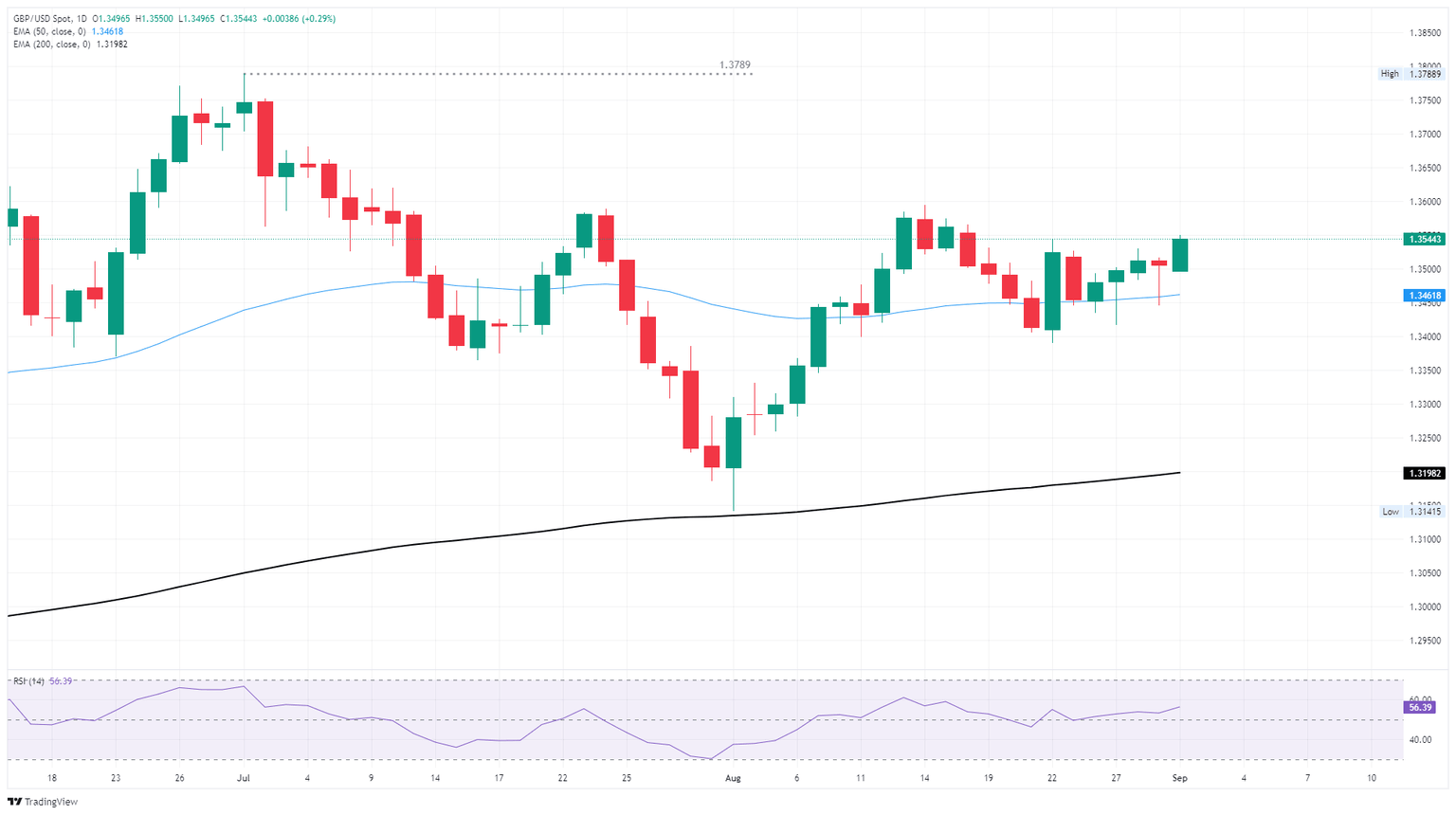

Pound Sterling Price News and Forecast: GBP/USD loses ground as the US Dollar recovers on uncertainty

GBP/USD falls toward 1.3500 amid uncertain Fed policy outlook

GBP/USD retraces its recent gains from the previous session, trading around 1.3520 during the Asian hours on Tuesday. The pair depreciates as the US Dollar (USD) gains ground, driven by persistent inflationary pressures in the United States (US), which heightened uncertainty over potential Federal Reserve (Fed) rate cuts. Traders will likely observe the August ISM Manufacturing Purchasing Managers Index (PMI) later in the day.

Furthermore, traders will also observe upcoming labor market data this week that could shape the US Federal Reserve’s (Fed) policy decision in September. Key reports include ADP Employment Change, Average Hourly Earnings, and Nonfarm Payrolls for August. Read more...

GBP/USD rises as risk appetite floats higher heading into tense week

GBP/USD found room on the high end on Monday, kicking off a fresh trading week with another leg up the charts. Cable rose around three-tenths of one percent despite a general lack of meaningful data or headlines as investors continue to bank on a fresh round of interest rate cuts from the Federal Reserve (Fed) this month.

Tuesday will be dominated by US economic data, with a clear docket on the UK side. US ISM Manufacturing PMI figures from August will be dropping during the American market session, and median market forecasts are expecting a general uptick to 49.0 from 48.0. The response rate for PMI surveys is generally too low to stretch the final figure into an accurate sample size, thus rendering any conclusions drawn from the survey a moot point. However, the final figure will nonetheless be watched by investors. Read more...

Author

FXStreet Team

FXStreet