Pound Sterling Price News and Forecast: GBP/USD bulls riding the whitewash of the Fed's dovish tilt

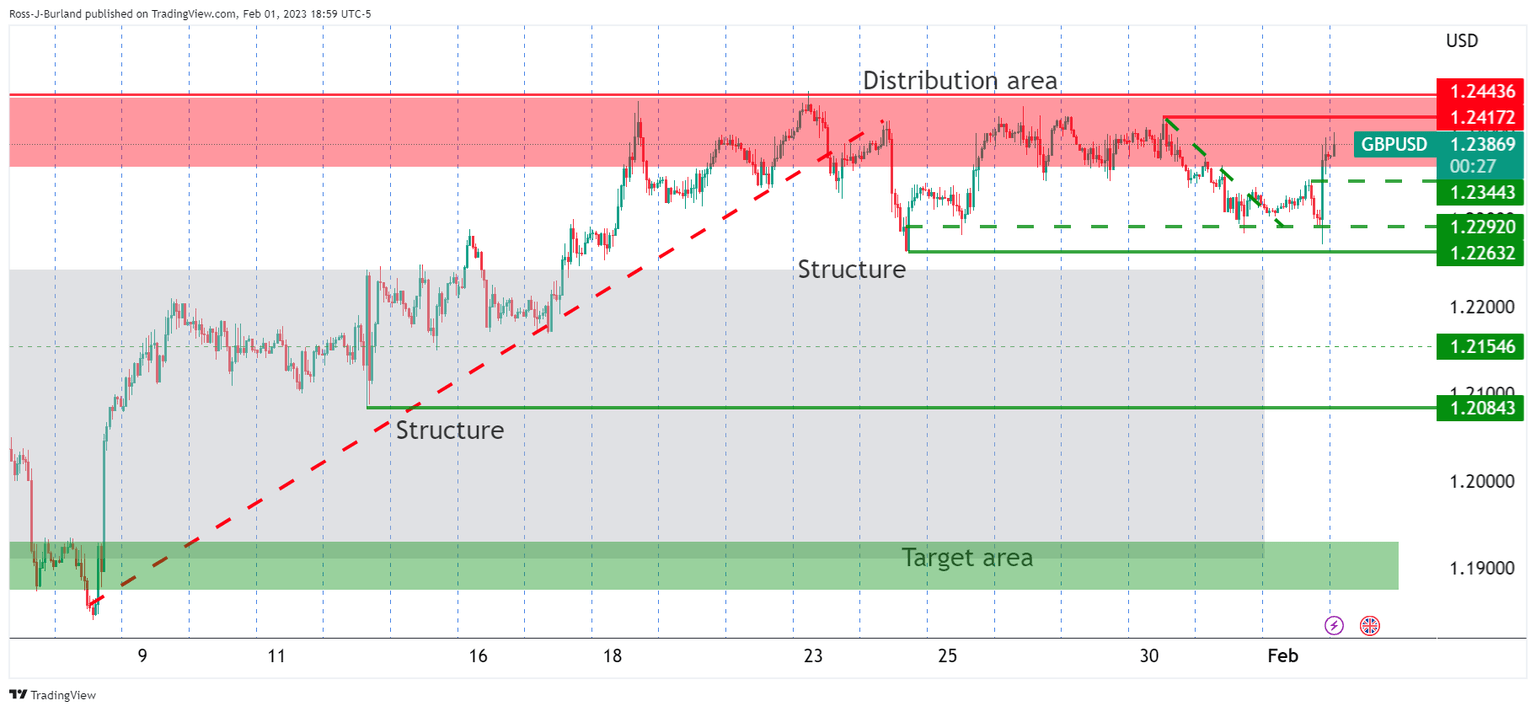

GBP/USD Price Analysis: Bulls eye a run to test the 1.24s resistance

GBP/USD rallied overnight on US Dollar weakness following the Federal Reserve event. The pair burst through 1.2350 resistance. GBP/USD now depends on the Bank of England and US jobs data on Friday. The following illustrates the technical structure of the price on the hourly time frame. Read more...

GBP/USD soars to near 1.2400 as Fed stretches interest rates in line with estimates

The GBP/USD pair has displayed a juggernaut rally to near the round-level resistance of 1.2400 in the late New York session. The Cable has been infused with an adrenaline rush after the interest rate decision by the Federal Reserve (Fed) chair Jerome Powell met expectations. Fed chair Jerome Powell has pushed interest rates to the 4.50-4.75% range by announcing a 25 basis point (bps) hike as the central bank needs more evidence to be confident that inflation is on a downward path.

The US Dollar Index (DXY) has surrendered the critical support of 101.00 for the first time in the past nine months. The USD Index has refreshed its nine-month low at 100.64 despite the Fed having denied the speculation of pausing further restrictions on monetary policy this year. Meanwhile, S&P500 has settled Wednesday’s trading session on a bullish note. The 500-US stock basket recovered initial losses and ended the session with significant gains, portraying a significant improvement in the risk appetite of the market participants. Read more...

Author

FXStreet Team

FXStreet