Pound Sterling Price News and Forecast: GBP/USD growing recession fears fuel downside risk

GBP/USD Forecast: Pound Sterling turns bearish despite big BoE hike

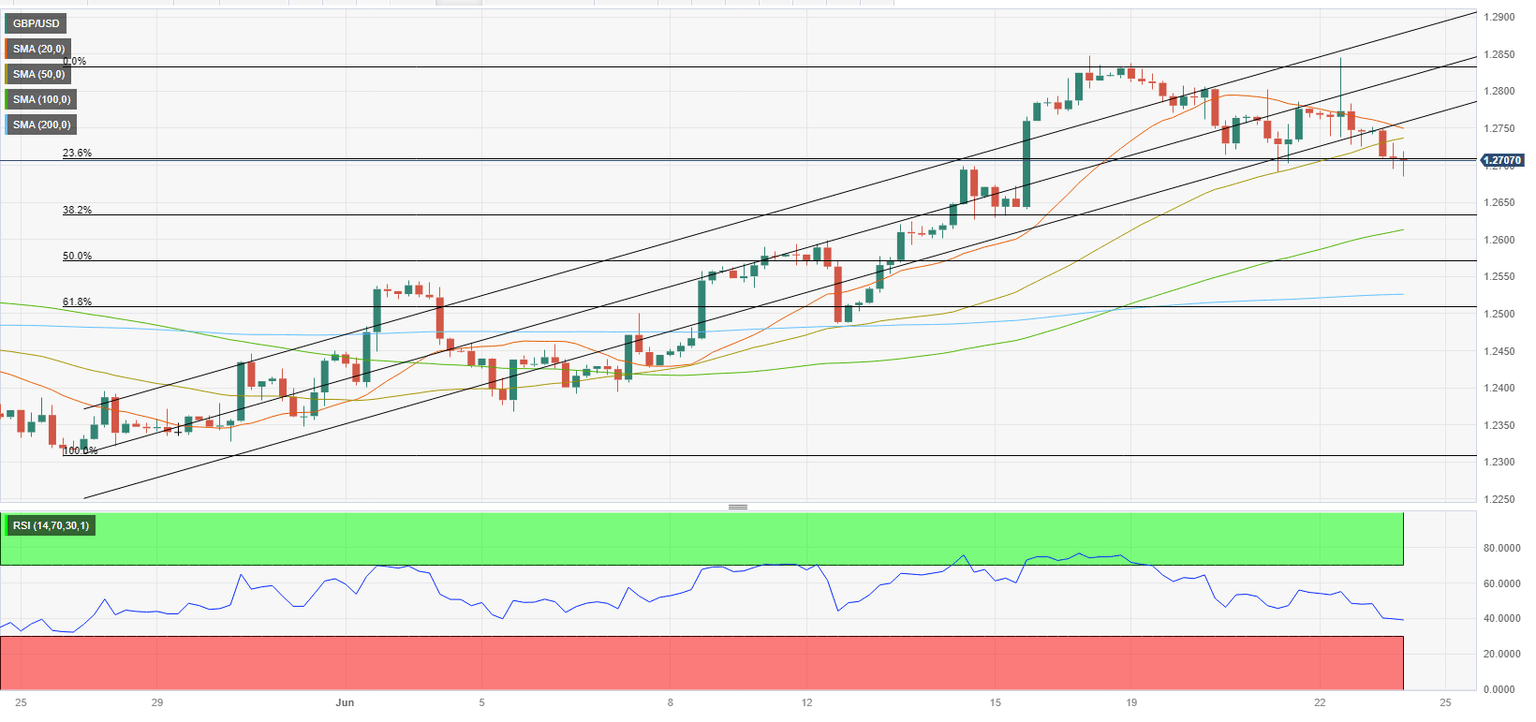

After having spiked above 1.2800 with the knee-jerk reaction to the Bank of England's (BoE) policy announcements, GPB/USD reversed its direction and closed in negative territory on Thursday. The pair stays on the back foot and trades below 1.2700 early Friday, its lowest level in a week.

The BoE raised its policy rate by 50 basis points (bps) to 5% following the June policy meeting. Although markets were expecting a 25 bps hike, many experts noted that Wednesday's strong inflation data could pave the way for a 50 bps increase in rates. Hence, the market reaction to the rate decision remained short-lived. Read more ...

GBP/USD outlook: Growing recession fears fuel downside risk

Cable kept weak tone in European session on Friday and fell to one week low after quite mild reaction on BoE’s 50 basis points rate hike on Thursday, as the pair traded in a choppy mode after rate decision, but the action stayed capped under key barriers (200WMA/monthly cloud base), keeping bearish pressure.

Dips were limited by slightly better-than-expected UK retail sales in May, but the sentiment was again soured by UK PMI data, which came below forecasts in June. Technical studies on daily chart are weaker but still bullish overall, with growing pressure seen from expectations that the UK economy could slide into recession after BoE’s jumbo hike on Thursday, which could drive the pound lower. Read more...

GBP/USD looks vulnerable above 1.2700 despite Fed-BoE policy divergence narrows

The GBP/USD pair is struggling in maintaining its auction above the round-level support of 1.2700 in the London session. The Cable is expected to deliver a downside break of the aforementioned support despite Federal Reserve (Fed)-Bank of England (BoE) policy divergence has narrowed significantly.

S&P500 futures have extended losses in Europe, portraying a severe decline in the risk appetite of the market participants. The market sentiment has turned negative as investors are worried about global growth due to higher interest rates by central banks. Read more ...

Author

FXStreet Team

FXStreet