Pound Sterling Price News and Forecast: GBP/USD is not out of the woods yet

GBP/USD Forecast: Pound Sterling is not out of the woods yet

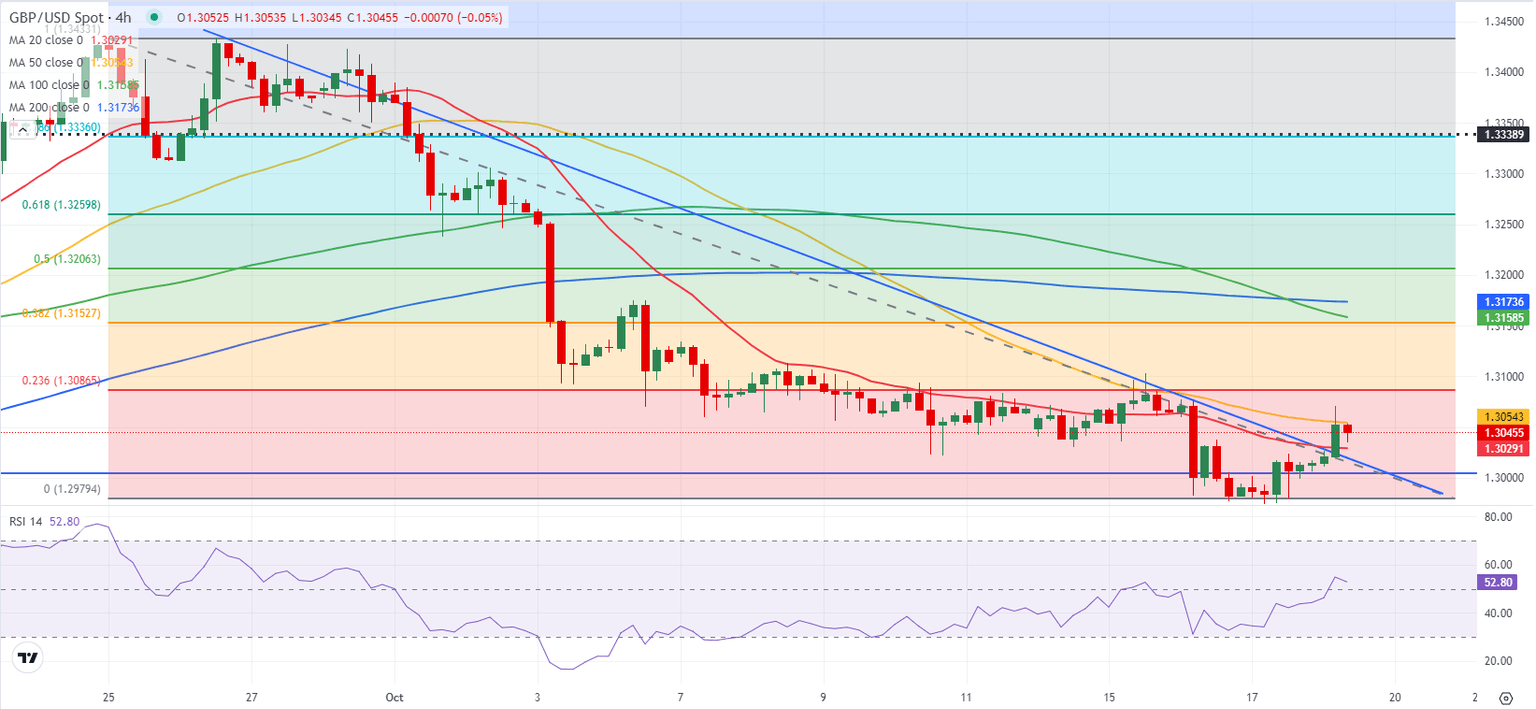

GBP/USD ignored the persistent US Dollar (USD) strength and closed in positive territory on Thursday. The pair continued to edge higher early Friday and advanced to the 1.3050 area. In the absence of high-impact data releases, the risk mood could impact GBP/USD's action heading into the weekend.

Following the sharp decline seen on Wednesday, GBP/USD found a foothold on Thursday. Although the USD held resilient against its major rivals, Pound Sterling managed to capture capital outflows out of the Euro. Following the European Central Bank's (ECB) decision to lower key rates by 25 basis points and President Christine Lagarde's dovish commentary, EUR/GBP fell nearly 0.5% on Thursday. Read more...

GBP/USD ticks higher to 1.3025 area on softer USD, BoE rate-cut bets cap gains

The GBP/USD pair attracts some follow-through buying during the Asian session on Friday and looks to build on the overnight bounce from the 1.2975-1.2970 region, or a two-month low. Spot prices currently trade around the 1.3020-1.3025 area, up 0.10% for the day amid a modest US Dollar (USD) downtick, though any meaningful appreciating move still seems elusive.

The USD Index (DXY), which tracks the Greenback against a basket of currencies, pulls back from its highest level since early August as traders opt to take some profits off the table following a strong rally since the beginning of this month. That said, growing acceptance that the Federal Reserve (Fed) will proceed with modest rate cuts over the next year should limit the USD losses and cap the GBP/USD pair. Read more...

Author

FXStreet Team

FXStreet