Pound Sterling Price News and Forecast: GBP/USD declines as traders adopt caution ahead of UK employment data

GBP/USD drops below 1.3400 ahead of UK labor data

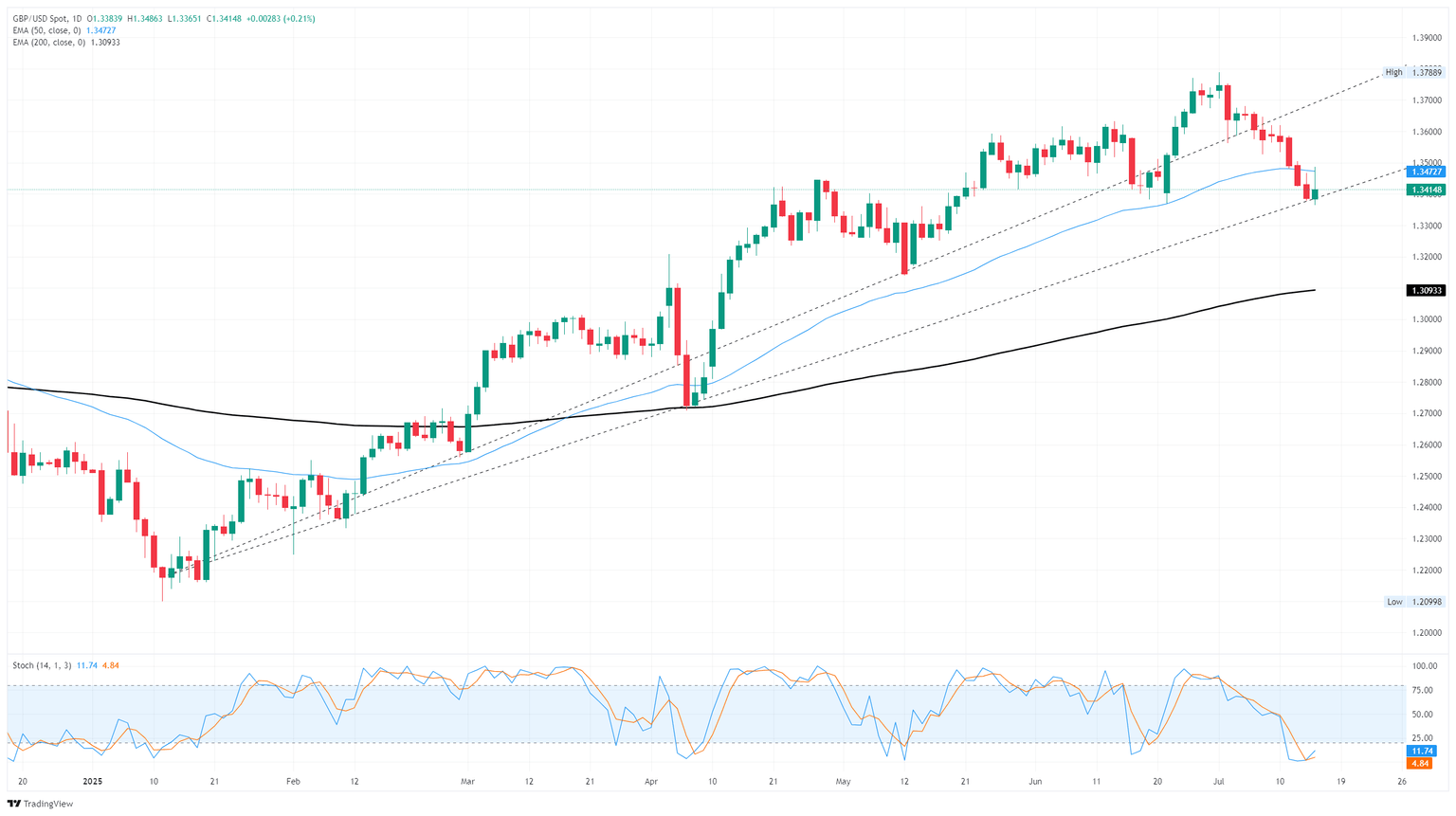

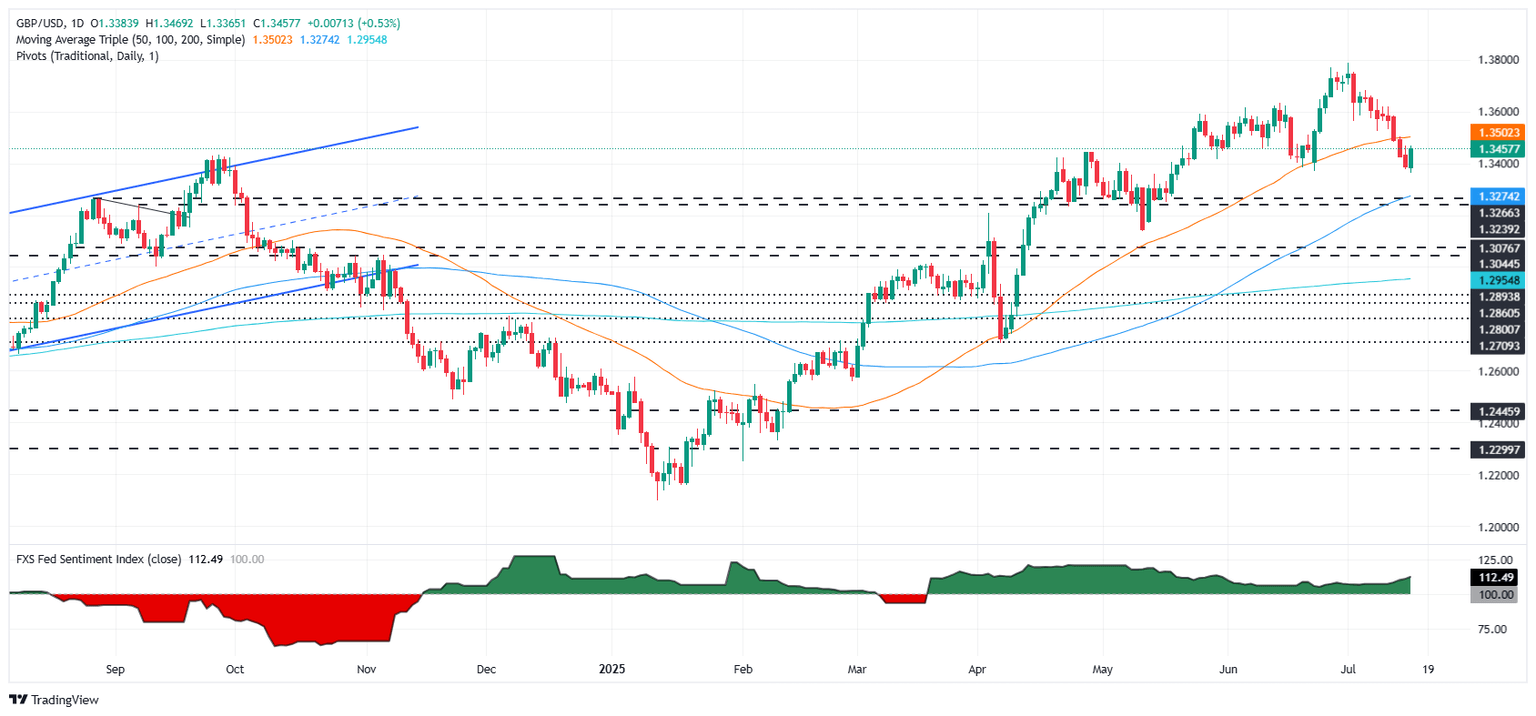

GBP/USD loses ground after registering gains in the previous session, trading around 1.3390 during the Asian hours on Thursday. Traders are awaiting the United Kingdom (UK) jobs report, which includes June’s Claimant Count Change and ILO Unemployment Rate for the three months to May, due later in the day.

The GBP/USD pair depreciates as the US Dollar (USD) gains ground due to rising odds of the Federal Reserve (Fed) maintaining its benchmark overnight interest rate unchanged in the 4.25%-4.50% range at its July policy meeting, driven by the hotter-than-expected June inflation figures from the United States (US). Read more...

GBP/USD snaps losing streak as fresh Greenback weakness reverses market flows

GBP/USD saw renewed gains on Wednesday, snapping an eight-session losing streak as Cable bidders pump the brakes on an extended backslide. The Greenback took a fresh hit from souring broad-market sentiment after President Donald Trump ramped up his attacks on Federal Reserve (Fed) Chair Jerome Powell, and investors may be getting worried about the Fed’s political independence.

UK Consumer Price Index (CPI) inflation in June accelerated across the board on Wednesday. Inflation risks make it difficult for the Bank of England (BoE) to make any further rate cuts, bolstering the Pound Sterling further. Read more...

GBP/USD rallies on US PPI dip and Trump’s potential Powell removal

The GBP/USD pair reverses its course and rallies as the latest US Producer Price Index (PPI) data reignites hopes of a rate cut by the Federal Reserve (Fed), while headlines suggest that US President Donald Trump may consider firing Fed Chair Jerome Powell. At the same time, inflation on the consumer side in the UK surprised investors, exceeding forecasts. At the time of writing, the pair trades at 1.3454, up by 0.55%.

The Producer Price Index in the US showed that factory prices remained unchanged in June, while PPI dipped from 2.6% to 2.3% YoY, below forecasts of 2.5%. The underlying prices edged lower, from 3% to 2.6%, which is below estimates of 2.7%. Read more...

Author

FXStreet Team

FXStreet