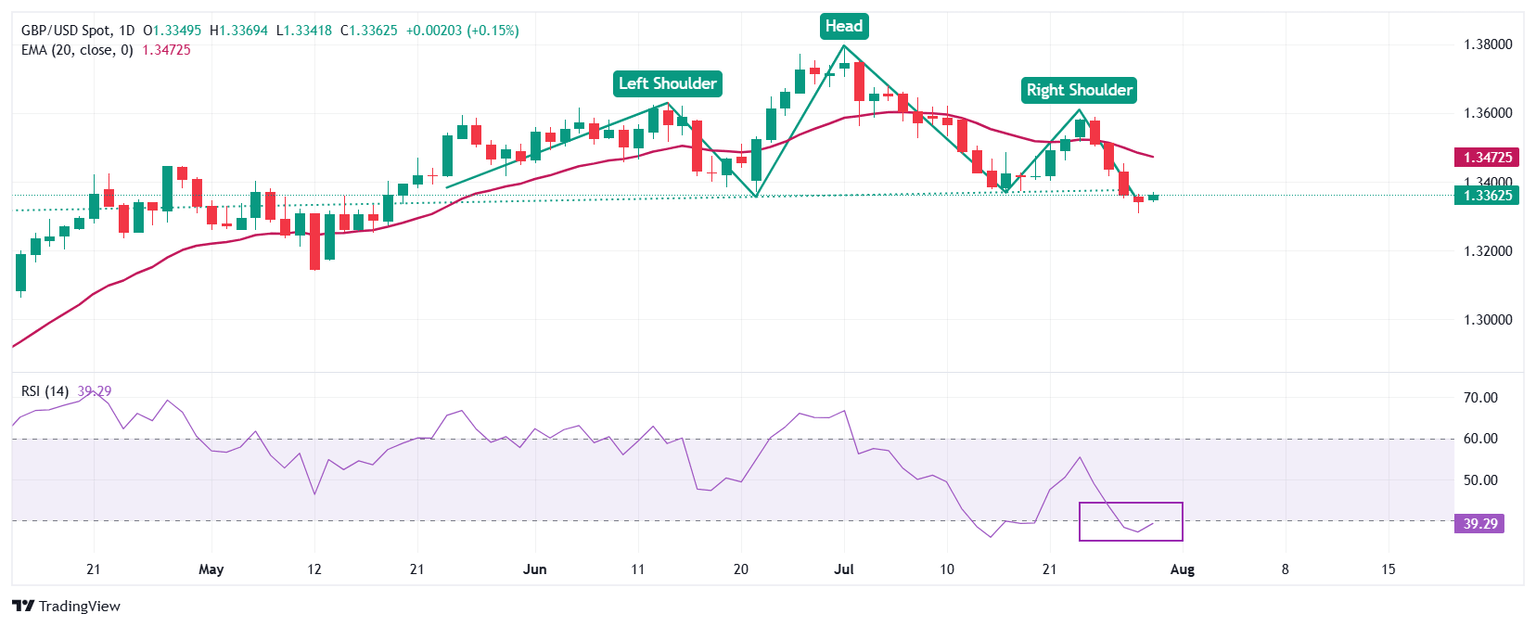

Pound Sterling Price News and Forecast: GBP/USD likely to consolidate between 1.3315 and 1.3385

Pound Sterling wobbles against US Dollar as Fed's policy takes centre stage

The Pound Sterling (GBP) trades cautiously near 1.3350 against the US Dollar (USD) during the European trading session on Wednesday as investors await the Federal Reserve’s (Fed) monetary policy announcement at 18:00 GMT.

At the time of writing, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, holds onto gains near the new monthly high of 99.00 posted on Tuesday. Read more...

GBP/USD: Likely to consolidate between 1.3315 and 1.3385 – UOB Group

Pound Sterling (GBP) is likely to consolidate between 1.3315 and 1.3385. In the longer run, price action continues to suggest GBP weakness; the next technical target is 1.3300, UOB Group's FX analysts Quek Ser Leang and Peter Chia note. Read more...

GBP/USD holds ground around 1.3350 as US Dollar weakens ahead of Fed decision

GBP/USD edges higher after four days of losses, trading around 1.3360 during the Asian hours on Wednesday. The pair gains ground as the US Dollar (USD) remains subdued ahead of US Federal Reserve (Fed) interest rate decision later in the North American session. Read more...

Author

FXStreet Team

FXStreet