Pound Sterling Price News and Forecast: GBP/USD could correct lower before next leg higher [Video]

![Pound Sterling Price News and Forecast: GBP/USD could correct lower before next leg higher [Video]](https://editorial.fxsstatic.com/images/i/GBPUSD-bearish-object_XtraLarge.png)

GBP/USD Forecast: Pound Sterling could correct lower before next leg higher

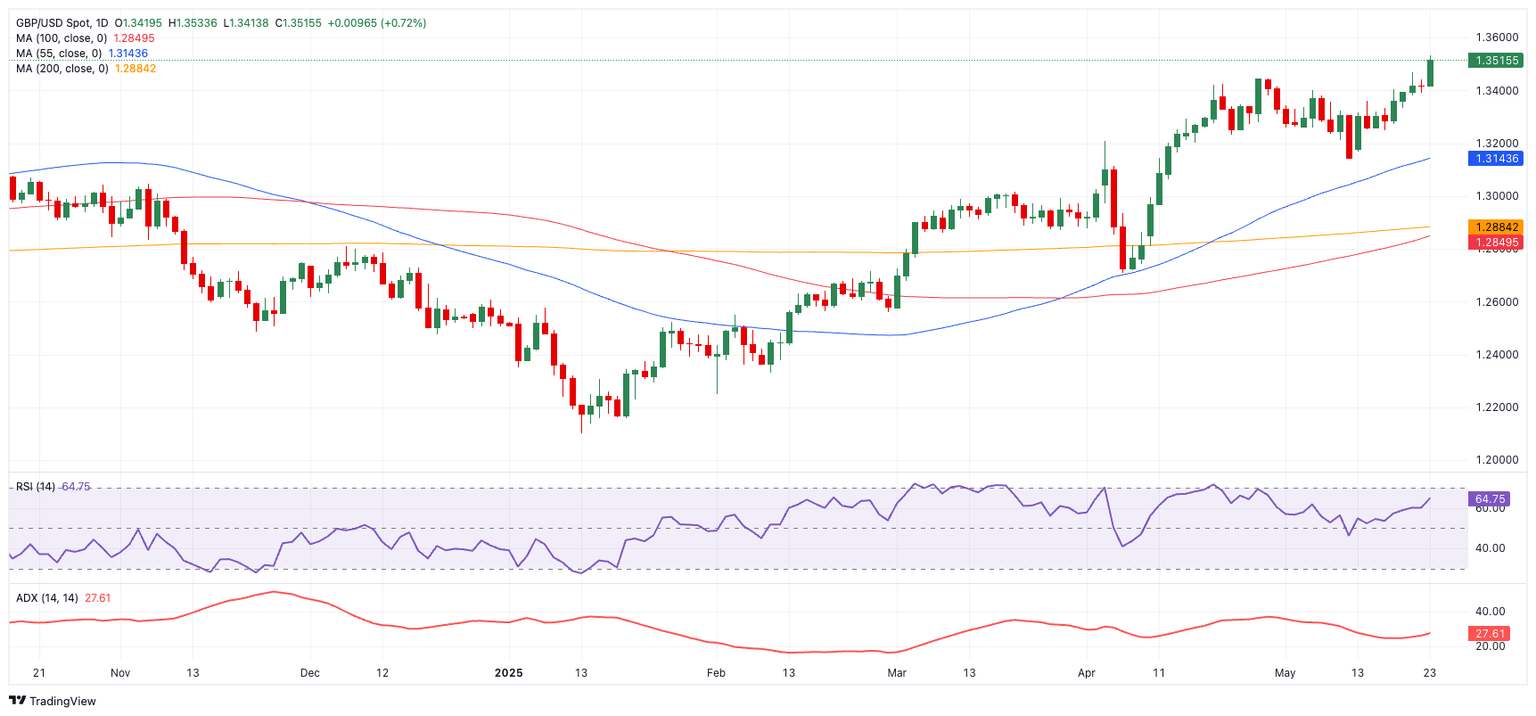

GBP/USD started the week on a bullish note and touched its highest level since February 2022 near 1.3600. The pair corrects lower in the European session and the technical outlook suggests that it remains overbought in the near term.

The US Dollar (USD) came under strong selling pressure on Friday and fuelled a decisive rally in GBP/USD heading into the weekend as United States (US) President Donald Trump threatened the European Union (EU) with 50% tariffs, noting that their discussions were going nowhere. Read more...

GBP/USD Elliott Wave technical analysis [Video]

The daily chart presents a distinctly bullish scenario for GBPUSD, showcasing strong impulsive characteristics in its current Elliott Wave configuration. This setup places the developing navy blue wave 3 within the broader gray wave 1, signaling the completion of the corrective navy blue wave 2 and the start of a potential long-lasting bullish impulse. This suggests GBPUSD has entered the most aggressive stage of its upward cycle. Read more...

GBP/USD Weekly Forecast: Next on the upside emerges the 2022 peaks

The British Pound held a firm tone throughout the week, pushing GBP/USD beyond the 1.3500 mark on Friday, territory last seen in late February 2022.

Sterling’s advance was driven largely by sustained pressure on the US Dollar (USD), which accelerated in the latter part of the week following President Donald Trump’s threat to impose 50% tariffs on European Union (EU) imports. Read more...

Author

FXStreet Team

FXStreet