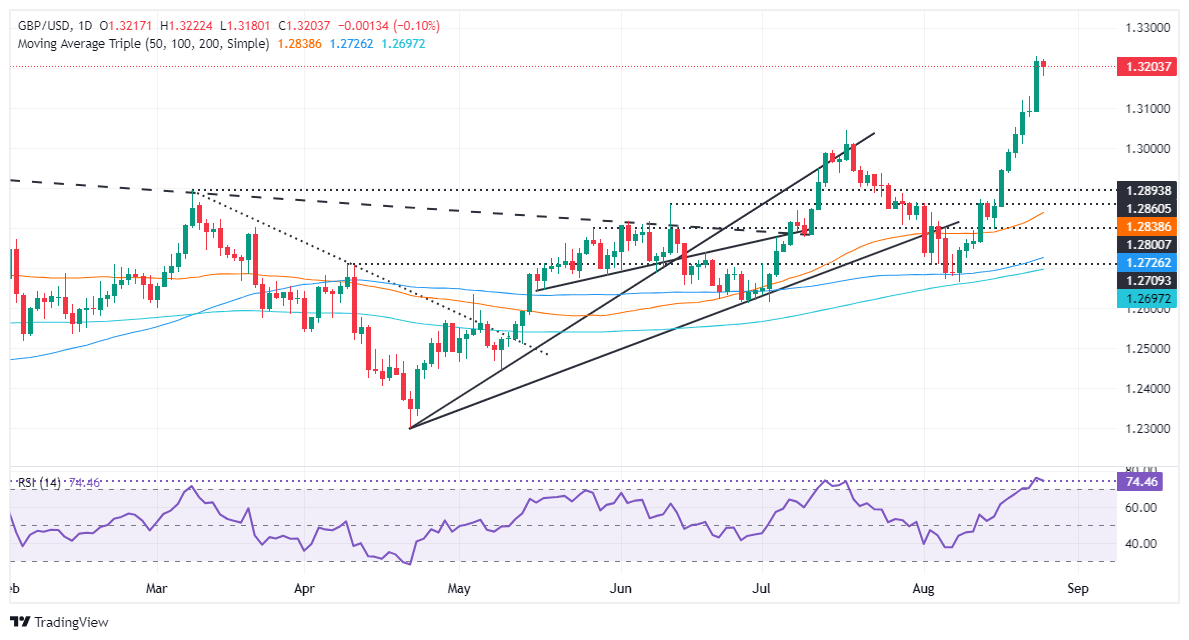

GBP/USD Price Forecast: Clings to 1.3200 in sideways trading

The Pound Sterling begins the week on a positive note, yet remains hovering around the 1.3200 figure, unable to break last Friday new year-to-date (YTD) high of 1.3230, and trades at 1.3204 almost flat.

Read More...

Pound Sterling rises as Powell assures policy change to support labor market

The Pound Sterling (GBP) trades close to an almost two-and-a-half-year high near 1.3200 against the US Dollar (USD) in Monday’s North American session. The GBP/USD pair aims to extend its seven-day winning streak as the US Dollar weakens after the unambiguous announcement from

Federal Reserve (Fed) Chair Jerome Powell, who said that the central bank will start cutting interest rates in September.

Read More...

GBP/USD edges higher above 1.3200 as Fed’s Powell signals ready to cut rates

The GBP/USD pair trades on a stronger note around 1.3215 during the early Asian session on Monday. The signal that the US

Federal Reserve (Fed) will start easing its monetary policy in September drags the Greenback lower and supports GBP/USD. Market players await the US Durable Goods Orders for July, which are due later on Monday.

Read More...