Pound Sterling Price News and Forecast: GBP/USD flat lines near 1.3575 on Thursday

GBP/USD holds steady above 1.3550 as investors await UK GDP, US PPI releases

The GBP/USD pair trades on a flat note around 1.3575 during the Asian trading hours on Thursday. Traders prefer to wait on the sidelines ahead of the key data from both the United Kingdom (UK) and the United States (US). The preliminary reading of UK Gross Domestic Product (GDP) for the second quarter (Q2) will be published later on Thursday, followed by US Producer Price Index (PPI) data for July.

Signs of cooling in the US labor market have pushed futures to bake in a series of rate reductions before the end of the year. This, in turn, might drag the Greenback lower against the GBP. Fed funds futures traders are now pricing in nearly a 94% probability of a 25 basis point (bps) cut at the September meeting, up from an 85% chance before the inflation data release, according to the CME FedWatch tool. Read more...

GBP/USD continues to climb ahead of another key double-header data dump

GBP/USD gained even more ground on Wednesday, climbing nearly six-tenths of one percent as US Dollar (USD) flows continues to wither. The Pound Sterling (GBP) is enjoying a much-needed bullish shift in fundamentals as United Kingdom (UK) economic data outpaces new soft spots appearing in key economic figures from the United States (US).

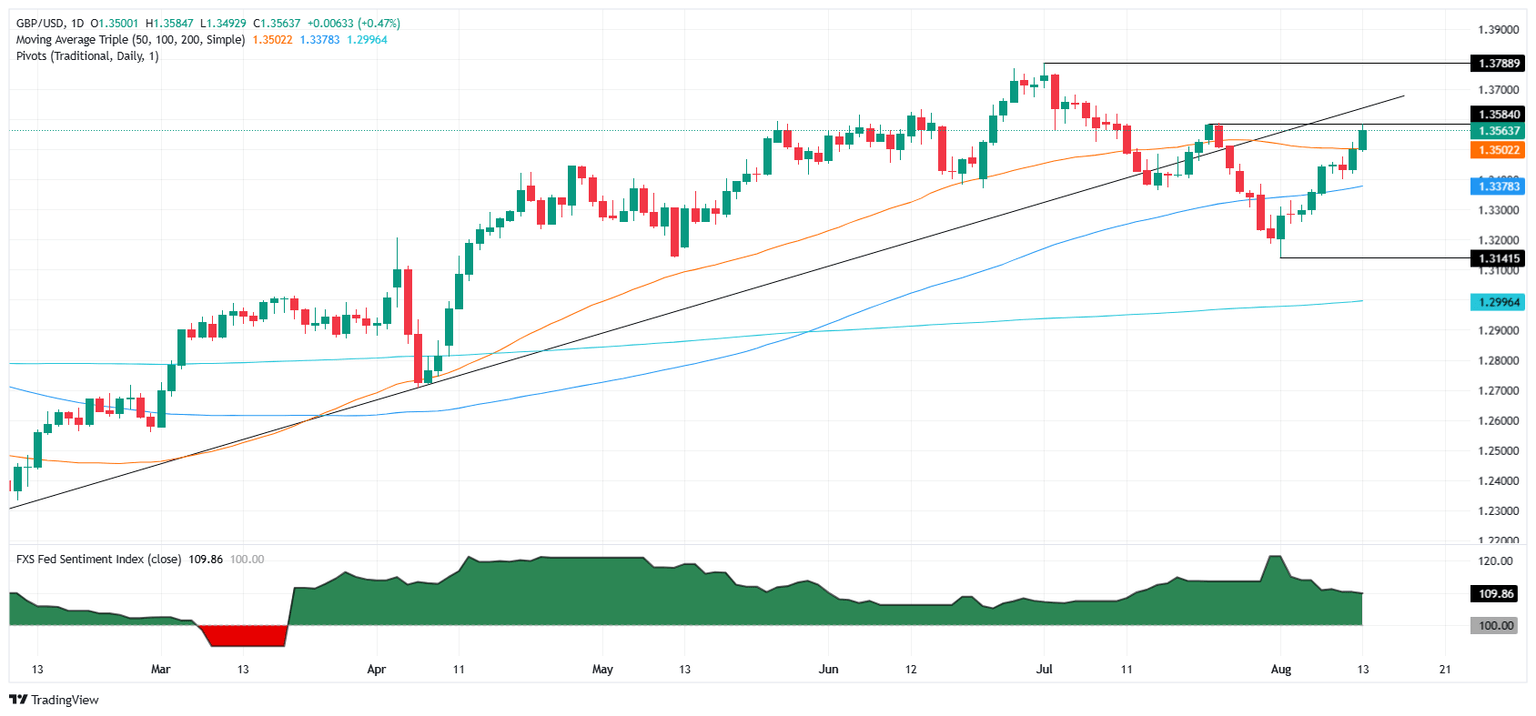

GBP/USD is extending one-sided bullish momentum north of the 50-day Exponential Moving Average (EMA), climbing into 1.3600 after closing flat or higher for all but one of the last nine trading sessions. Cable has risen over 3.35% bottom-to-top after finding a technical floor near the 200-day EMA near 1.3150, but could be poised to run out of bullish momentum near the last swing high. Read more...

GBP/USD rallies as Fed cut bets soar despite hot core CPI

The GBP/USD pair advances during the North American session, up by 0.56% as the US Dollar (USD) gets battered amid increasing bets that the Federal Reserve (Fed) might resume its easing cycle as soon as September. The pair trades at 1.3572 after bouncing off lows of 1.3487.

The latest inflation report in the United States (US) revealed that headline inflation was unchanged in July at 2.7% YoY from June’s print. Excluding volatile items, prices jumped above the 3% threshold to 3.1% YoY, though market participants mainly ignored it. After the data, Fed interest rate probabilities show that market players had priced in a 97.85% chance of a cut at the upcoming meeting. Read more...

Author

FXStreet Team

FXStreet