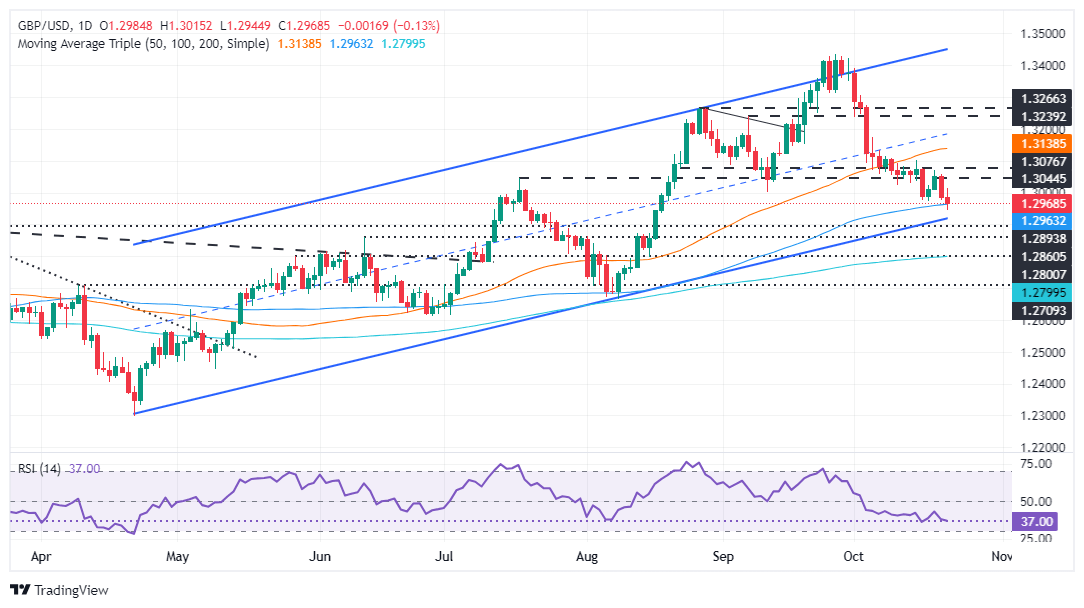

Pound Sterling Price News and Forecast: GBP/USD dives below 1.3000 and tests 100-DMA

GBP/USD Price Forecast: Dives below 1.3000 and tests 100-DMA

The Pound Sterling extended its losses against the US Dollar for two straight days, with sellers clearing the 1.3000 figure decisively, which could pave the way for further downside. At the time of writing, the GBP/USD trades at 1.2961, fluctuating around the 100-day moving average (DMA), down 0.15%. Read More...

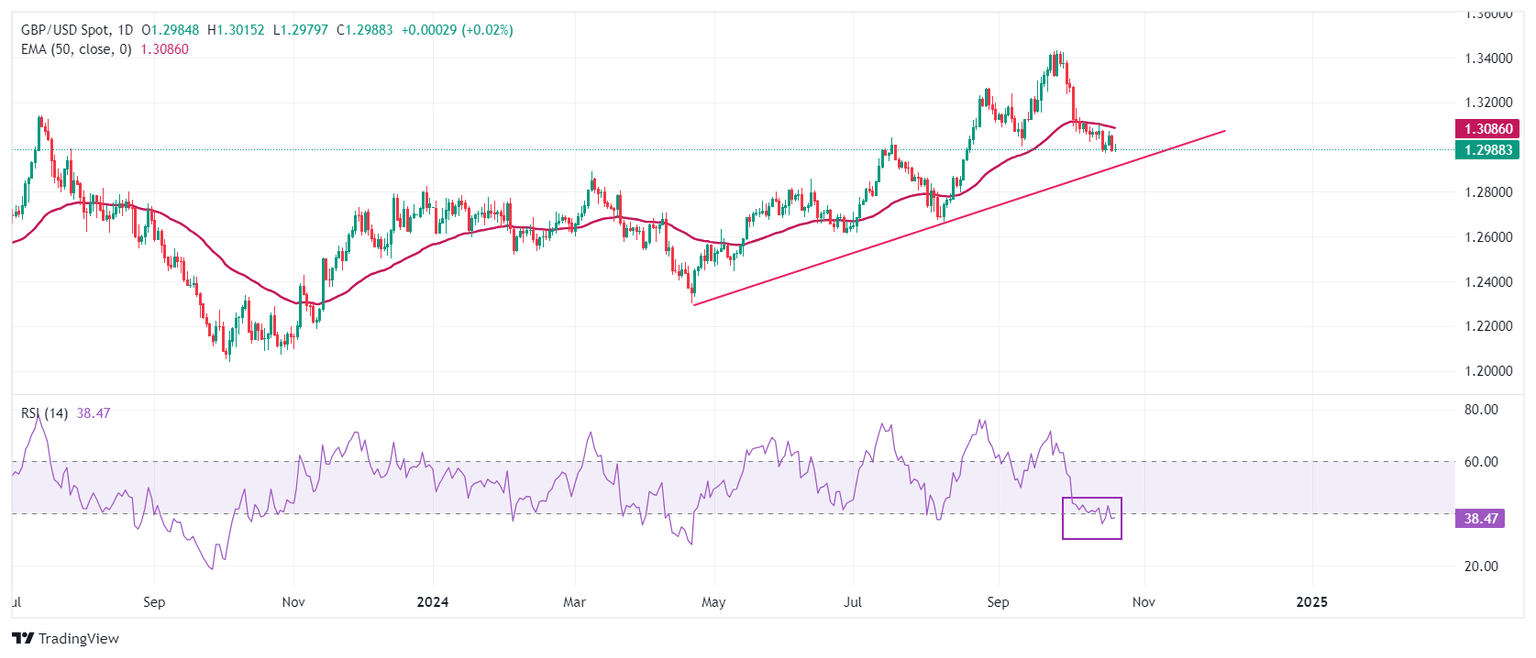

Pound Sterling falls to two-month low against US Dollar

The Pound Sterling (GBP) edges down slightly to near 1.2950 against the US Dollar (USD) in Tuesday’s North American session, the lowest level seen in two months. The GBP/USD pair is expected to extend its downside as the US Dollar strives to break above the 11-week high amid uncertainty surrounding the US presidential election. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, clings to gains near 104.00. Read More...

GBP/USD Price Forecast: Holds position around 1.3000 within descending channel

GBP/USD retraces its recent losses, trading around 1.3000 during the Asian hours on Tuesday. The daily chart analysis shows the pair is consolidating within the descending channel pattern, which suggests a bearish bias for the pair. Read More...

Author

FXStreet Team

FXStreet