Pound Sterling Price News and Forecast: GBP/USD climbs despite Trump’s auto tariffs

GBP/USD climbs despite Trump’s auto tariffs, markets bet on UK exemption

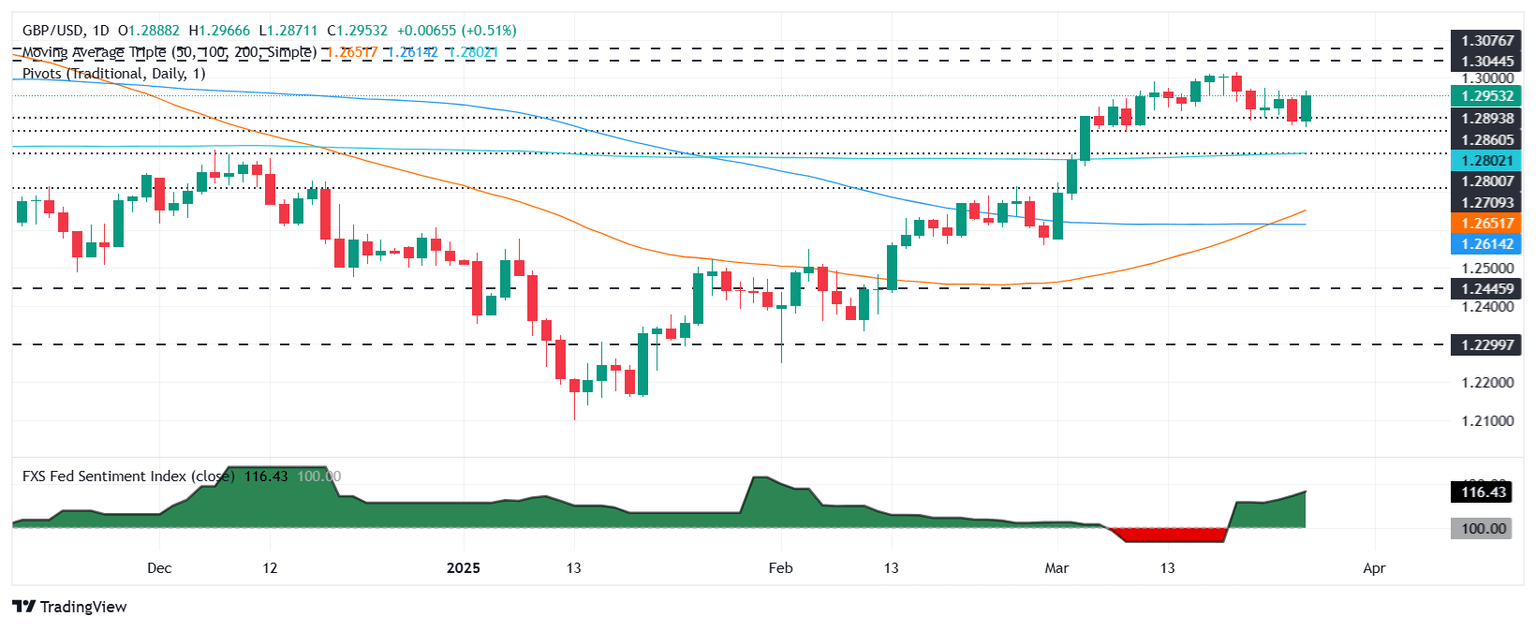

The Pound Sterling (GBP) rises during the North American session against the Greenback even though US President Donald Trump enacted automotive tariffs on all cars made outside the United States (US). Initially, risk appetite deteriorated, but it has improved. Therefore, high-beta currencies like the Sterling advance, with GBP/USD trading near 1.2930, up 0.35%. Read More...

Pound Sterling outperforms USD despite Trump's auto tariffs

The Pound Sterling (GBP) recovers strongly to near 1.2965 against the US Dollar (USD) during North American trading hours on Thursday. The GBP/USD pair bounces back after a slight corrective move in the last five trading days from the four-month high of around 1.3000. The Cable rebounds as the US Dollar retraces even though United States (US) President Donald Trump has imposed 25% tariffs on all imports of automobiles and their components. Read More...

GBP/USD rises above 1.2900 as US yields decline, Q4 GDP Annualized report eyed

GBP/USD recovers its recent losses from the previous session, climbing to around 1.2910 during Thursday’s Asian session. The pair is strengthening as the US Dollar (USD) remains under pressure due to declining Treasury yields, with the 2-year and 10-year yields hovering at 4.0% and 4.34%, respectively. Market participants are closely monitoring upcoming US economic data, including weekly Initial Jobless Claims and the final Q4 Gross Domestic Product (GDP) Annualized report, set for release later in the day. Read More...

Author

FXStreet Team

FXStreet