Pound Sterling Price News and Forecast: GBP/USD could attract technical buyers if it clears 1.2700

GBP/USD Forecast: Pound Sterling could attract technical buyers if it clears 1.2700

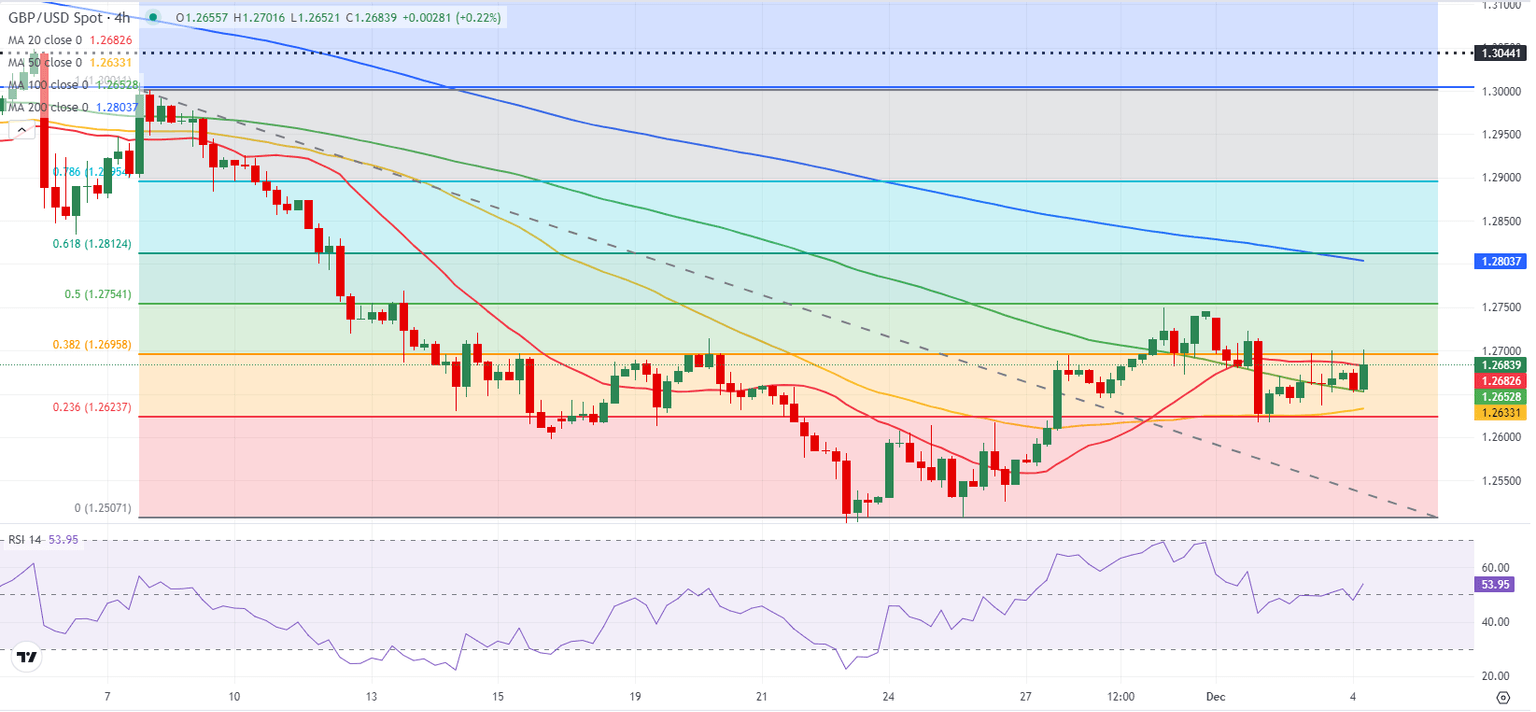

Following Monday's sharp decline, GBP/USD recovered modestly on Tuesday. The pair continues to edge higher toward 1.2700 in the early European session on Wednesday.

The data from the US showed on Tuesday that JOLTS Job Openings for October rose to 7.74 million from 7.37 million in September. This reading came in above the market expectation of 7.48 million and helped the US Dollar (USD) stay resilient against its rivals, limiting GBP/USD's upside. Read more...

GBP/USD Price Forecast: Bearish bias remains unchanged below 1.2700

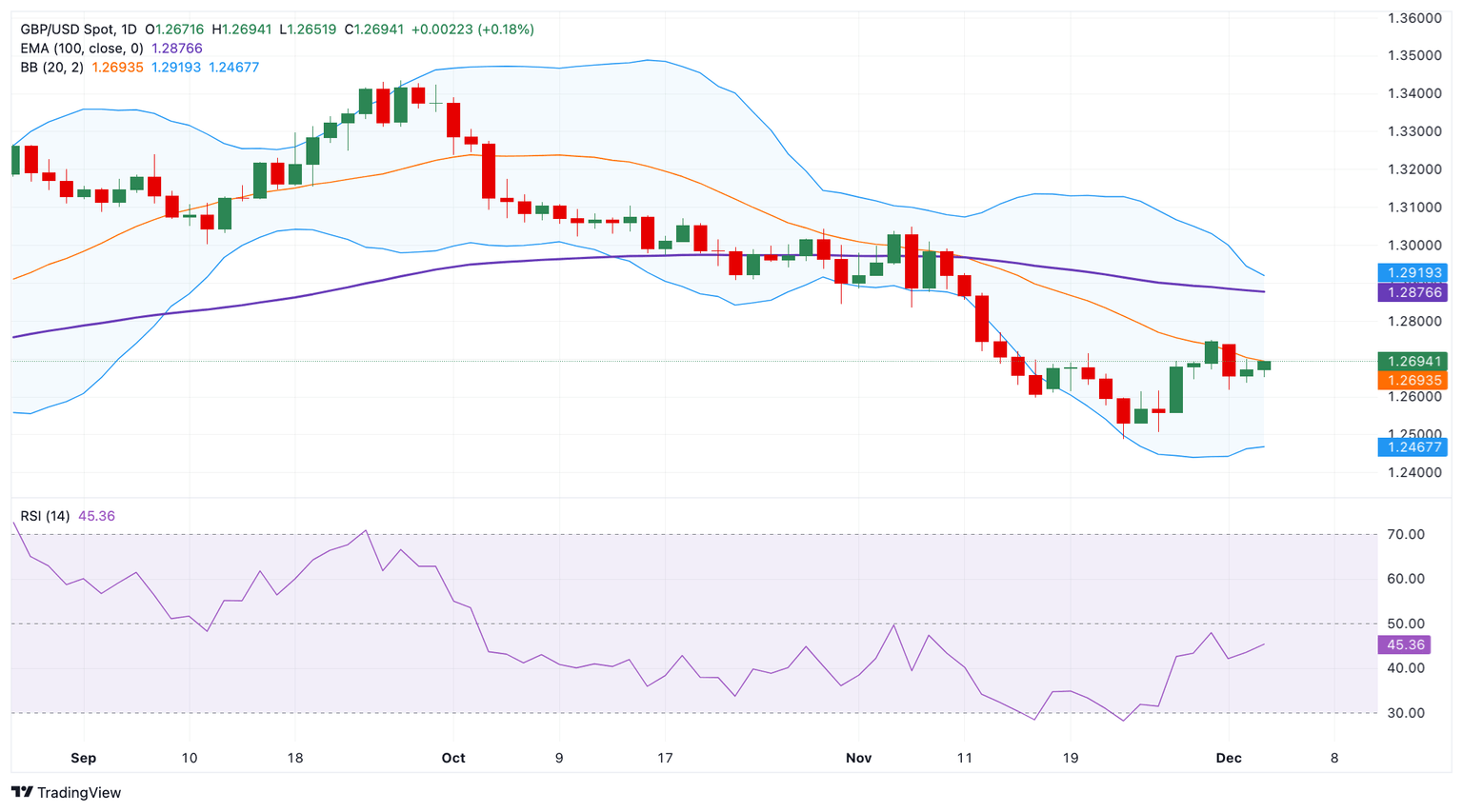

The GBP/USD pair trades in positive territory for the second consecutive day around 1.2690 during the early European session on Wednesday. However, the potential upside for GBP/USD seems limited as the expectation of less aggressive interest rate cut by the US Federal Reserve (Fed) and the concerns about US President-elect Donald Trump's tariffs policies could provide some support to the Greenback. Investors await Federal Reserve Chair Jerome Powell's speech for cues about the interest rate outlook.

The bearish outlook of GBP/USD remains in play as the major pair holds below the key 100-day Exponential Moving Average (EMA) on the daily timeframe. Furthermore, the 14-day Relative Strength Index (RSI) remains capped below the midline around 45.35, suggesting that the further downside cannot be ruled out. Read more...

Author

FXStreet Team

FXStreet