Pound Sterling Price News and Forecast: GBP/USD is oscillating in a narrow range below 1.2500

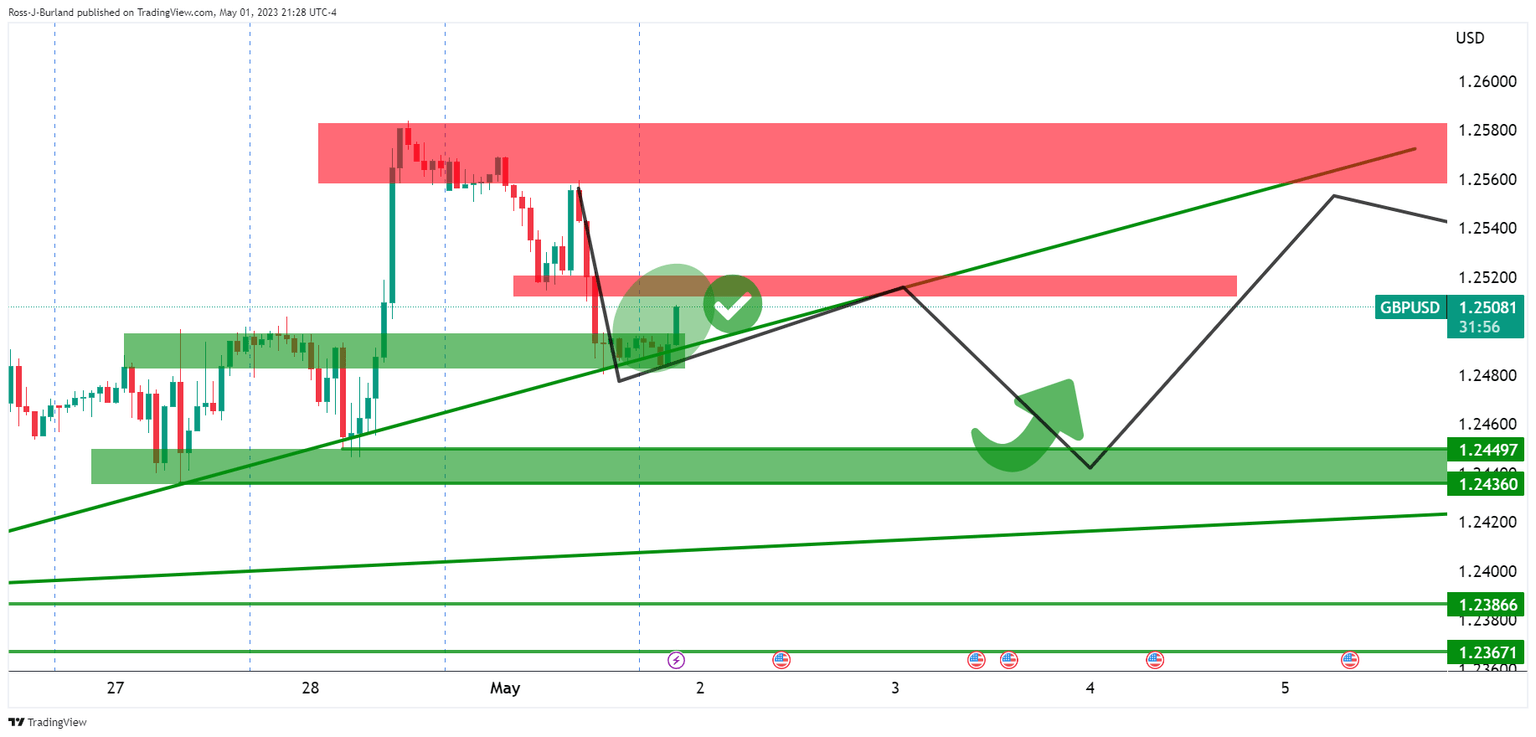

GBP/USD Price Analysis: Bears could be about to make their moves

GBP/USD bulls are moving in from key support. Bears could be lurking around a 50% mean reversion. GBP/USD is correcting into a potential resistance area. Read more...

GBP/USD juggles below 1.2500 as investors await Fed’s rate policy and US ADP job data

The GBP/USD pair is showing back-and-forth action in a narrow range below the psychological resistance of 1.2500 in the early Asian session. The Cable is demonstrating a volatility contraction, however, a power-pack action is expected ahead of the interest rate decision by the Federal Reserve (Fed) and the United States Automatic Data Processing (ADP) Employment data.

S&P500 futures have added more losses in early Asia as anxiety among market participants ahead of the Fed’s interest rate policy is deepening. An elevation in the risk aversion market mood is expected to impact risk-sensitive assets further. Read more...

Author

FXStreet Team

FXStreet