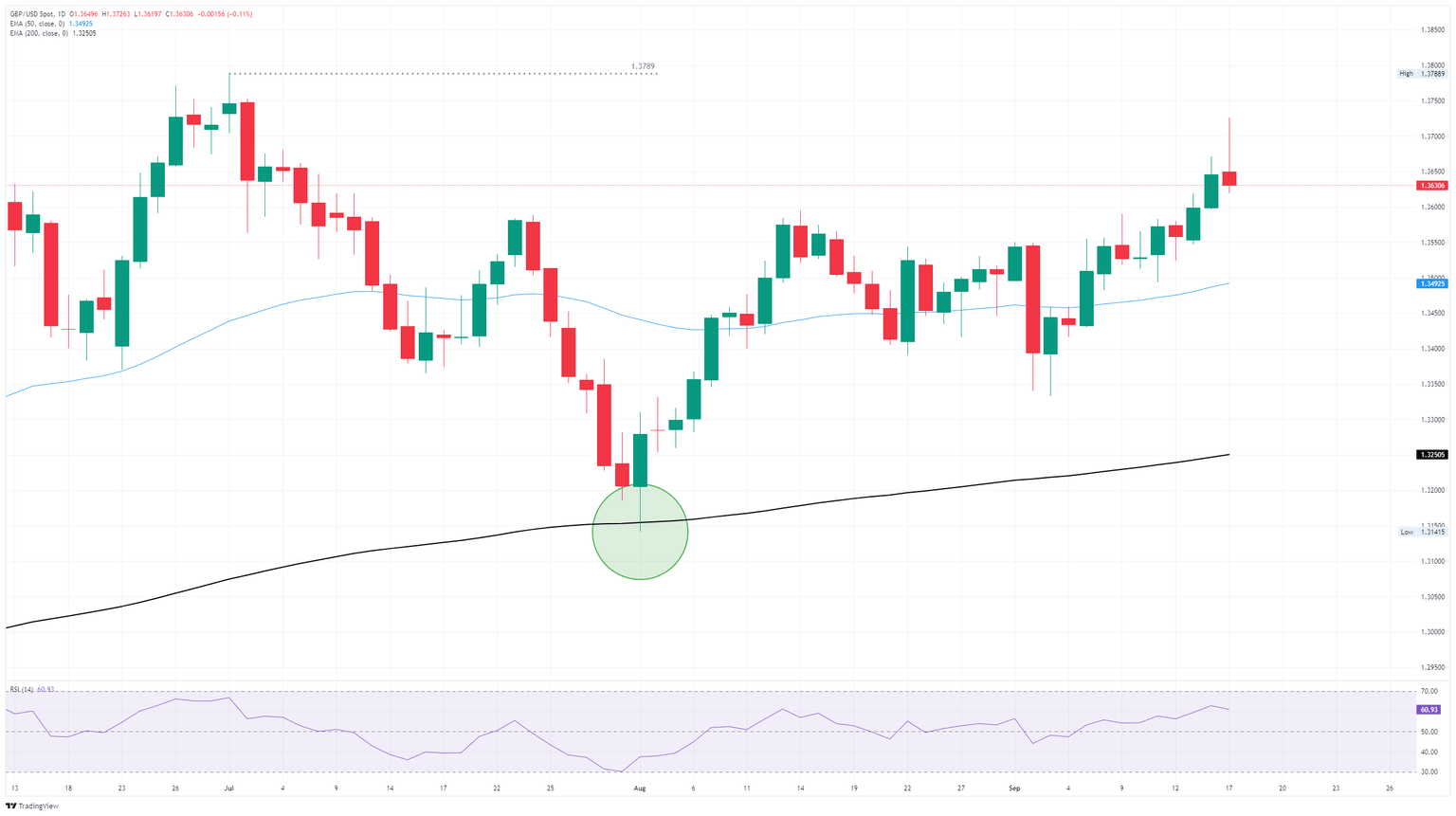

Pound Sterling Price News and Forecast: GBP/USD drifts lower to near 1.3615 on Thursday

GBP/USD declines to near 1.3600 ahead of BoE rate decision

The GBP/USD pair edges lower to around 1.3615 during the early European session on Thursday, pressured by a rebound in the US Dollar (USD). The Bank of England (BoE) interest rate decision will take center stage later on Thursday, with no change in rates expected.

The Federal Reserve (Fed) decided to cut the interest rates by 25 basis points (bps) at its September meeting on Wednesday. This is the Fed's first reduction this year and puts the target range for its main lending rate at 4.0% - 4.25%. Read more...

GBP/USD: BoE has tough act to follow after Fed cuts rates

GBP/USD surged into its highest bids in eleven weeks on Wednesday, bolstered by a spat of broad-market Greenback weakness after the Federal Reserve (Fed) delivered its first interest rate cut of the year, and the dot plot shifted lower to incorporate more rate cuts in the future than the previous Fed meeting.

The Fed's Summary of Economic Projections (SEP)indicated that Fed policymakers foresee more rate adjustments in the near future. The dot plot suggests that most policymakers anticipate interest rates will reach about 3.5-3.75% by the end of the year, with the possibility of two more rate cuts through December. Read more...

GBP/USD spikes toward 1.3700 as Fed cuts rates, eyes turn to Powell presser

GBP/USD surges during the North American session after the Federal Reserve (Fed) cut rates by 25 basis points as expected, and eyes further rate reductions towards the year-end. At the time of writing, the pair trades within the 1.3650 – 1.3700 range as traders await Fed Chair Powell's press conference.

The Federal Reserve acknowledged growing downside risks to the labor market, noting that while unemployment remains low, it has edged higher. The policy decision was not unanimous, with Governor Stephen Miran voting for a larger 50-basis-point cut, in line with some analysts’ expectations. Read more...

Author

FXStreet Team

FXStreet