Pound Sterling Price News and Forecast: GBP/USD gains even as UK unemployment rate accelerates [Video]

![Pound Sterling Price News and Forecast: GBP/USD gains even as UK unemployment rate accelerates [Video]](https://editorial.fxsstatic.com/images/i/gbp-usd-001_XtraLarge.jpg)

Pound Sterling gains even as UK Unemployment Rate accelerates

The Pound Sterling (GBP) trades higher against its major peers, except for the US Dollar, on Thursday. The British currency gains after a mixed United Kingdom (UK) job market report, which showed more employment levels but also a higher unemployment rate.

The ILO Unemployment Rate has increased to 4.7%, above expectations and the prior reading of 4.6%. However, the report showed that the number of workers added by employers in the three-months ending May came in higher at 134K than the prior reading of 89K. Read more...

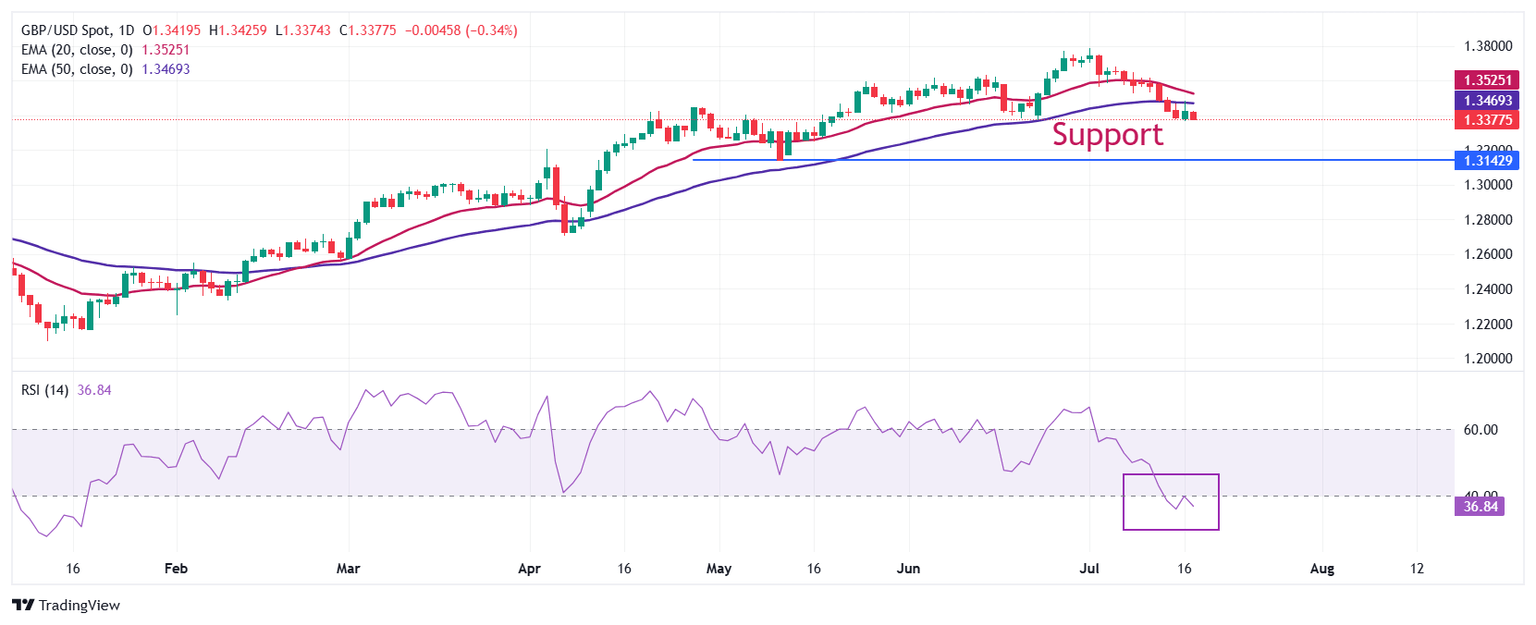

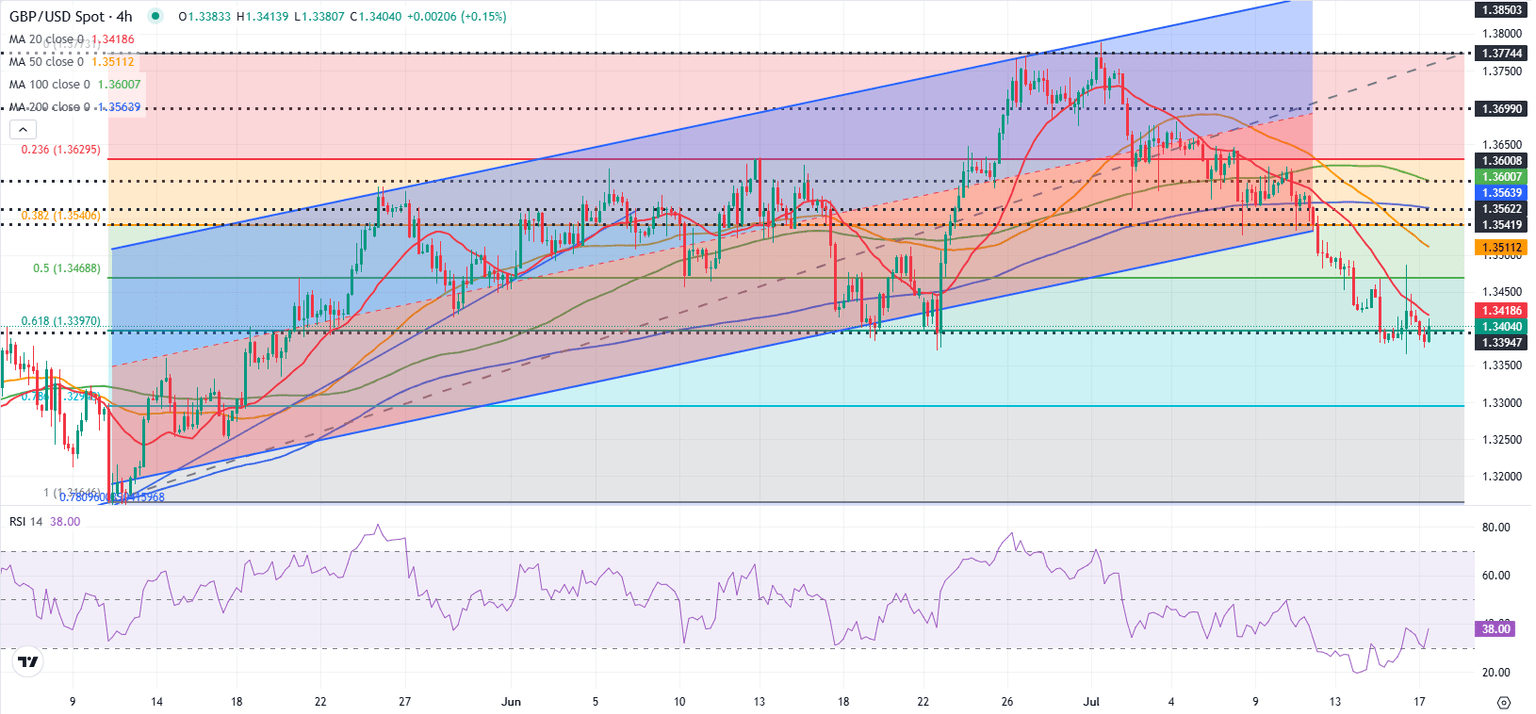

GBP/USD Forecast: Pound Sterling limits losses after UK employment data

GBP/USD trades marginally lower on the day at around 1.3400 in the European session on Thursday. Although Pound Sterling gathers strength against other major currencies, GBP/USD's technical outlook is yet to point to a buildup of recovery momentum.

The UK's Office for National Statistics (ONS) reported early Thursday that the ILO Unemployment Rate edged higher to 4.7% in the three months to May from 4.6%. In this period, Employment Change rose by 134,000, following the 89,000 increase recorded previously. Finally, annual wage inflation, as measured by the change in Average Earnings Excluding Bonus, declined to 5%, coming in above the market expectation of 4.9%. Read more...

GBP/USD Elliott Wave technical analysis [Video]

The daily Elliott Wave analysis for GBPUSD shows the currency pair is moving through a counter-trend correction. Navy Blue Wave 4 is unfolding within a broader Gray Wave 1 framework, signaling a short-term retracement after the prior impulsive move completed with Navy Blue Wave 3. Read more...

Author

FXStreet Team

FXStreet