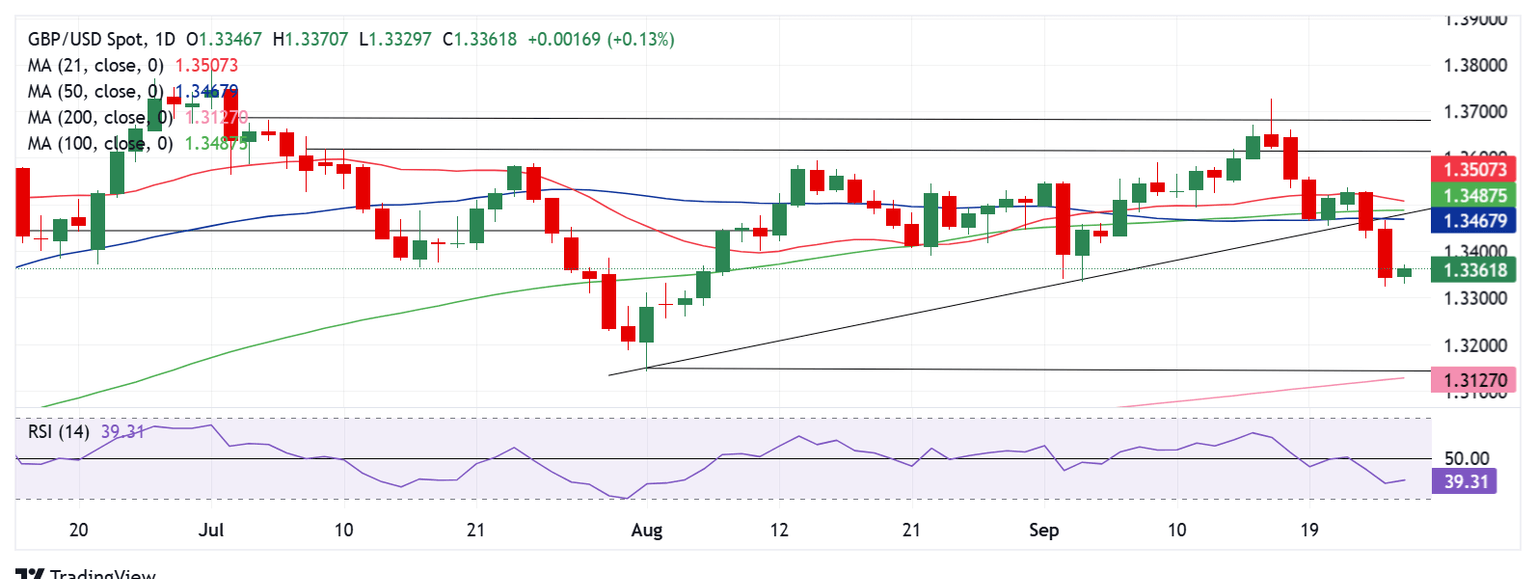

Pound Sterling Price News and Forecast: GBP/USD hit a seven-week low after failing to hold above 1.3500

GBP/USD gains ground above 1.3400 as US PCE inflation data support Fed rate cut bets

The GBP/USD pair edges higher to near 1.3415 during the early Asian session on Monday. The US Dollar (USD) weakens against the Pound Sterling (GBP) as the US August inflation report reinforced market expectations that the US Federal Reserve (Fed) will likely proceed with another interest rate cut in October.

The US Personal Consumption Expenditures (PCE) Price Index rose 2.7% year-over-year in August, compared to 2.6% in the previous reading, according to the US Bureau of Economic Analysis on Friday. This figure was in line with analyst forecasts. The core PCE, which excludes food and energy prices, came in at 2.9% YoY during the same period, also matching expectations. Read more...

GBP/USD Weekly Forecast: Pound Sterling to remain under pressure ahead of US Nonfarm Payrolls

The Pound Sterling (GBP) reversed early recovery gains and turned negative on the week against the US Dollar (USD), smashing GBP/USD to seven-week lows below 1.3350. A broad-based US Dollar resurgence, combined with a cautious risk tone throughout the week and disappointing UK business PMI surveys, helped Pound Sterling sellers to strengthen their control.

Markets pared back their bets for aggressive US Federal Reserve (Fed) interest rate cuts this year, in light of encouraging economic data and cautious Fed commentary. This shift in the sentiment surrounding the Fed easing expectations powered the USD recovery against its six major rivals. Read more...

Author

FXStreet Team

FXStreet