Pound Sterling Price News and Forecast: GBP/USD edges lower to around 1.2580 on Friday early European session

GBP/USD holds below 1.2600 as US PCE inflation data looms

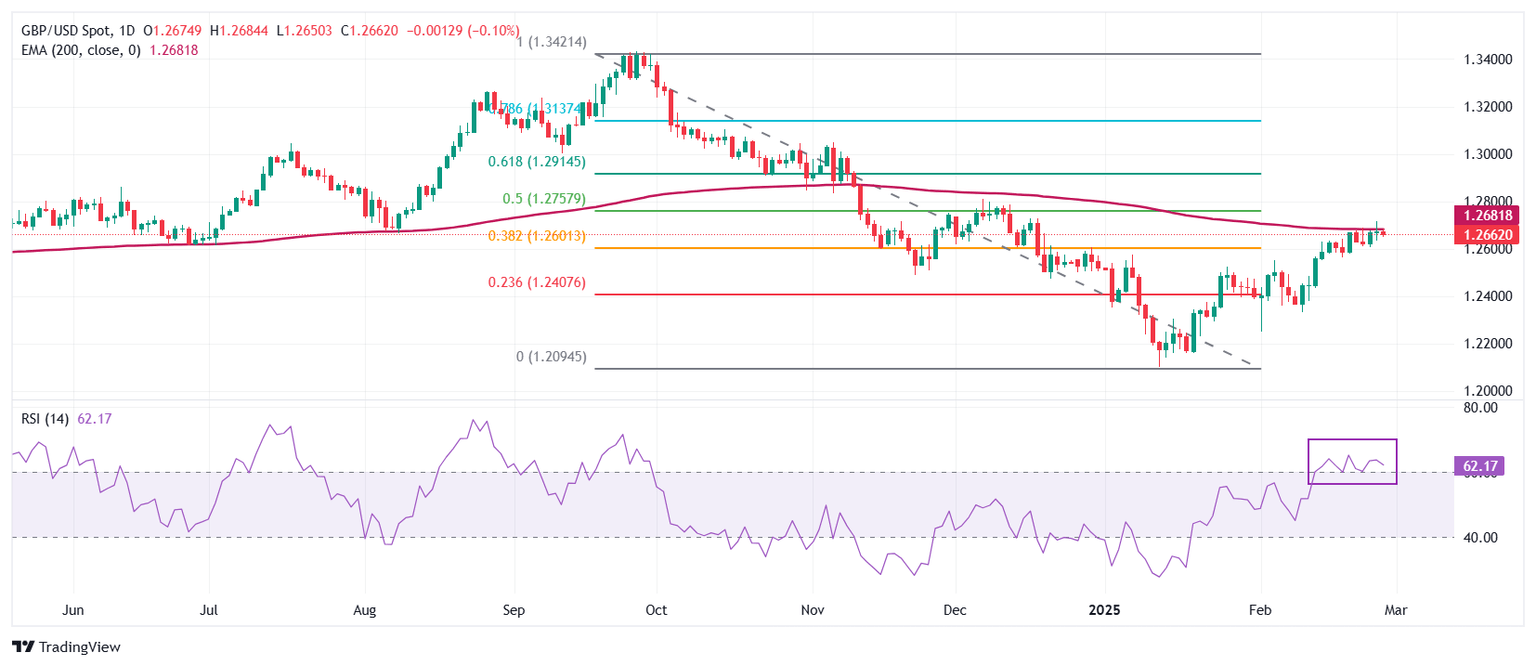

The GBP/USD pair extends its downside to near 1.2580 during the early European session on Friday. Tariff uncertainty from US President Donald Trump undermines the Pound Sterling (GBP) against the US Dollar (USD). The US Personal Consumption Expenditures (PCE) Price Index for January will be the highlight later on Friday.

Trump met with UK Prime Minister Keir Starmer late Thursday, and President Trump was quick to announce that there might be trade tariffs imposed on the UK as well unless ambiguous terms of a trade deal with the US are agreed upon within an undetermined deadline. Investors will closely watch the developments surrounding further Trump’s policies. Any signs of escalating trade tensions could lift the Greenback and create a headwind for GBP/USD. Read more...

GBP/USD tumbles as tariffs on UK come into play

GBP/USD turned south and tumbled on Thursday, falling nearly six-tenths of a percent and sending bids skidding back into the 1.2600 handle. Risk sentiment is souring after a batch of US data points toward a general lack of strength within the US economy, as well as flagging an extended uptick in core US inflation pressures.

US President Donald Trump met with UK Prime Minister Keir Starmer late Thursday, and President Trump was quick to announce that there might be trade tariffs imposed on the UK as well unless ambiguous terms of a trade deal with the US are reached within an unspecified timeframe. Following on the heels of Donald Trump’s latest pivot on tariffs due on Canada and Mexico, the timing is poor as investors grapple with further geopolitical turmoil on the road ahead. Read more...

Pound Sterling slumps against US Dollar as Trump threatens reciprocal tariffs

The Pound Sterling (GBP) slides to near 1.2630 against the US Dollar (USD) in North American trading hours on Thursday. The GBP/USD pair faces pressure as the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, jumps higher slightly above 107.00 after threats of reciprocal tariffs from United States (US) President Donald Trump in the US opening session and upbeat US Durable Goods Orders data for January.

"April 2 reciprocal tariff date remains in full force," Trump said in a press conference. He also threatened to impose an additional 10% tariffs on China. He has already slapped a 10% levy on China earlier this month. On Canada and Mexico, Trump confirmed that 25% tariffs are coming on March 4. Read more...

Author

FXStreet Team

FXStreet