Pound Sterling Price News and Forecast: GBP/USD enters a bearish consolidation phase near a multi-week low

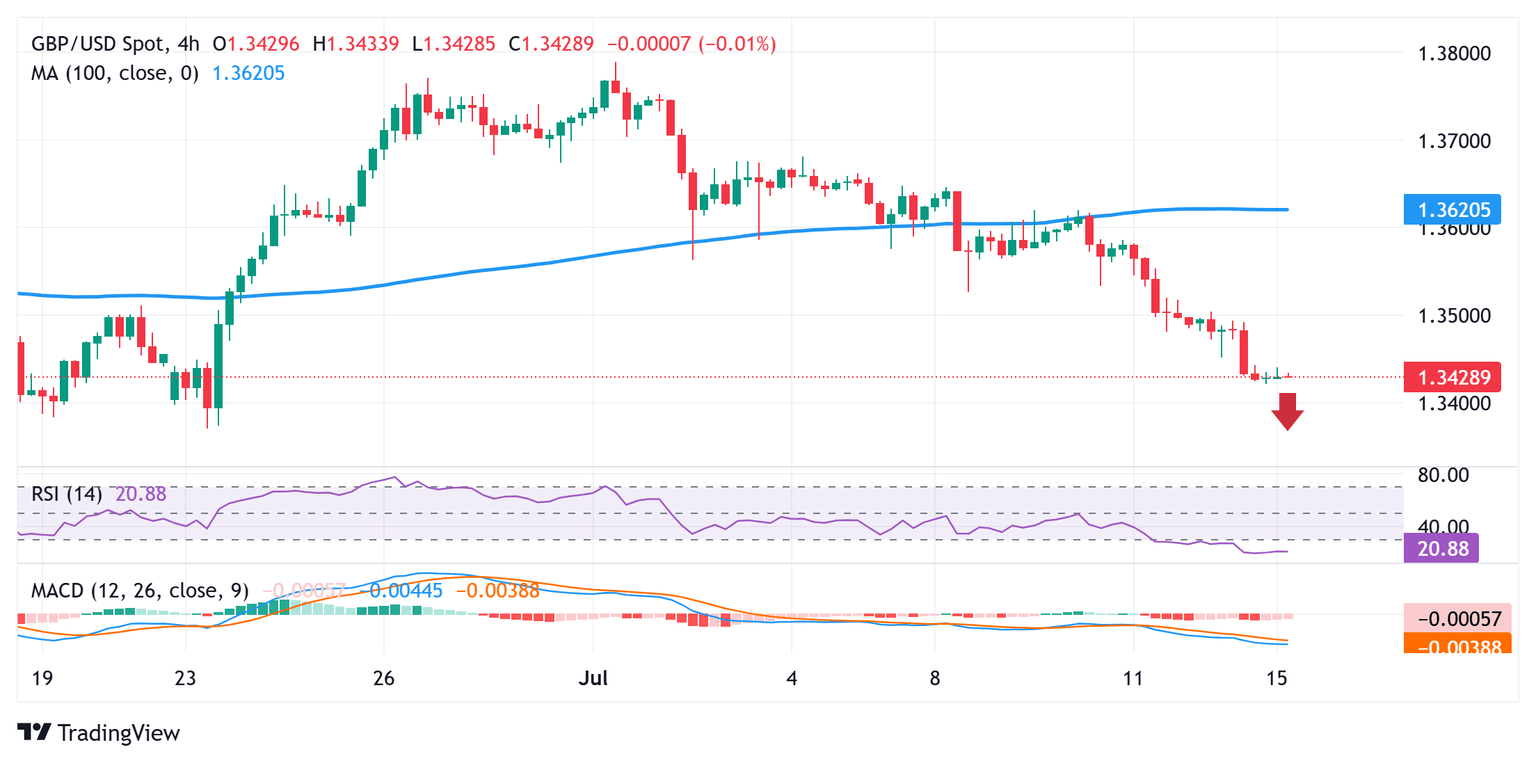

GBP/USD Price Analysis: Struggles near multi-week low, around 1.3430 ahead of US CPI

The GBP/USD pair consolidates near the 1.3430-1.3435 region, just above a three-week low touched during the Asian session on Tuesday as traders keenly await the release of the US consumer inflation figure. Meanwhile, the fundamental backdrop seems tilted in favor of bears and suggests that the path of least resistance for spot prices is to the downside.

The disappointing macro data released from the UK last week reinforced bets that the Bank of England (BoE) could cut interest rates again in August. This marks a significant divergence in comparison to diminishing odds for an immediate rate cut by the Federal Reserve (Fed) and validates the negative outlook for the GBP/USD pair. That said, a modest US Dollar (USD) pullback from a multi-week high lends support to the currency pair. Read more...

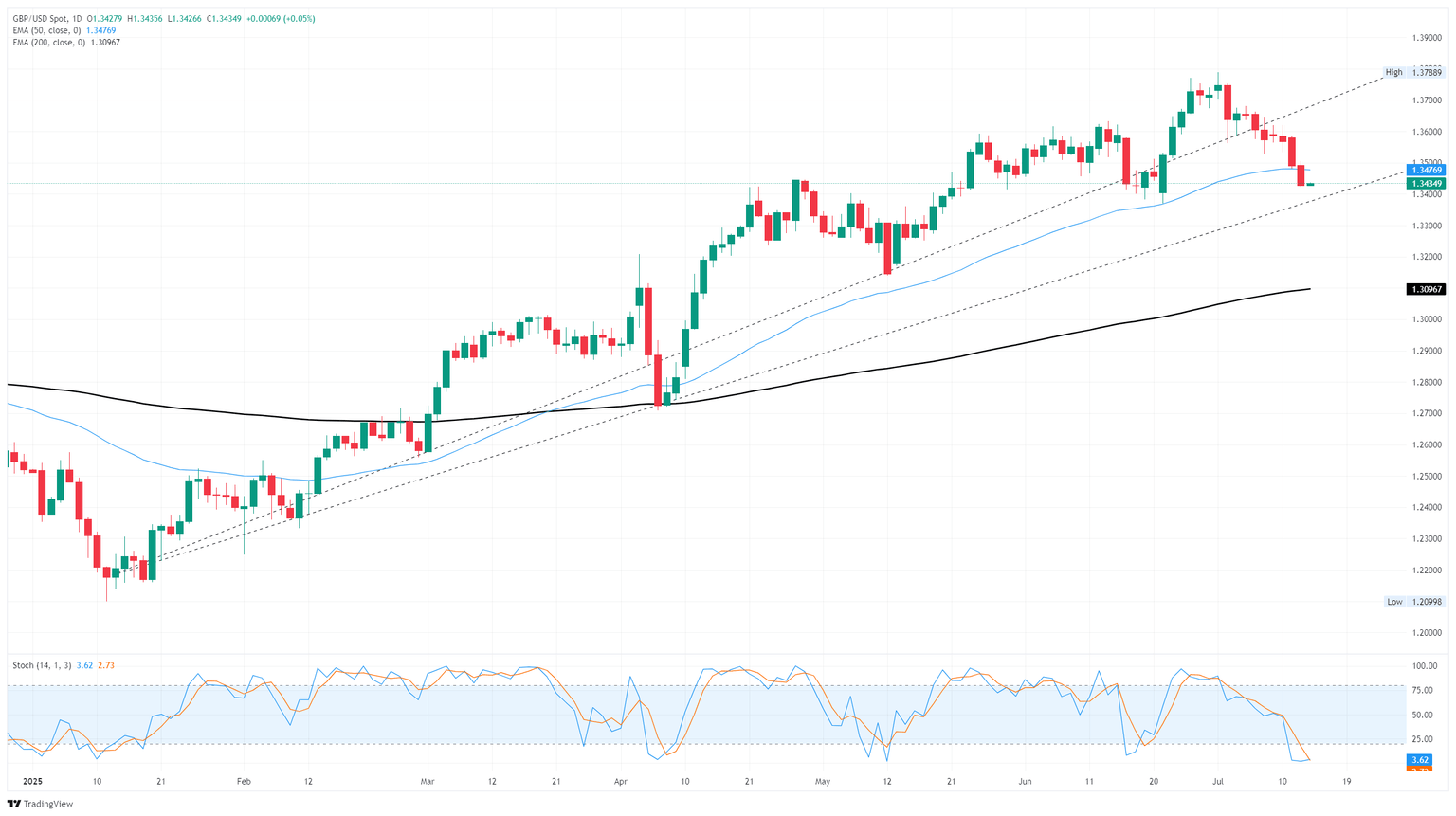

GBP/USD extends declines to kick off the new trading week

GBP/USD sank further on Monday, closing lower for a seventh consecutive market session and slipping back below the 50-day Exponential Moving Average (EMA) for the first time since mid-April. Markets are expecting the latest round of tariff threats from US President Donald Trump to end with yet another delay or a suspension, but rough economic data from the UK, as well as a general level of unease for investors, is keeping risk appetite at bay and bolstering the safe haven US Dollar.

A new deadline for a wide swath of tariffs has been arbitrarily penciled in for August 1, following another delay of Trump’s “undelayable” reciprocal tariffs that were announced in April. On top of the Trump administration’s “liberation day” reciprocal tariffs, Trump is now threatening double-digit tariff increases on some of the US’s closest trading partners, including South Korea, Japan, Canada, and Mexico. Read more...

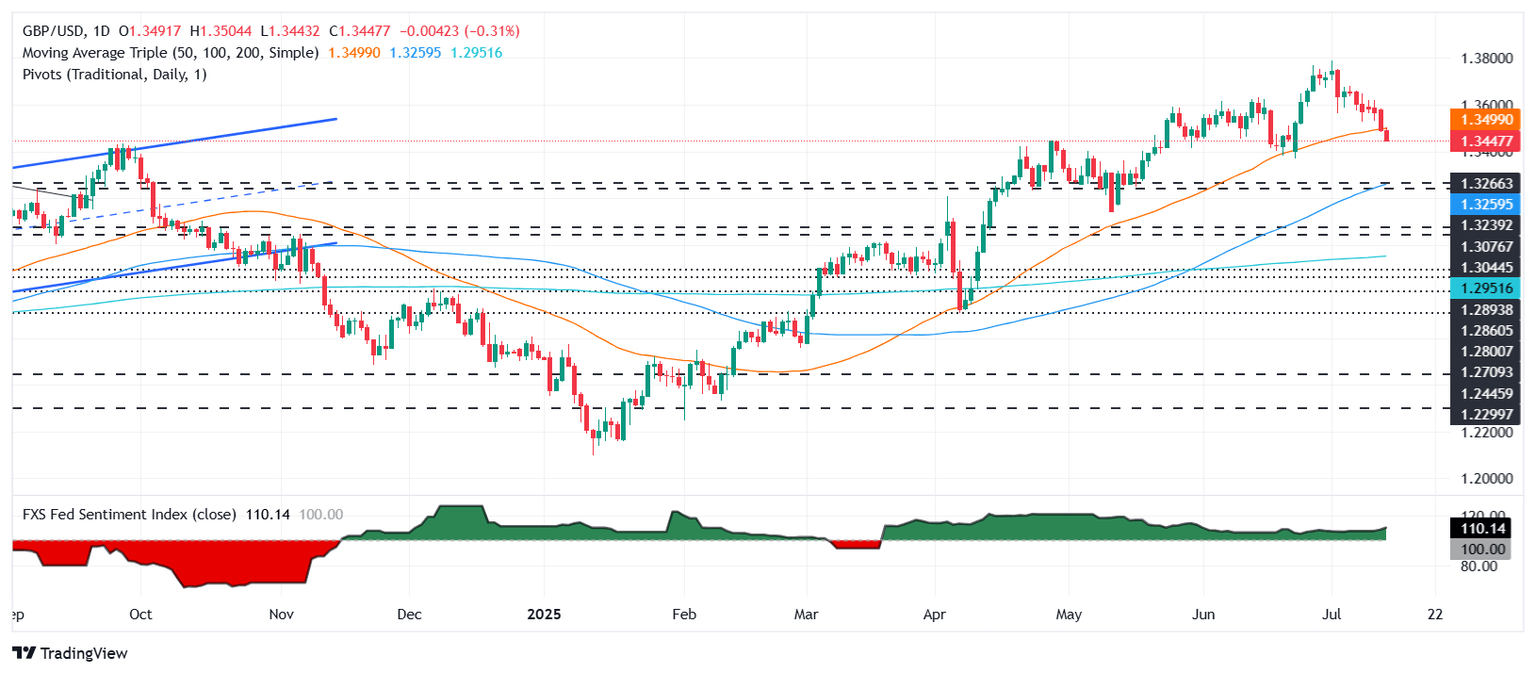

GBP/USD slips as Trump’s tariffs roil FX markets, CPI data looms

The Pound Sterling (GBP) retreats by 0.18% during the North American session as the US Dollar (USD) recovers following US President Donald Trump's wave of tariffs that included the European Union (EU) and Mexico. Although initially triggering a risk-off reaction, sentiment shifted positively in equities but not in the FX space. GBP/USD trades at 1.3453 at the time of writing.

Over the weekend, US President Donald Trump announced 30% tariffs on imports from the European Union and Mexico, with the latter being less harmed than Canada’s 35% duties imposed last Thursday. In the meantime, the current week opened with a deteriorated mood. However, traders seem confident that three of the largest partners of the US –Canada, the EU, and Mexico–would sign deals ahead of the fixed August 1 deadline. Read more...

Author

FXStreet Team

FXStreet