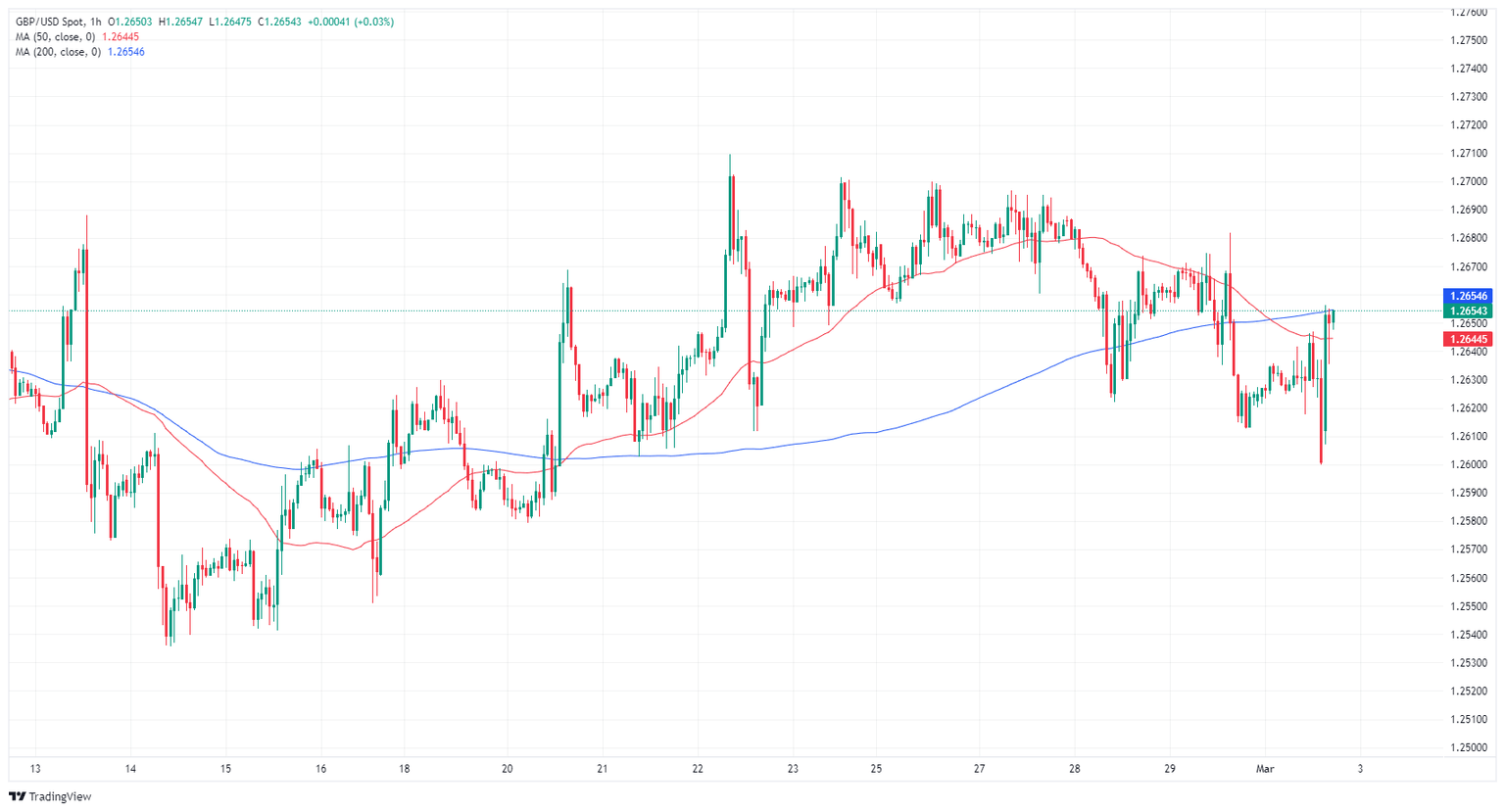

GBP/USD catches a bullish bounce after US ISM PMI miss sparks risk appetite

GBP/USD caught an intraday bump on Friday after a surprise miss in the US ISM Manufacturing Purchasing Managers Index (PMI) sparked renewed risk appetite on the back of fresh hopes for easing inflation to kick off a round of rate cuts from the Federal Reserve (Fed).

Read More...

Pound Sterling seeks fresh guidance on interest rates

The Pound Sterling (GBP) finds support in Friday’s European session after closing in negative territory on Thursday. The GBP/USD pair holds key 1.2600 support amid hopes that the

Bank of England (BoE) will begin reducing interest rates after the Federal Reserve (Fed).

Read More...

GBP/USD sticks to modest recovery gains around 1.2630, upside potential seems limited

The GBP/USD pair attracts some buying during the Asian session on Friday and for now, seems to have snapped a two-day losing streak to a one-week low, around the 1.2615-1.2610 region touched the previous day. Spot prices currently trade around the 1.2630-1.2635 zone and remain at the mercy of the US Dollar (USD) price dynamics.

Read More...