GBP/USD Price Analysis: Bears are waiting to pounce below 1.2800

GBP has been the market's darling this week so far as the initial balance extends higher and higher. However, as the following charts illustrate, there could be a turnaround on the cards soon.

Read More...

Pound Sterling recovers as more interest rate hikes remain favored

The Pound Sterling (GBP) is looking for a break above the immediate resistance as the United Kingdom’s government looking beyond monetary tools to bring down stubborn inflation. The recovery in the GBP/USD pair has faded as the adaptation of new fiscal measures such as cutting wages of public sector employees by the British administration are losing their impact. The British government also asked companies to bring down profit margins to tame sticky inflation, which might help trim fears of a bleak

economic outlook.

Read More...

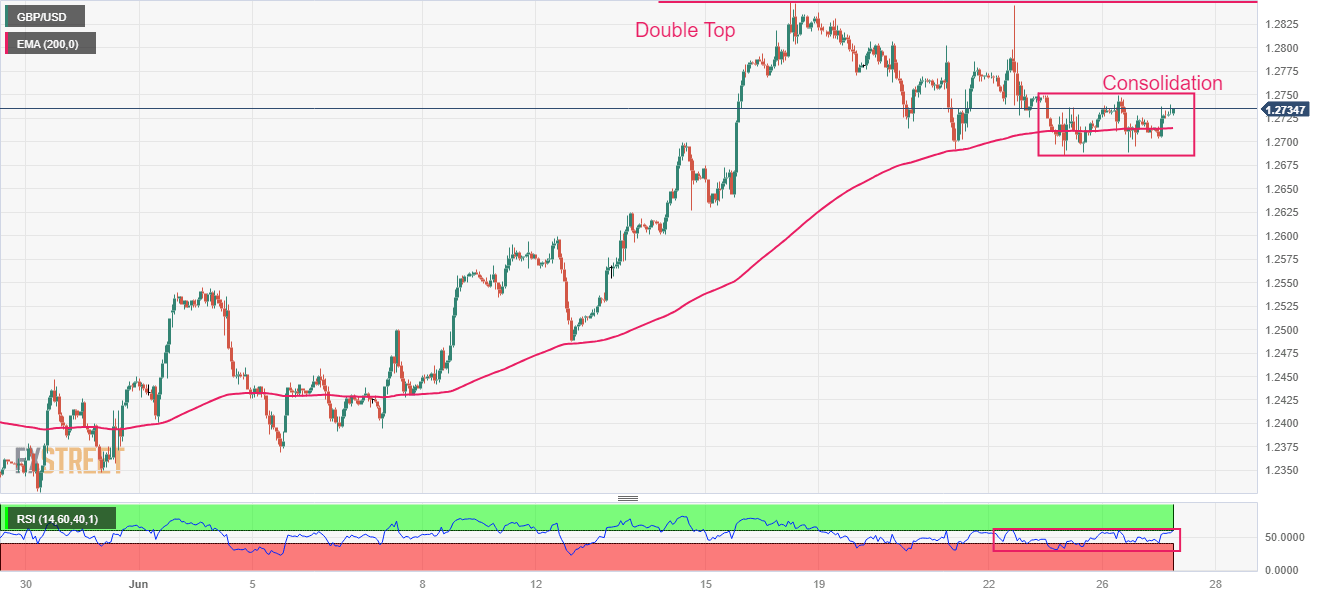

GBP/USD Price Analysis: Volatility contracts above 1.2700 despite cheerful market mood

The GBP/USD pair is trading back and forth in a narrow range of 1.2700-1.2750 in the early London session. The upside in the Cable is restricted as higher inflationary pressures in the United Kingdom have dampened its

economic outlook while the downside is supported due to correction in the US

Dollar Index (DXY).

Read More...