Pound Sterling Price News and Forecast: GBP/USD could struggle to rebound [Video]

![Pound Sterling Price News and Forecast: GBP/USD could struggle to rebound [Video]](https://editorial.fxsstatic.com/images/i/GBPUSD-bearish-line_XtraLarge.png)

GBP/USD Forecast: Pound Sterling could struggle to rebound

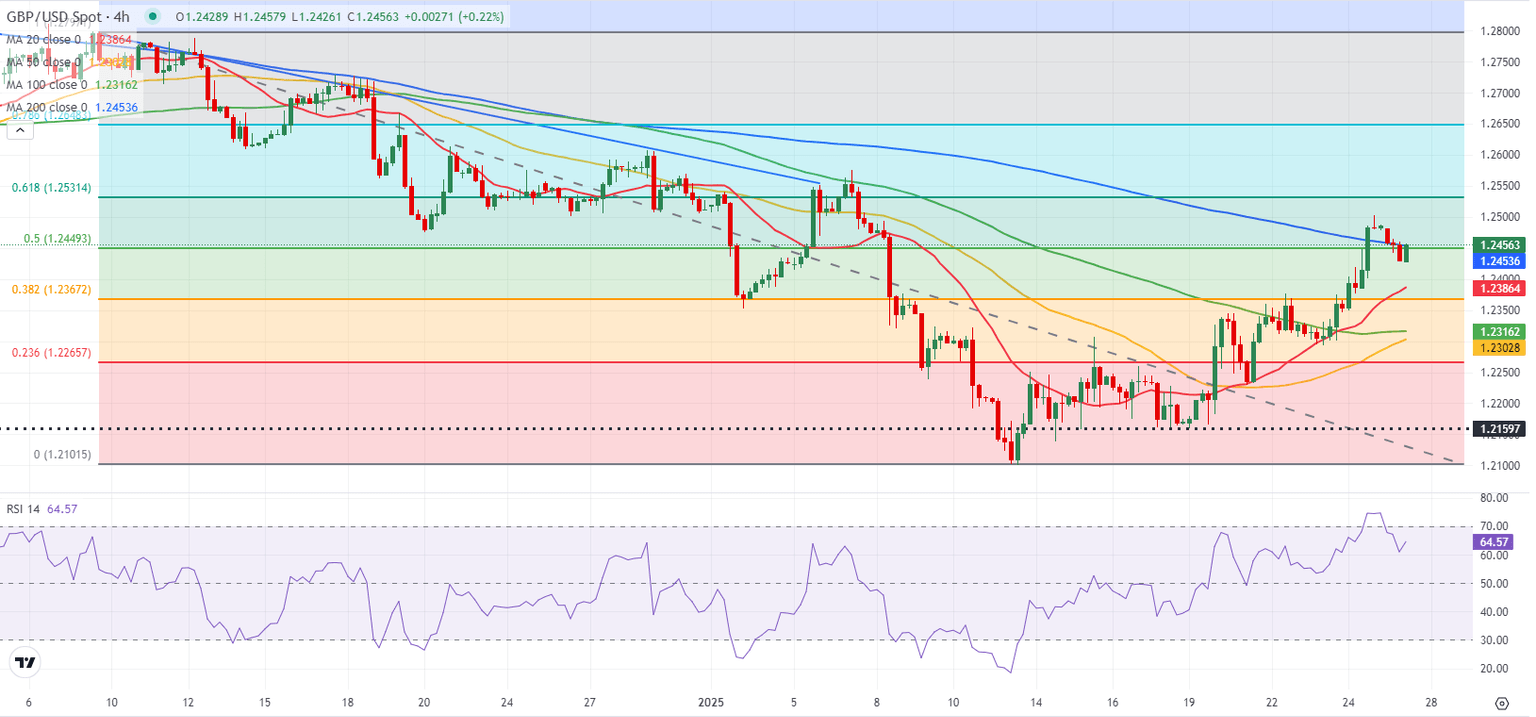

GBP/USD fails to build on the previous week's strong gains and retreats to the 1.2450 area in the European morning on Monday. Although the technical outlook suggests that the bullish bias remains intact, the pair could have a hard time regaining its traction in the risk-averse market environment.

Safe-haven flows dominate the action in financial markets to start the week, helping the US Dollar (USD) hold its ground. The uncertainty surrounding US President Donald Trump's trade policy after the Wall Street Journal reported that the Trump administration was not planning to negotiate with Canada or Mexico and start imposing 25% tariffs on February 1 causes investors to adopt a cautious stance. Read more...

GBP/USD Elliott Wave technical analysis [Video]

The analysis focuses on the GBPUSD currency pair through Elliott Wave Theory on a daily chart, indicating a bullish trend with an impulsive wave pattern. The key observation lies in Navy Blue Wave 1, which is part of the broader Gray Wave 1, marking the onset of a fresh upward movement.

Currently, the market suggests the completion of Navy Blue Wave 1 within Gray Wave 1, transitioning into the corrective phase of Navy Blue Wave 2. This phase temporarily consolidates previous gains before the bullish trend resumes with further impulsive price action. Read more...

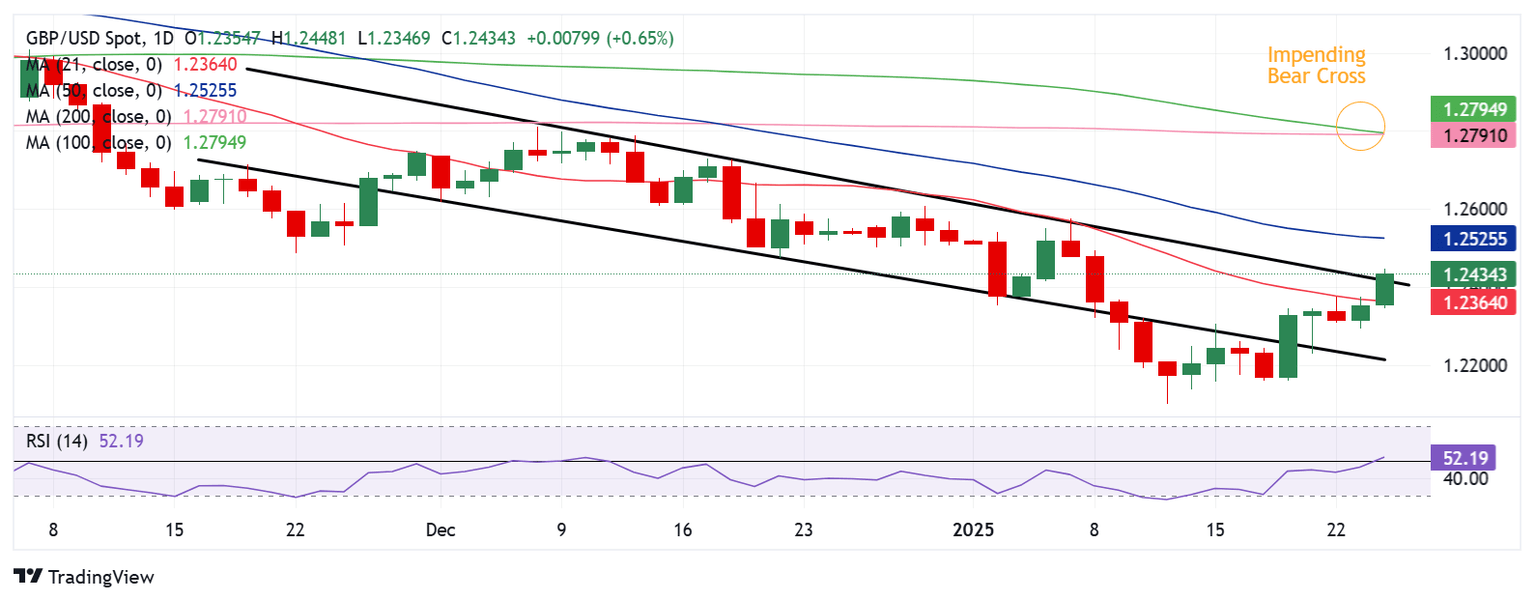

GBP/USD Weekly Outlook: Bearish risks loom amid recovery from 14-month lows

The Pound Sterling (GBP) extended its recovery from 14-month lows of 1.2100 against the US Dollar (USD), with GBP/USD testing offers above 1.2400.

US President Donald Trump returned to the White House for the second term, and his tariff talks remained the primary market driver, influencing risk sentiment, the US Dollar, and eventually the high-beta currency pair - GBP/USD. The Greenback languished in monthly lows against its major rivals amid uncertainty over Trump’s tariff policy and his calls to lower interest rates and the USD. Read more...

Author

FXStreet Team

FXStreet