Pound Sterling Price News and Forecast: GBP/USD gains momentum, the next upside barrier is seen at 1.2640

GBP/USD Weekly Forecast: Pound Sterling buyers set to extend control

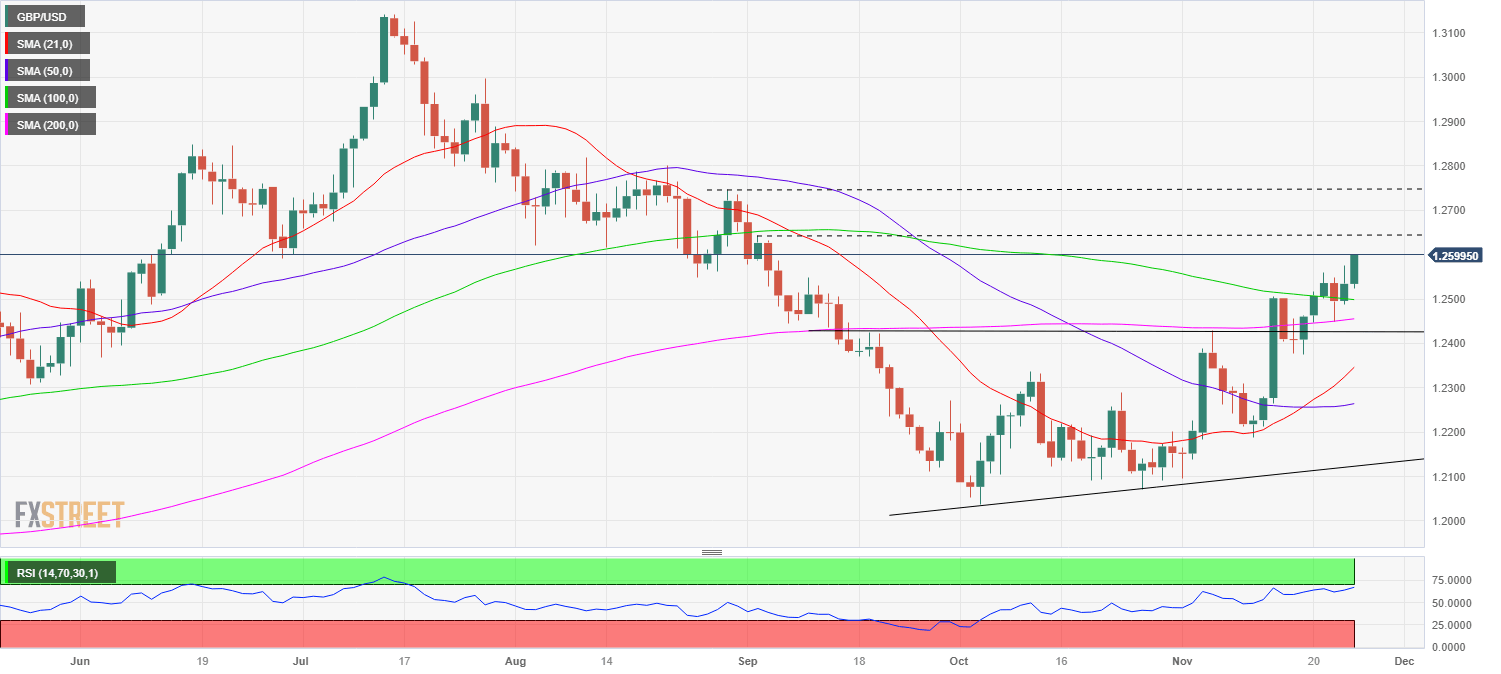

The Pound Sterling gathered further strength against the United States Dollar (USD) this week, as GBP/USD renewed a two-month high just shy of the 1.2600 level. The pair remains exposed to further upside risks, in the face of a bullish technical setup on the daily chart, heading into a relatively data-light week. Read more...

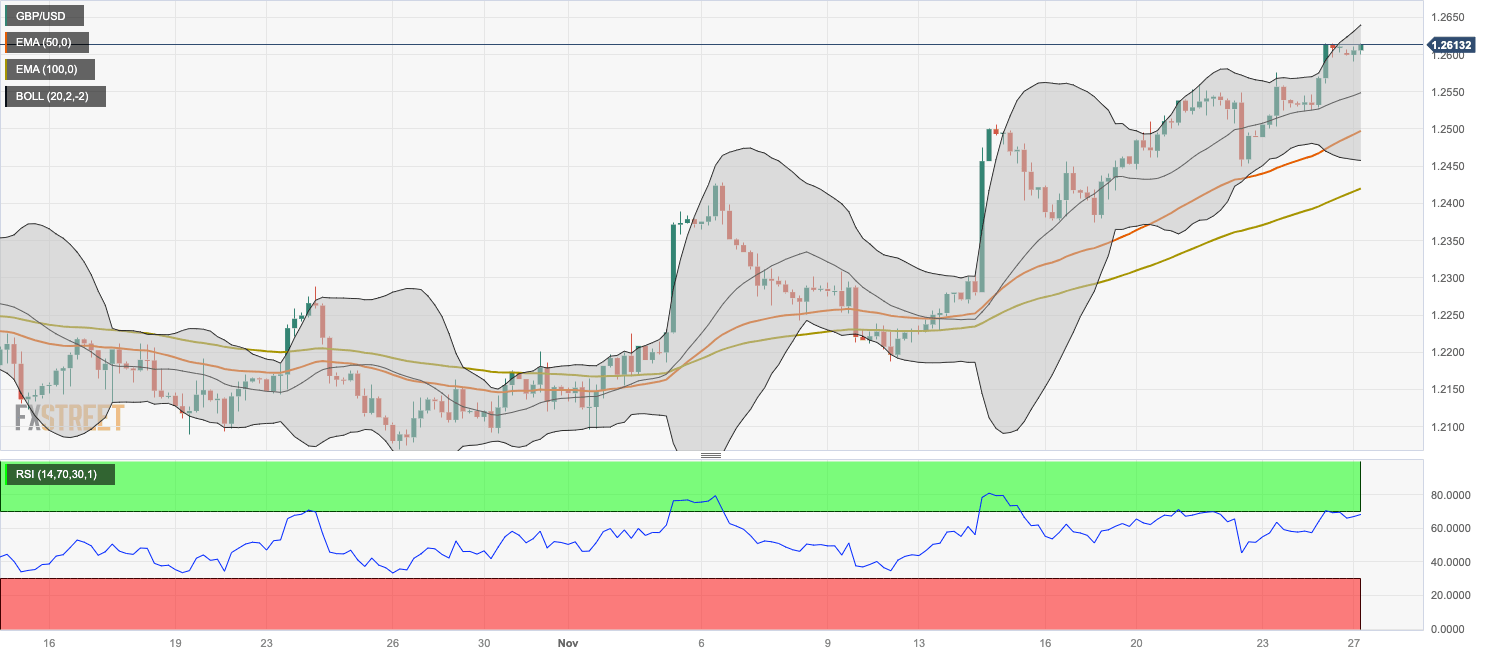

GBP/USD Price Analysis: Gains momentum, the next upside barrier is seen at 1.2640

The GBP/USD pair kicks off the week in a positive mood above 1.2600, the highest level since late August during the early Europen session on Monday. The uptick of GBP/USD is bolstered by the stronger-than-expected UK S&P Global/CIPS PMI data for November and the softer US Dollar (USD). The pair currently trades near 1.2610, unchanged for the day. Read more...

GBP/USD consolidates above 1.2600 on hawkish BoE members, awaits US data

GBP/USD moves sideways around 1.2610 during the European session on Monday. The weakening of the US Dollar (USD), driven by growing speculation that the Federal Reserve has completed its interest rate hikes, has worked in favor of the Pound Sterling (GBP). Read more...

Author

FXStreet Team

FXStreet