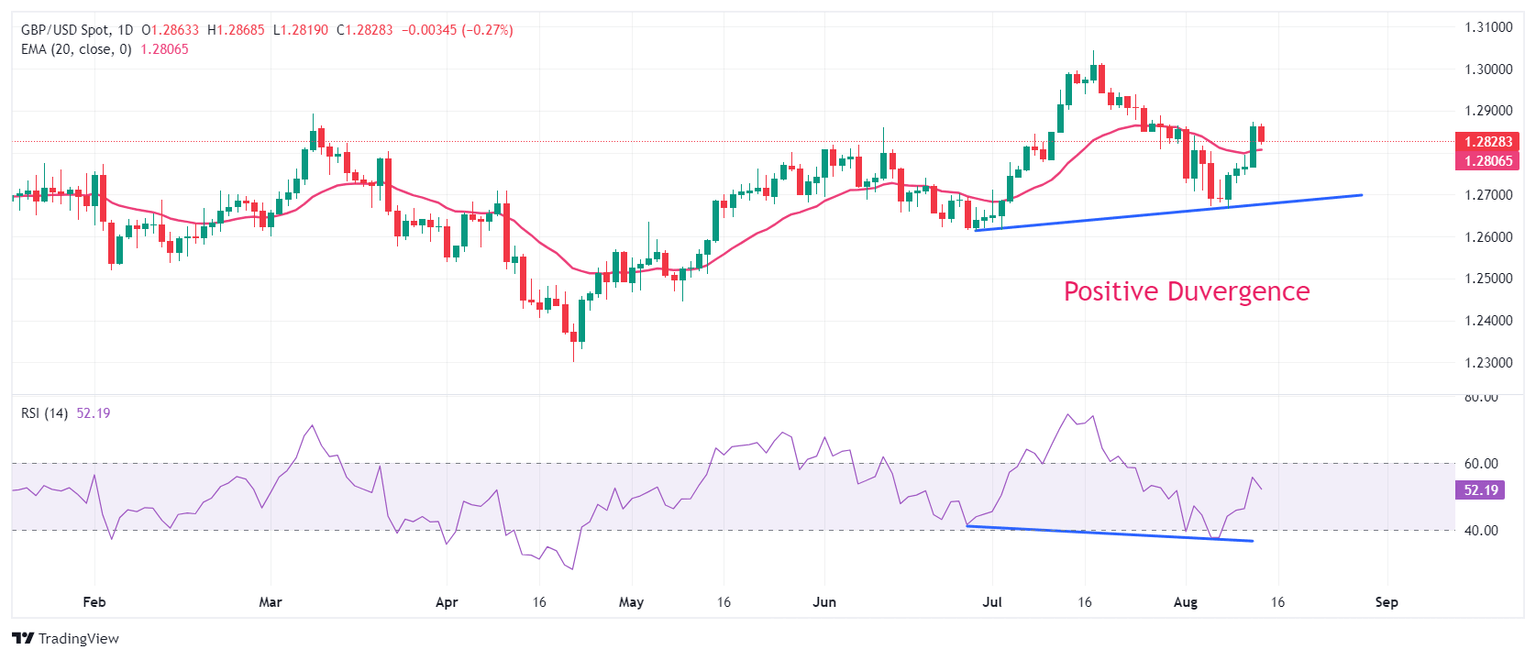

Pound Sterling Price News and Forecast: GBP/USD consolidates in a range above mid-1.2700s

Pound Sterling slides as soft UK service inflation boosts BoE rate-cut bets

The Pound Sterling (GBP) recovers the majority of its intraday losses against the US Dollar (USD) in Wednesday’s European trading hours. The GBP/USD pair rebounds after posting the day's low at 1.2815 as the US Dollar (USD) declines ahead of US CPI data for July, which will be published at 12:30 GMT. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, declines toward seven-month low at 102.16. Read More...

GBP/USD consolidates in a range above mid-1.2700s ahead of inflation data from UK and US

The GBP/USD pair ticks lower during the Asian session on Wednesday and moves away from over a two-week high, around the 1.2870-1.2875 region touched the previous day. The downside, however, remains cushioned as traders keenly await the release of the latest consumer inflation figures from the UK and the US. Read More...

Author

FXStreet Team

FXStreet