GBP/USD Price Analysis: Bulls are in the market and eye a bullish extension

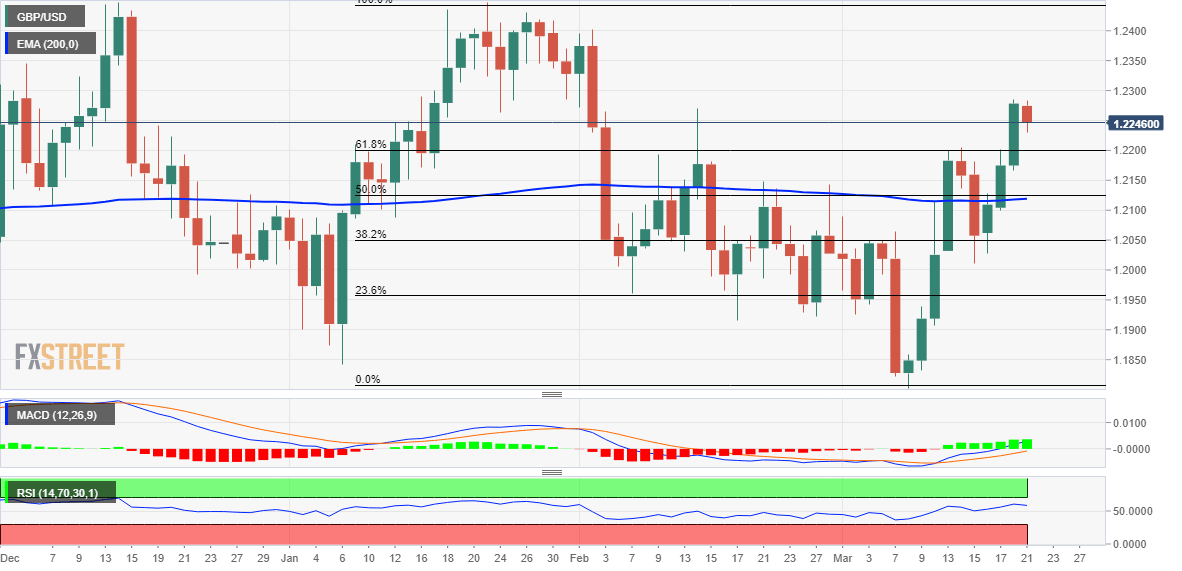

GBP/USD is grappling with the 1.22 area on Tuesday, keeping close to an almost seven-week high as traders reckoned banking stress could keep the Federal Reserve and the Bank of England from hiking

rates much further.

Read More...

GBP/USD Price Analysis: Keeps the red around mid-1.2200s, downside remains cushioned

The GBP/USD pair stalls a three-day-old uptrend on Tuesday and retreats from its highest level since early February touched the previous day. The pair maintains its offered tone through the early North American session and is currently placed just below the mid-1.2200s, though lacks follow-through.

Read More...

GBP/USD retreats from multi-week high, slides below mid-1.2200s amid modest USD strength

The GBP/USD pair comes under some selling pressure on Tuesday and snaps a three-day winning streak to its highest level since early February, around the 1.2285 region touched the previous day. The pair maintains its offered tone through the first half of the European session and is currently placed near the lower end of its daily range, around the 1.2235-1.2230 zone.

Read More...