Pound Sterling Price News and Forecast: GBP/USD flat lines around 1.3280 in Tuesday’s Asian session

GBP/USD holds steady above 1.3250 as investors brace for US ISM Services PMI release

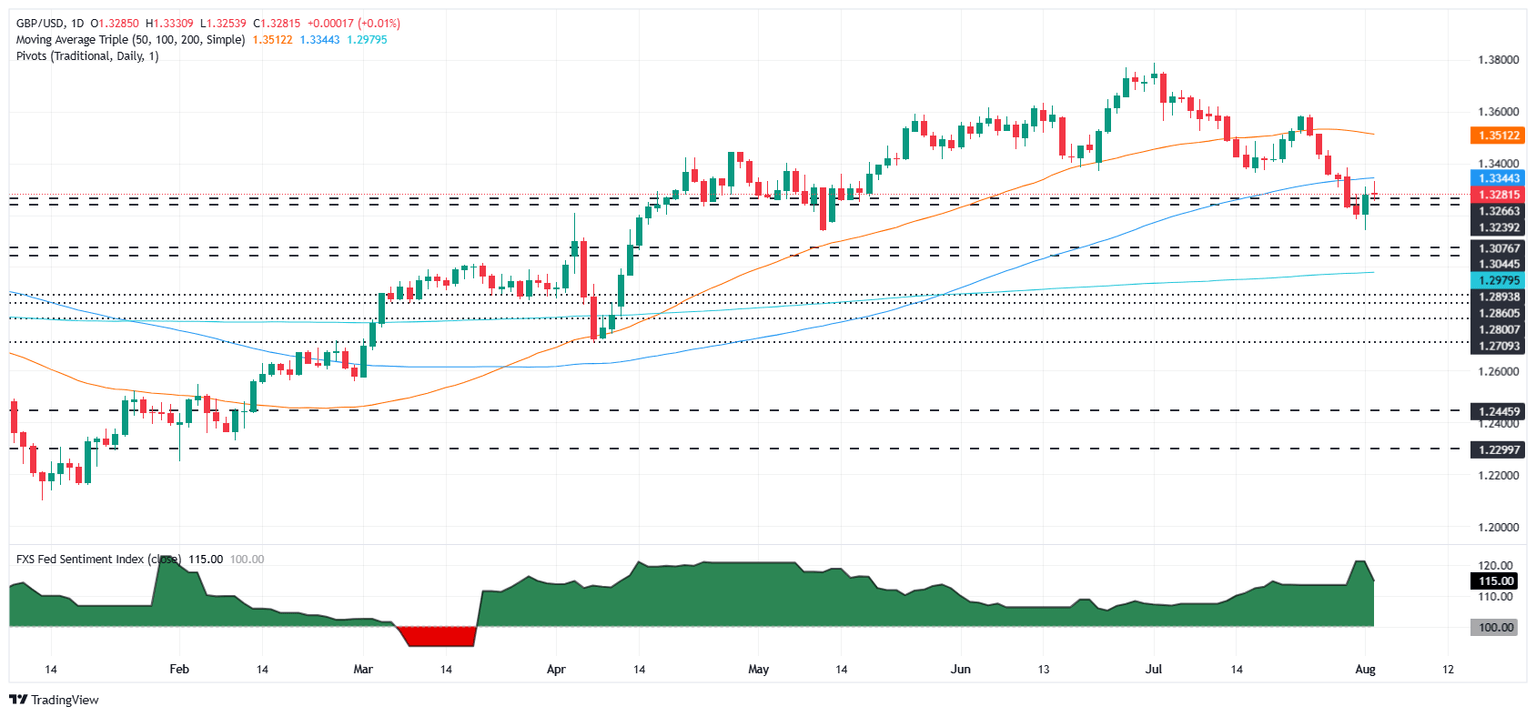

The GBP/USD pair trades on a flat note near 1.3280 during the Asian trading hours on Tuesday. Nonetheless, rising odds of Federal Reserve (Fed) rate cuts could weigh on the US Dollar (USD) against the Cable. Investors will keep an eye on the US ISM Services Purchasing Managers Index (PMI) data, which is due later on Tuesday.

Soft US job data released on Friday prompted investors to ramp up bets of imminent Federal Reserve (Fed) rate cuts, which undermine the Greenback. The US employment growth undershot expectations in July, and the Nonfarm Payrolls (NFP) count for the prior two months was revised down by a massive 258K jobs, indicating a sharp deterioration in US labor market conditions. Read more...

GBP/USD looks upwards ahead of looming BoE rate cut

GBP/USD pumped the brakes on Monday, holding steady near the 1.3300 handle after a sharp rebound brought on by fresh Greenback weakness thanks to an unexpected softening in US labor data late last week. The data docket is relatively quiet this week on both of the Atlantic, though the Bank of England’s (BoE) latest interest rate decision looms ahead on Thursday.

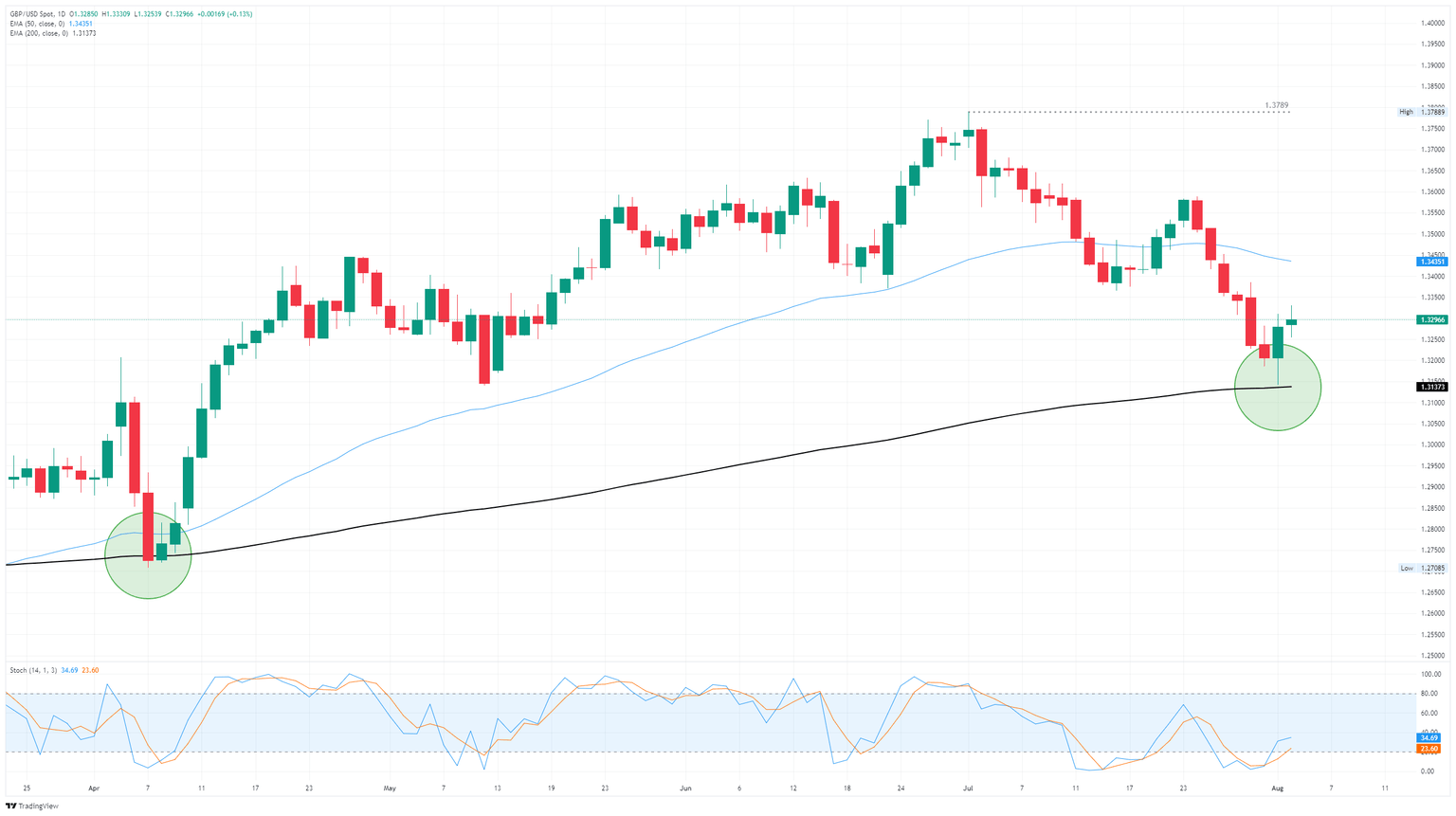

The Pound Sterling (GBP) held onto late-week gains through Monday’s market session, and remains bolted to the 1.3300 region after a sharp technical bounce near the 200-day Exponential Moving Average (EMA) around 1.3150. A turnaround in Greenback flows helped to snap a six-day losing streak in the Cable, but now the burden is on GBP bulls to keep things keel-side down heading into the BoE’s next rate call. Read more...

GBP/USD rebounds as Fed fate cut bets rise on weak US jobs data

The GBP/USD rallies for the second straight day, up by 0.12% following a dismal jobs report in the United States (US). The data prompted investors to price in a rate cut by the Federal Reserve at the upcoming September meeting. The pair trades at 1.3289, after bouncing off daily lows of 1.3253.

Last week, the 258K revision to Nonfarm Payroll figures for May and June, along with July’s 73K print, below forecasts of 110K, weighed on the Dollar amidst fears that the labor market begins to show some cracks. The NFP report triggered the firing of the US Bureau of Labor Statistics (BLS) Commissioner Erika McEntarfer by US President Donald Trump, who said that the BLS faked jobs numbers. Read more...

Author

FXStreet Team

FXStreet