Pound Sterling Price News and Forecast: GBP/USD bears are taking the charge and heading south

GBP/USD Forecast: Brexit hopes seem insufficient against disease depression and downtrend resistance

Levelling up? The phrase that Prime Minister Boris Johnson's promise to lift standards of living for low-earning Brits may be relevant to Brexit talks. The Financial Times is reporting that the EU is ready to compromise with the UK on the sensitive "level-playing field" issue – aligning regulations across the channel after the current transition period expires.

Talks between London and Brussels resume on Monday as the clock ticks down toward year-end. Without an accord, Britain will fall to World Trade Organization rules in 2021. After four rounds of inconclusive talks, any hope helps the pound. Read More...

GBP/USD: Bears are taking the charge and heading south

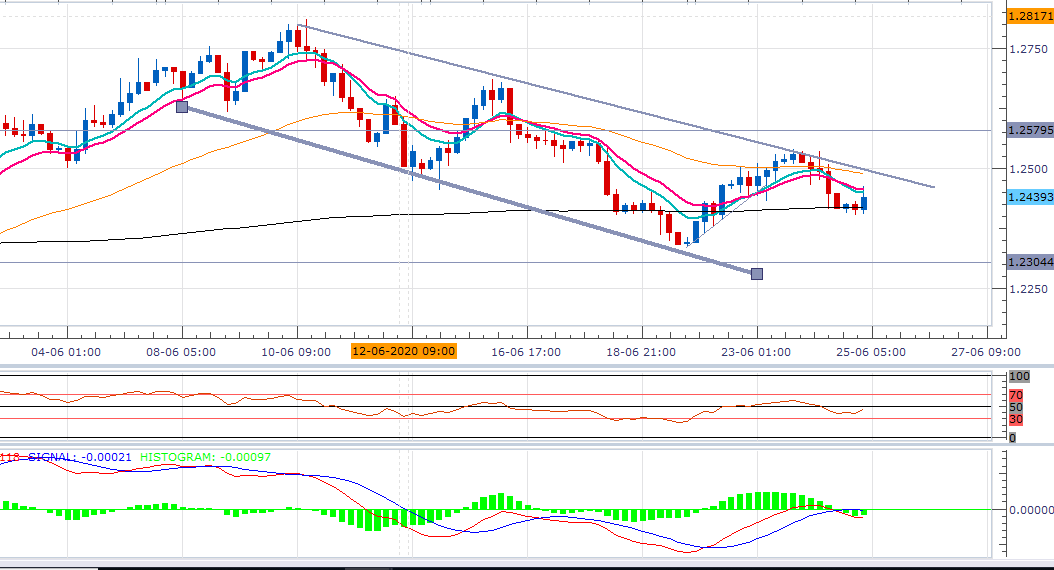

Pair is showing roller coaster move on daily chart. Initially it moved up to 1.2819 level then reversed down to 1.2340 level where bears ensured to everyone that trend has been changed from upside to downside and then our strategy was to sell on high. Few days back we are buying the pair from intraday point of view and it bounced from 1.2340 to 1.2540 which was mind blowing move of 200 pips.

Yesterday after arriving at 1.2540 level pair slipped down to 1.2504 level which confirmed our bearish move. So here we would suggest our traders that go for sell on every bounce. Today at the time of writing pair is trading at 1.2460 level which is perfect bounce from intraday point of view to short the pair. Read More...

GBP/USD Forecast: Break below 1.2400 will set the stage for further weakness

The GBP/USD pair failed to capitalize on its early uptick to weekly tops, instead met with some fresh supply near the 1.2540-50 region amid a strong pickup in the US dollar demand. Worries about the ever-increasing number of new coronavirus cases overshadowed the optimism over a sharp V-shaped global economic recovery. This, in turn, triggered a fresh wave of risk-aversion trade and forced investors to take refuge in the safe-haven greenback.

The British Pound was further pressured by reports that the US is considering tariffs on $3.1 billion of exports from the United Kingdom, France, Spain and Germany. Meanwhile, the already weaker risk sentiment deteriorated further after the International Monetary Fund (IMF) projected a deeper recession in 2020 and a slower recovery in 2021. Read More...

Author

FXStreet Team

FXStreet