Pound Sterling Price News and Forecast: GBP/USD holds ground as the Pound steadies on BoE policy stance

GBP/USD stays near 1.3350 as traders adopt caution due to UK inflation risks

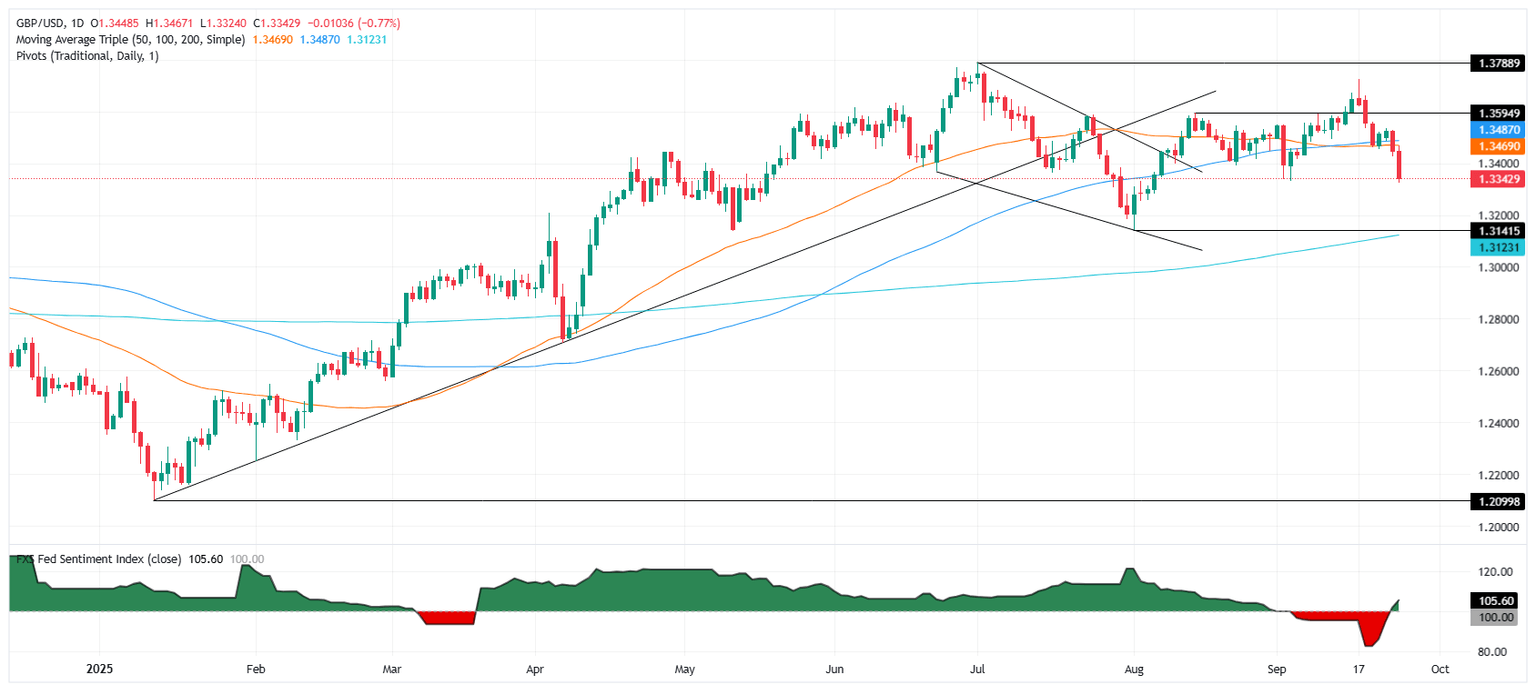

GBP/USD holds ground after two days of losses, trading around 1.3350 during the Asian hours on Friday. The downside of the pair could be restrained as the Pound Sterling (GBP) may gain ground on the United Kingdom’s (UK) inflation risks and the uncertain Bank of England’s (BoE) policy stance.

BoE policymaker Megan Greene urged caution on rate cuts, suggesting a pause in November as risks to inflation have shifted to the upside. However, Governor Andrew Bailey signaled that more easing is still needed. "But exactly when that will be and how much it will be will depend on the path of inflation going down," Bailey added, while noting that there is some softening in the labor market, alongside cautiousness among consumers. Read more...

GBP/USD sinks below 1.3400 on strong US data, focus shifts to PCE

The GBP/USD ended Thursday’s session with losses of over 0.78%, seeming poised to test lower prices as a scarce economic docket in the UK would leave traders adrift to dynamics linked to the US Dollar. The pair trades below the 20, 50, 100 and 200-day SMAs, after puking below 1.3400 as Friday’s Asian session begins.

Serling fell to a four-week low of 1.3324 on Thursday after the release of macroeconomic news in the US, spurred a trim of Fed dovish bets, which boosted the Greenback. From a technical perspective, if GBP/USD slides beneath the 1.33 handle, the next area of interest would be the 200-day SMA At 1.3124. Read more...

Author

FXStreet Team

FXStreet