Pound Sterling Price News and Forecast: GBP/USD keeps losing strength

GBP/USD Forecast: Investors struggle to find a reason to buy the British pound

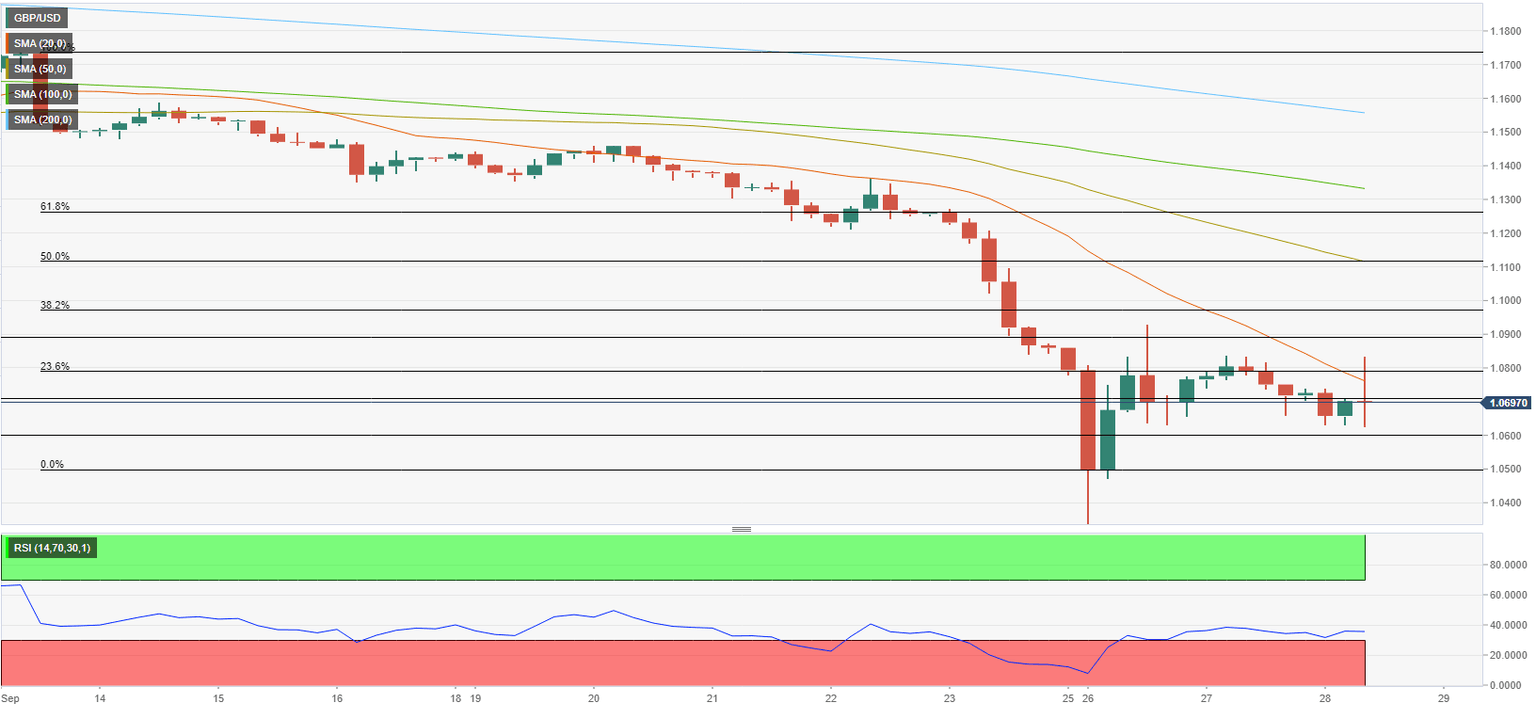

GBP/USD ended up posting modest gains on Tuesday but lost its recovery momentum early Wednesday. As markets assess the latest announcement from the Bank of England (BoE), the pair stays near 1.0700 but investors are likely to continue to find it highly risky to bet on a steady rebound in the British pound.

Commenting on the recent market developments, "it's hard not to draw the conclusion that we will need significant monetary policy response," Bank of England (BoE) Chief Economist Pill said late Tuesday. Pill further noted that they will not be selling gilts into a dysfunctional market but these remarks did little to nothing to help the sterling find demand. Read more...

GBP/USD keeps losing strength

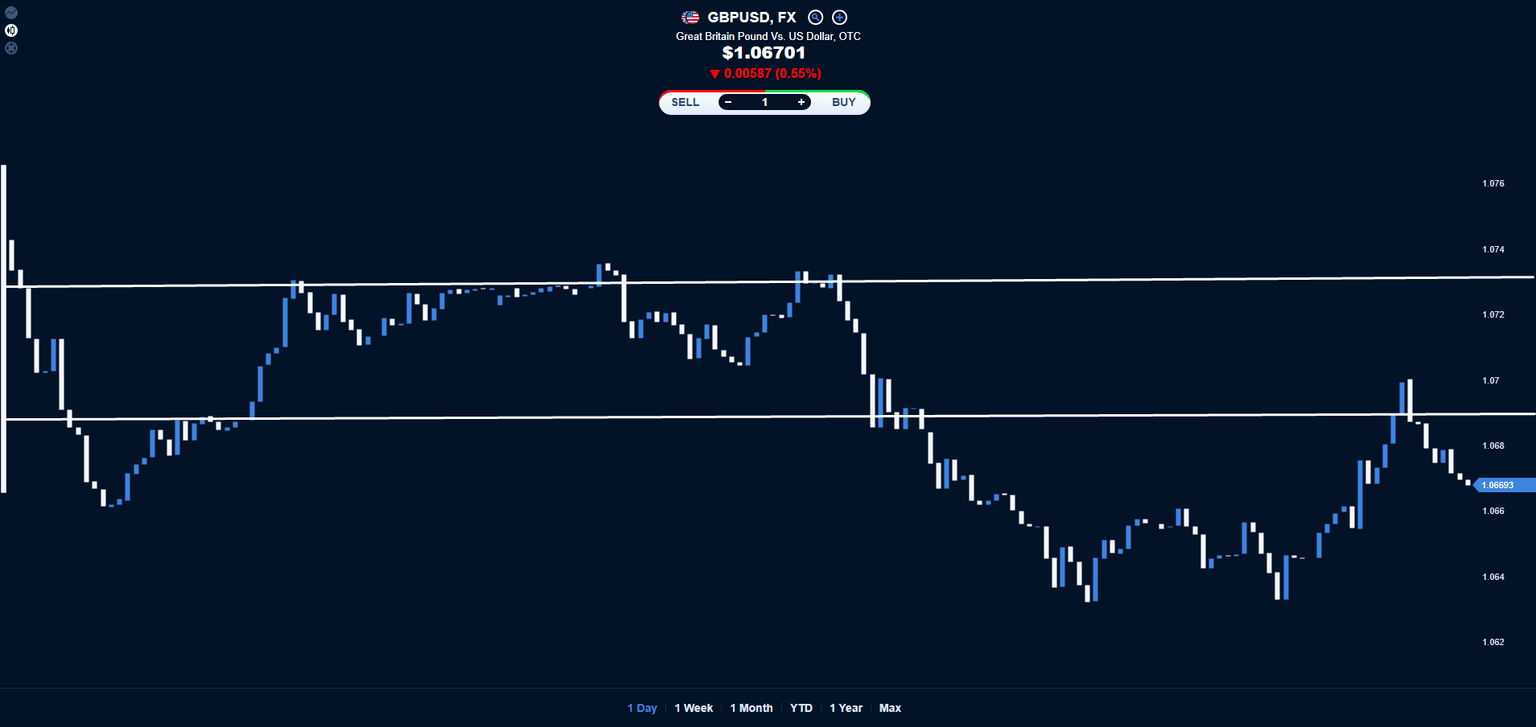

Looking at GBPUSD’s chart, we can see that it is in a downward trend and that it is unable to pass above the level of 1.0740, whereas currently it is traded at the rate of 1.067. After the announcement of the British government for the tax cuts, GBP is keep loosing strength and today we could see it falling towards its support of 1.0650 and if it will not manage to hold it above that level, then we should see it testing the level of 1.0630. Read more...

GBP/USD bounces off low, still deep in the red amid anxiety over UK’s economic plans

The GBP/USD pair plunges nearly 300 pips from the daily high and slips below mid-1.0500s heading into the North American session on Wednesday, though lacks follow-through. The pair is currently placed just below the 1.0600 round-figure mark, still down over 1.25% for the day.

The British pound did get a minor lift after the Bank of England announced that it will start buying long-dated UK government bonds to help restore orderly market conditions. The UK central bank's intervention appeared to calm the market, sending the yield on the 30-year benchmark gilt down by more than 50 bps at one point. The initial market reaction, however, fades rather quickly, which is evident from the GBP/USD pair's dramatic intraday turnaround from the 1.0840 region. Read more...

Author

FXStreet Team

FXStreet