Pound Sterling Price News and Forecast: GBP/USD lacks any firm intraday direction; confined in a range

GBP/USD flat lines above 1.2900 mark as traders await Trump’s tariffs announcement

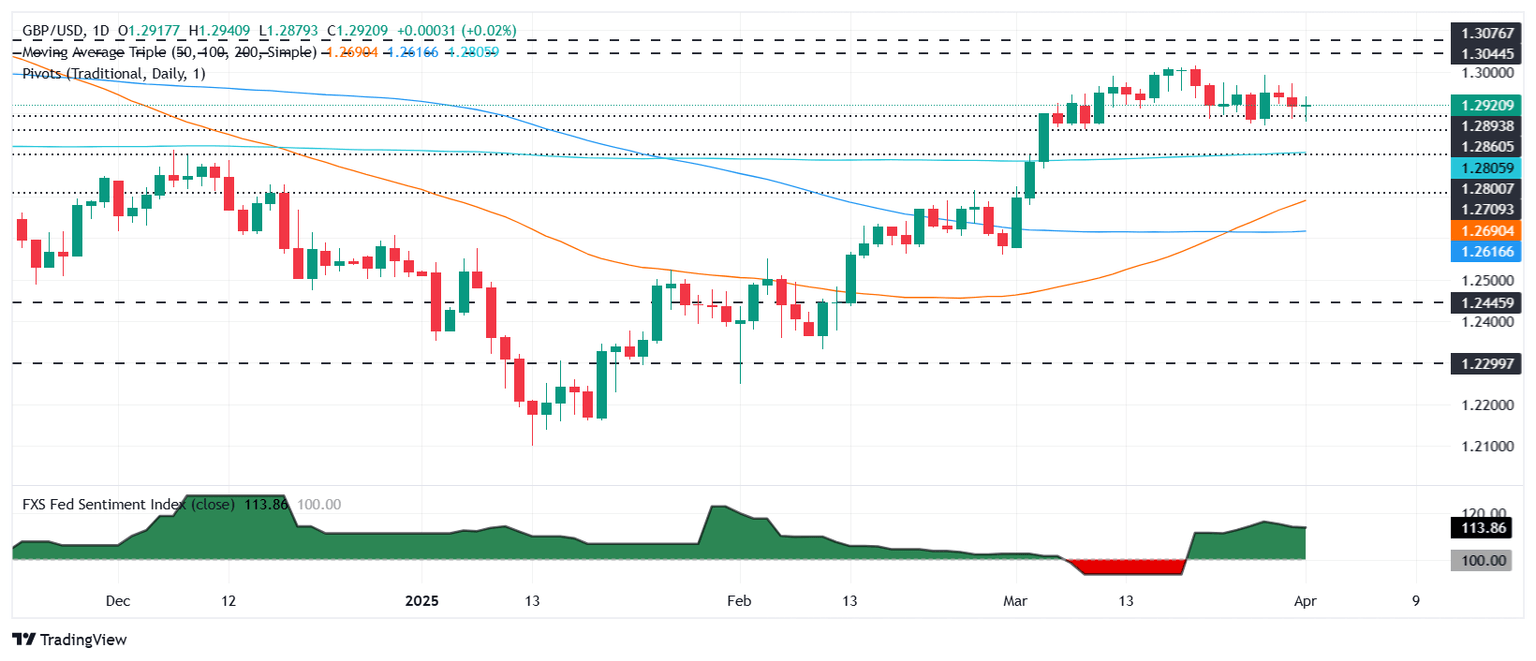

The GBP/USD pair struggles to capitalize on the overnight bounce from the vicinity of the 1.2870 support zone, or a multi-week low touched last Thursday, and oscillates in a narrow band during the Asian session on Wednesday. Spot prices currently trade around the 1.2915-1.2920 region, nearly unchanged for the day, as traders keenly await US President Donald Trump's reciprocal tariffs announcement before placing fresh directional bets.

In the meantime, investors opt to wait on the sidelines amid the risk of a widening global trade war, especially after Trump dashed hopes that the levies would be limited to a smaller group of countries with the biggest trade imbalances. The UK expects to be hit by new US tariffs, indicating that a deal to exempt British goods will not be reached in time. This, in turn, is seen acting as a headwind for the British Pound (GBP) and the GBP/USD pair. Read more...

GBP/USD holds flat as markets await tariffs

GBP/USD flatlined on Tuesday, churning just above the 1.2900 handle as investors buckle down for the wait to US President Donald Trump’s long-awaited tariff announcements slated for Wednesday evening. At 1900 GMT on Wednesday, President Trump is expected to unveil his “reciprocal” tariff package that he has been threatening since taking office on January 20.

Economic data has taken a firm back seat in the face of geopolitical uncertainty from still ambiguous trade policies from the White House. The Wall Street Journal reported on Tuesday that the United States Trade Representative Office may be preparing a last-minute alternative tariff proposal to present to Donald Trump in an effort to alleviate and streamline a lopsided pile of tariff threats from the US President over the past 71 days. Read more...

GBP/USD steady near 1.2920 as weak ISM data and tariff fears pressure US Dollar

The Pound Sterling (GBP) trades with minuscule losses against the US Dollar (USD) following the release of the latest Manufacturing PMI from the Institute for Supply Management (ISM), suggesting that business conditions are deteriorating, with companies feeling the impact of tariffs. At the time of writing, GBP/USD trades at 1.2920, virtually unchanged.

March’s ISM Manufacturing PMI painted a gloomy economic outlook after plunging to 49 from February’s 50.3, below forecasts of 49.5. The index contracted after two straight months of expansion, preceded by 26 consecutive months of contraction. At the same time, JOLTS data reported by the US Department of Labor depicted that vacancies in February decreased but remained at the same level, according to the release. The figures came at 7.568 million, down from 7.762 million and missing estimates of 7.63 million. Read more...

Author

FXStreet Team

FXStreet